Duration of utility-scale batteries depends on

Mar 25, 2022 · Our Annual Electric Generator Report also contains information on how energy storage is used by utilities. Utility-scale battery storage can be

Energy Storage Feasibility and Lifecycle Cost Assessment

Simulate payback periods and return on investment (ROI) for different scenarios. Evaluate how storage systems integrate with existing infrastructure and impact grid stability. Analyze

Long-Duration Energy Storage Use Cases

Dec 3, 2024 · EPRI, Long Duration Energy Storage Council, Edison Electric Institute (EEI), and the United States Department of Energy (DOE) Utilities, energy companies, industrial

Fact Sheet | Energy Storage (2019) | White Papers | EESI

Feb 22, 2019 · Pumped-Storage Hydropower Pumped-storage hydro (PSH) facilities are large-scale energy storage plants that use gravitational force to generate electricity. Water is

Return on Investment (ROI) of Energy Storage Systems:

Mar 1, 2025 · Explore the Return on Investment (ROI) of energy storage systems for commercial and industrial applications. Learn how factors like electricity price differentials, government

How to Calculate the Payback Period for Your Energy Storage

Sep 7, 2024 · Divide the total cost of the system by the annual energy savings to arrive at the payback period. In our scenario, the payback period would be $10,000 / $1,500 = 6.67 years.

How is the payment period for energy storage

Jun 7, 2024 · Net metering laws, tax credits, and incentives for energy storage installations can significantly uplift financial forecasts for energy storage

Understanding the Return of Investment (ROI) of Energy Storage

5 days ago · Energy storage systems can store cheaper off-peak energy for use during expensive peak periods. Subsidies, tax credits, and rebates offered by governments can enhance the

Is Commercial Energy Storage Worth It? ROI, Payback, and

Apr 25, 2025 · Commercial energy storage systems generate returns in several ways: In 2023, a logistics centre in northern Italy installed a 2MWh battery system alongside 1.5MW of rooftop

Grid-Scale Battery Storage: Frequently Asked Questions

Jul 11, 2023 · What is grid-scale battery storage? Battery storage is a technology that enables power system operators and utilities to store energy for later use. A battery energy storage

Comprehensive review of energy storage systems

Jul 1, 2024 · The applications of energy storage systems have been reviewed in the last section of this paper including general applications, energy utility applications, renewable energy

How many years does it take for an energy storage power station to pay

Apr 5, 2024 · The timeframe for an energy storage power station to pay back its installation and operational costs can vary significantly due to a range of influencing factors. 1. The average

Electricity explained Energy storage for electricity generation

Energy storage for electricity generation An energy storage system (ESS) for electricity generation uses electricity (or some other energy source, such as solar-thermal energy) to charge an

6 FAQs about [How long does it take for enterprise energy storage equipment to pay back ]

How long does an energy storage system last?

The 2020 Cost and Performance Assessment analyzed energy storage systems from 2 to 10 hours. The 2022 Cost and Performance Assessment analyzes storage system at additional 24- and 100-hour durations.

What do you need to know about energy storage?

Energy demand and generation profiles, including peak and off-peak periods. Technical specifications and costs for storage technologies (e.g., lithium-ion batteries, pumped hydro, thermal storage). Current and projected costs for installation, operation, maintenance, and replacement of storage systems.

Is energy storage a good investment?

As energy storage becomes increasingly essential for modern energy management, understanding and enhancing its ROI will drive both economic benefits and sustainability. To make an accurate calculation for your case and understand the potential ROI of the system, it’s best to contact an expert.

How does energy storage affect Roi?

The cost of electricity, including peak and off-peak rates, significantly impacts the ROI. Energy storage systems can store cheaper off-peak energy for use during expensive peak periods. Subsidies, tax credits, and rebates offered by governments can enhance the financial attractiveness of ESS installations.

Which energy storage technologies are included in the 2020 cost and performance assessment?

The 2020 Cost and Performance Assessment provided installed costs for six energy storage technologies: lithium-ion (Li-ion) batteries, lead-acid batteries, vanadium redox flow batteries, pumped storage hydro, compressed-air energy storage, and hydrogen energy storage.

Are energy storage returns undervalued?

Such complexity means the expected economic returns are often undervalued, especially if shortcuts are taken to simplify the analysis. Adopting a holistic approach that considers all revenue streams across a broad range of external events could improve the outlook of energy storage returns.

Learn More

- How much does a kilowatt of enterprise energy storage equipment cost

- How much does St George s energy storage equipment cost

- How much does energy storage equipment cost in Kuwait City

- How long can the energy storage inverter supply power

- Tunisian enterprise small energy storage equipment

- How long does battery energy storage usually last

- How much does energy storage equipment cost in Freetown

- Brasilia enterprise photovoltaic power generation energy storage equipment

- How long does it take to get a return on investment in energy storage batteries

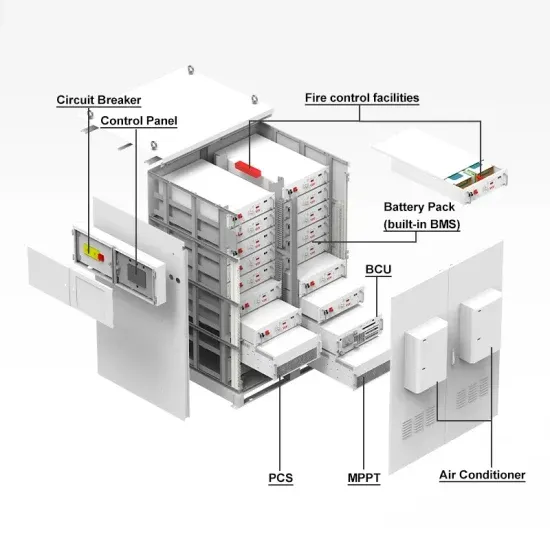

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

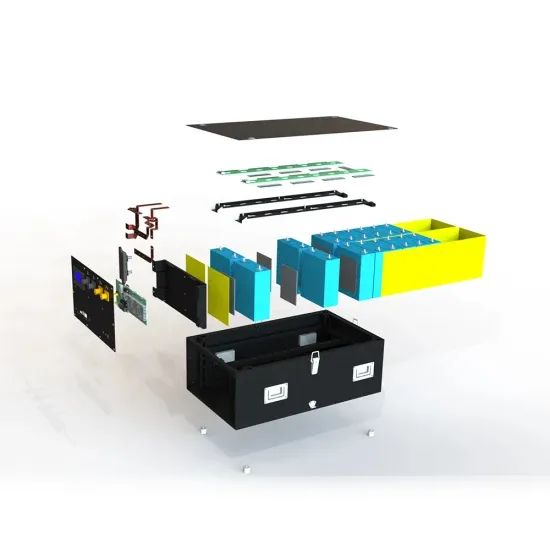

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.