Djibouti Lithium Battery Packaging Equipment Company

Explore cutting-edge energy storage solutions in grid-connected systems. Learn how advanced battery technologies and energy management systems are transforming renewable energy

Djibouti Smart Energy Storage Battery Enterprise

News and analysis concerning energy storage, including battery storage, research and development of new types of batteries, lithium-ion technology, as well as energy storage

Djibouti New Energy Storage

Djibouti is advancing its clean energy initiatives with a 25-megawatt solar project that includes battery storage. This project, developed by AMEA Power, aims to generate 55 GWh

Djibouti Energy Storage Container Company Factory Operation

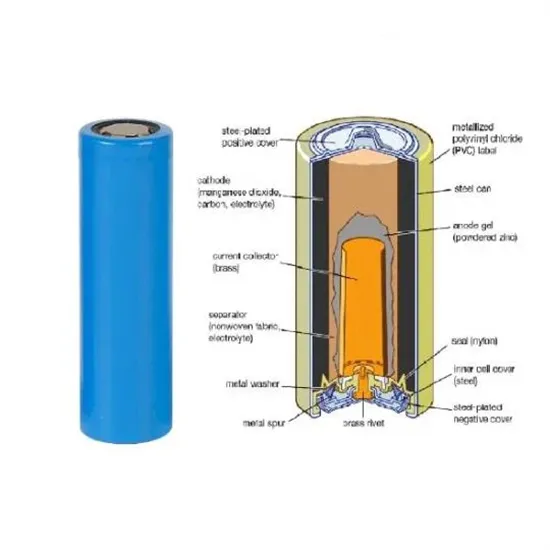

The Battery Energy Storage System (BESS) is a versatile technology, crucial for managing power generation and consumption in a variety of applications. Within these systems, one key

Djibouti outdoor mobile energy storage power supply

Lithium Storage Modules Engineered for Foldable Containers Engineered to complement solar folding containers, our lithium-ion battery systems deliver dependable power storage with fast

List of Djibouti new energy battery companies

The 25-megawatt solar project with Battery Storage will support Djibouti''''s clean energy ambitions by generating 55 GWh of clean energy per year, enough to reach more than 66,500 people;

Djibouti 1000 kWh lithium energy storage battery

This report defines and evaluates cost and performance parameters of six battery energy storage technologies (BESS) (lithium-ion batteries, lead-acid batteries, redox flow batteries, sodium

Companies producing batteries in Djibouti

The 25-megawatt solar project with Battery Storage will support Djibouti''''s clean energy ambitions by generating 55 GWh of clean energy per year, enough to reach more than 66,500 people

Djibouti energy storage battery company

Top Battery Energy Storage Companies Additionally, the company''''s iron salt energy storage system, centered around a redox flow battery unit, represents a breakthrough in long-duration

The most Djibouti energy battery company

The 25-megawatt solar project with Battery Storage will support Djibouti''''s clean energy ambitions by generating 55 GWh of clean energy per year, enough to reach more than 66,500 people;

Djibouti Energy Storage Lithium Battery Wholesaler

LJY Energy Lithium battery supplier looking for wholesaler dealer LJY Energy is a leading lithium battery supplier specializing in high-quality and reliable lithium battery solutions. Our products

Battery energy storage companies in Djibouti

energy relies on large-scale energy storage. Megapack is a powerful battery that provides energy storage and support, helpi g to stabilize the grid and prevent outages. By strengthening our

Djibouti Battery Energy Storage System Market (2024-2030

Djibouti Battery Energy Storage System Market (2024-2030) | Size, Analysis, Share, Companies, Segmentation, Industry, Revenue, Outlook, Value, Growth, Forecast & Trends

Djibouti battery and energy technologies

25-megawatt solar project with Battery Storage will support Djibouti''''s clean energy ambitions by generating 55 GWh of clean energy per year, enough to reach more than 66,500 people; The

What are the battery companies in Djibouti

Here are five of the top battery storage companies in operation The company''''s Gigafactory mainly manufactures batteries and battery packs for Tesla vehicles and energy storage

5 FAQs about [Djibouti quality energy storage battery company]

What is the cost of electricity in Djibouti?

The cost of electricity in Djibouti is 23.4 US cents per kWh (in 2017). This is higher than the costs in Ethiopia, which were 4.7 and 4.4 US cents/kwh in 2016 and 2017, respectively.

What is Djibouti's new solar project?

The project will be the first solar Independent Power Project (IPP) in Djibouti and will be located in Grand Bara, south of Djibouti City. The solar project is being fully developed by AMEA Power under a Build-Own-Operate and Transfer (BOOT) model and will generate 55 GWh of clean energy per year, enough to reach more than 66,500 people.

Who will take over the Djibouti electricity project?

The Sovereign Fund of Djibouti (FSD) will be joining the project before financial close as a minority shareholder. The offtaker for the project will be Electricité de Djibouti. As part of its strategic plan, the Government of Djibouti aims to reduce CO2 emissions by around 40% by 2030.

Who signed the Djibouti Solar Power Project (IPP)?

The signing was witnessed by the Minister of Energy and Natural Resources, H.E. Yonis Ali Guedi. The project will be the first solar Independent Power Project (IPP) in Djibouti and will be located in Grand Bara, south of Djibouti City.

Who signed the PPA in Djibouti 2023?

The signing ceremony was held in Djibouti on August 27th, 2023. The PPA was signed by Mr. Djama Ali Guelleh, CEO of the national utility company, Electricité de Djibouti (EDD) and Mr. Hussain Al Nowais, Chairman of AMEA Power. The signing was witnessed by the Minister of Energy and Natural Resources, H.E. Yonis Ali Guedi.

Learn More

- Papua New Guinea Home Energy Storage Battery Company

- Islamabad s powerful communication base station battery energy storage system company

- Funafoti Photovoltaic Energy Storage Battery Company

- High quality home battery storage for sale company

- Thailand photovoltaic energy storage battery company

- East Timor local energy storage battery company

- Uz energy storage lithium battery is which company s brand

- Energy storage battery company inventory

- Black Mountain Lithium Battery Energy Storage Equipment Company

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.