BOLIVIA POWER INVERTERS AND SOLAR PANELS

"Explore top solar panel manufacturers in Bolivia, supply chain hubs, and essential fairs for the solar energy sector in this comprehensive guide.". List of Bolivian solar panel installers -

ABB inverter maintenance and repair

5 days ago · Inspection and maintenance. Inverter repair and maintenance services, from on-site inspection and quotation to follow-up repairs, replacement of original parts, and most

Locally Grounded. Globally Powered. With 10+ years in

1 day ago · 🌱 Locally Grounded. Globally Powered. With 10+ years in India, Sungrow combines local expertise with global innovation — powering projects from rooftops to utility scale. India''s

Top 10 Fabricantes De Inversores En Bolivia

En este artículo analizaremos juntos las top 10 fabricantes de inversores en Bolivia y varias marcas conocidas cuyos productos se encuentran en Bolivia. Esta lista puede servir de

IER & ENGINEERING SOLUTIONS – IER & ENGINEERING

IER & Engineering Solutions (Pvt) Ltd has provided services in the field of Solar Inverter repair, VFD repair for over 10 years. Company is highly qualified team of engineers, who provide

Solis Inverter SOP (Standard operating procedure)

Sep 23, 2020 · refer the below attached document to know the Solis inverter START, STOP, standard operating procedure (SOP). follow the step mentioned in document if still found

Top 10 Inverter Manufacturers in Bolivia

May 23, 2025 · In this article, we will together discuss the top 10 inverter manufacturers in Bolivia and various well-known brands whose products are found in Bolivia. This list can be used as a

Fronus Solar Energy

Aug 18, 2025 · Discover sustainable and cost-effective solar energy solutions with Fronus Solar Energy. We offer high-efficiency solar panels, inverters, and batteries designed to maximize

INVERTER Suppliers Data, List of INVERTER Exporters Bolivia

bolivia is one of the leading manufacturers, suppliers or exporters of INVERTER in the global trade market. In 2020, the nation has exported INVERTER worth of billion USD. If you''re

Top Solar inverter Suppliers in Bolivia

Jun 26, 2025 · Solar inverters convert the direct current (DC) output of panels to the alternating current (AC) on which most residential and commercial appliances run. In short, the inverters

Renewable Energy Manufacturers in Bolivia

Product types: lead acid batteries, renewable energy system batteries, electric vehicle batteries, battery components, industrial batteries, DC to AC power inverters, rechargeable batteries,

Learn More

- Buenos Aires Inverter Repair Factory

- 3 5 kw solar inverter factory in Bolivia

- East Timor Inverter Repair Factory

- Inverter repair factory in Chiang Mai Thailand

- Hybrid solar inverter factory in Brisbane

- 1 5 kw solar inverter factory in Netherlands

- Hot sale atess hybrid inverter factory Buyer

- Inverter Energy Storage Machine Factory

- House inverter system factory in Lisbon

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

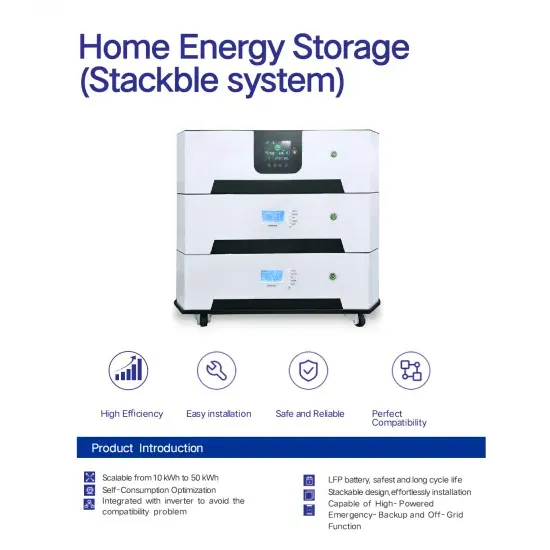

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.