Energy storage capacity optimization of wind-energy storage

Nov 1, 2022 · Finally, the influences of feed-in tariff, frequency regulation mileage price and energy storage investment cost on the optimal energy storage capacity and the overall benefit

A review of hybrid renewable energy systems: Solar and wind

Dec 1, 2023 · Solar energy generation is contingent upon daylight and clear weather conditions, whereas wind energy is unpredictable, depending on fluctuating wind speeds. The

Recent Advancements in the Optimization Capacity

Dec 27, 2024 · Present of wind power is sporadically and cannot be utilized as the only fundamental load of energy sources. This paper proposes a wind-solar hybrid energy storage

Capacity configuration of a hydro-wind-solar-storage

Oct 15, 2022 · The hydro-wind-solar-storage bundling system plays a critical role in solving spatial and temporal mismatch problems between renewable energy resources and the electric load

Value of storage technologies for wind and solar energy

Jun 13, 2016 · We first present the results of optimizing the discharge behaviour of a solar or wind plant combined with storage, for a fixed storage size, to maximize the revenue of the plant. We

Global Renewable Surge: How Wind, Solar & Storage are

Mar 11, 2025 · The world is witnessing an energy revolution. As traditional coal plants grow older, we''re seeing a rapid increase in the use of renewable energy sources such as wind and solar

Exploring the interaction between renewables and energy storage

Dec 15, 2022 · The complementary nature between renewables and energy storage can be explained by the net-load fluctuations on different time scales. On the one hand, solar normally

Capacity planning for wind, solar, thermal and energy storage

Nov 28, 2024 · This article proposes a coupled electricity-carbon market and wind-solar-storage complementary hybrid power generation system model, aiming to maximize energy

Optimal size ratios for solar, wind-powered

Jul 5, 2024 · "The objective is to extend beyond the analysis of a specific case study and provide broadly applicable considerations for the optimal design of

Evaluating the Technical and Economic Performance of

Aug 28, 2017 · Report Background and Goals Declining photovoltaic (PV) and energy storage costs could enable "PV plus storage" systems to provide dispatchable energy and reliable

Storage of wind power energy: main facts and feasibility −

Sep 2, 2022 · A review of the available storage methods for renewable energy and specifically for possible storage for wind energy is accomplished. Factors that are needed to be considered

Enhancing wind-solar hybrid hydrogen production through

Jun 1, 2024 · Wind-solar hybrid hydrogen production is an effective technique route, by converting the fluctuate renewable electricity into high-quality hydrogen. However, the intermittency of

Energy storage capacity optimization strategy for combined wind storage

Nov 1, 2022 · In order to deal with the power fluctuation of the large-scale wind power grid connection, we propose an allocation strategy of energy storage capacity for combined wind

Globally interconnected solar-wind system addresses future

May 15, 2025 · A globally interconnected solar-wind power system can meet future electricity demand while lowering costs, enhancing resilience, and supporting a stable, sustainable

A provincial analysis on wind and solar investment needs

Jan 15, 2025 · In this paper, we estimate the wind and solar investment needs of Chinese provinces between 2020 and 2060 under four alternative pathways towards China''s 2060

Wind and solar need storage diversity, not just capacity

Jul 23, 2025 · According to the International Energy Agency, the levelized cost of electricity for utility-scale solar photovoltaics has declined by over 80% since 2010, while the cost of

Third Annual Energy Supply Investment and Banking Ratios

Jan 29, 2025 · The energy industry is shifting more of its investments into cleaner sources of supply. Bank financing for low-carbon energy supply technologies reached 95% of that for

The wind-solar hybrid energy could serve as a stable power

Oct 1, 2024 · In addition, the authors found that the complementary strength between wind and solar power could be enhanced by adjusting their proportions. This study highlights that hybrid

Investment Planning Model and Economics of Wind-Solar-Storage

Mar 6, 2022 · With the goal of peaking carbon emission and carbon neutrality, China is developing a renewable-based power system. Investors pay more attend to hybrid generati.

Capacity planning for wind, solar, thermal and energy storage

Nov 28, 2024 · Based on the analysis, decision-makers should prioritize increasing investments in wind, solar, and energy storage systems, as their installed capacities significantly rise under

Opportunities for Hybrid Wind and Solar PV Plants in

Mar 25, 2022 · This resource analysis aims to address these questions and take a first step toward quantifying the dots indicate a higher proportion of solar PV, and blue dots indicate

Optimal Configuration and Economic Operation of Wind–Solar-Storage

Jan 17, 2023 · We develop a wind-solar-pumped storage complementary day-ahead dispatching model with the objective of minimizing the grid connection cost by taking into account the

World Energy Investment 2024 – Analysis

4 days ago · Global energy investment is set to exceed USD 3 trillion for the first time in 2024, with USD 2 trillion going to clean energy technologies and infrastructure. Investment in clean

The energetic implications of curtailing versus storing solar

Aug 28, 2013 · We present a theoretical framework to calculate how storage affects the energy return on energy investment (EROI) ratios of wind and solar resources. Our methods identify

Optimal allocation of energy storage capacity for hydro-wind-solar

Mar 25, 2024 · Multi-energy supplemental renewable energy system with high proportion of wind-solar power generation is an effective way of "carbon neutral", but the randomness and

Annual state of Renewable Energy Report Pakistan 2021

Aug 31, 2022 · W expansion of renewables portfolio only (GoP, 2021). As of June 2021, total investment in solar, wind, and bagasse-based power plants (operational and under

Analysis of investment and R&D strategies evolution in wind-solar

High initial investment ratio, high technology maturity, high externalities, and high network density can stimulate investment and collaborative behavior to some extent. Improvements in network

6 FAQs about [Investment ratio of wind solar and storage]

How much investment is needed for wind and solar energy?

Our research reveals a projected annual investment requirement of $317 billion in wind and solar energy infrastructure, representing a threefold increase compared to the historical average of approximately $100 billion per year.

Does more solar and wind mean more storage value?

“Our results show that is true, and that all else equal, more solar and wind means greater storage value. That said, as wind and solar get cheaper over time, that can reduce the value storage derives from lowering renewable energy curtailment and avoiding wind and solar capacity investments.

Do storage technologies add value to solar and wind energy?

Some storage technologies today are shown to add value to solar and wind energy, but cost reduction is needed to reach widespread profitability.

How much energy is invested in wind & solar PV in 2023?

In 2023, each dollar invested in wind and solar PV yielded 2.5 times more energy output than a dollar spent on the same technologies a decade prior. In 2015, the ratio of clean power to unabated fossil fuel power investments was roughly 2:1. In 2024, this ratio is set to reach 10:1.

Are solar and wind the future of energy supply?

The fact that solar and wind will be responsible for the majority of investment in the energy supply sector indicates that more efforts beyond 2030 are required, with trillions of dollars involved [, , ].

How much money does China need to invest in wind & solar?

In the core scenario, results indicate that average annual wind and solar investment needs are $317 billion per year between 2020 and 2060, or 2.3 % of China's GDP in 2020. The average annual investment is $340 billion if we only look at the period between 2024 and 2060. The overall investment reaches $12.7 trillion for the entire 40 years.

Learn More

- Wind solar and energy storage ratio

- Wind and solar energy storage power station investment

- Price of wind solar and energy storage power generation system in Brno Czech Republic

- Are wind solar and energy storage considered new energy

- Palau Wind and Solar Energy Storage Power Station

- Reykjavik photovoltaic and wind power station energy storage ratio

- Energy storage ratio of wind power projects in Egypt

- Dakar wind and solar energy storage project construction

- Solar energy storage ratio

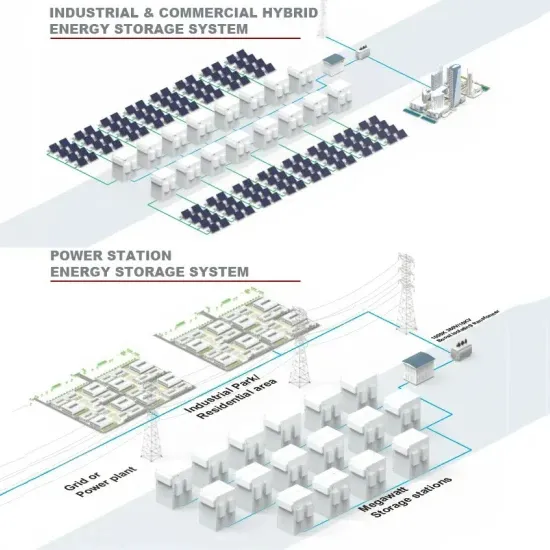

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.