Poland Power Transition Outlook 2023

Feb 6, 2023 · Executive summary Poland''s power sector faces significant economic- and policy-driven shifts that could see emissions fall 60-86% over 2021-2030. This report presents three

Polish Grids 2040 – Ready for 90 GW of Renewables

Jan 22, 2025 · To meet the needs of the energy system and consumers, Poland''s network development model requires urgent changes. The new report by Forum Energii, titled "Polish

What are the energy storage plants in poland

The strategic goal of the Group in the area of energy storage is to have 800 MW of new energy storage installed capacity in Poland by 2030. The energy stores will ensure safe system

Poland''s SA Energy Storage Power Station Subsidy: A

With Poland''s SA (Storage Acceleration) subsidy program gaining momentum, stakeholders are scrambling to understand how to tap into this goldmine. This article breaks down the Poland

EXECUTIVE SUMMARY OF POLAND''S NATIONAL

Nov 18, 2021 · Poland''s National Energy and Climate Plan for years 2021-2030 (NECP PL) along with attachments has been developed in fulfilment of the obligation set out in Regulation (EU)

2025 Poland Energy Storage Policy Promotion: A Catalyst for

Feb 19, 2023 · Poland''s 2025 energy storage policy isn''t just paperwork—it''s a €2.3 billion game plan to turn wind gusts and sunny days into 24/7 power. Imagine storing summer sunshine for

List of energy storage projects in poland

process of bidding into last year''''s Polish state-owned power company PGE Group (WSE:PGE) is planning to build a battery energy storage system (BESS) of at least 200 MW/820MWh

Poland''s Energy Storage Revolution: How Battery Systems

With coal still generating 68% of electricity as of 2024 [1], the country faces mounting pressure to meet EU climate targets while ensuring grid stability. The recent completion of Żarnowiec

POLANSA NEW ENERGY STORAGE POWER STATION

In the ''''Guidance on New Energy Storage'''', energy storage on the power side emphasizes the layout of system-friendly new energy power station projects, the planning and construction of

Where Are Poland''s Power Storage Stations Located? Key

Jan 15, 2024 · Let''s unpack the geography and ambition behind Europe''s newest energy storage hotspot – and yes, we''ll even tell you exactly where to find Poland''s largest power storage

Polish utility plans to add 10 GWh of energy

Mar 25, 2025 · Polish utility PGE Group is planning to add more than 80 energy storage facilities through to 2035 to the tune of PLN 18 billion ($4.7 billion).

Poland looks set to be an energy storage leader

Jun 10, 2024 · Poland, Europe''s tenth-largest economy, is set to become a hotbed of energy storage project development as the share of renewable energy on its grid soars. The country

Poland energy transition storage boom

Mar 13, 2025 · According to data contained in PSE''s grid development plan for 2025-2034, more than 43 GW of photovoltaics and about 18 GW of onshore wind power, plus gigawatts of

6 FAQs about [Poland energy storage power station planning]

Will Poland become a hotbed of energy storage project development?

Poland, Europe’s tenth-largest economy, is set to become a hotbed of energy storage project development as the share of renewable energy on its grid soars. The country built out a record 1.2 GW of onshore wind power in 2023, according to industry body WindEurope, bringing its total installed capacity to around 9.4 GW.

How can energy storage support Poland's electricity system?

By addressing challenges such as peak load balancing and frequency regulation, energy storage enhances the resilience and flexibility of Poland’s electricity system. The storage support program is expected to begin accepting applications in the second quarter of 2025. Full details and deadlines will be published by the NFOŚiGW.

Will PGE build a battery energy storage system in Poland?

process of bidding into last year''sPolish state-owned power company PGE Group (WSE:PGE) is planning to build a battery energy storage system (BESS) of at least 200 MW/820MWh which will be linked to an existing pumped-s orage power plant in the north of Poland. The project has obtained the first license promise in Poland for electri ity sto

How many GWh of energy storage capacity will Poland have by 2035?

In a bid to tackle the challenge of the growing electricity production from renewable energy sources, the Polish utility is looking to add more than 10 GWh of energy storage capacity by 2035. Its plans involve more than 80 projects, the value of which is estimated at around PLN 18 billion ($4.7 billion).

What is the most advanced energy storage project in Poland?

The most advanced energy storage project in the PGE Group’s portfolio is the Żarnowiec Energy Storage Facility. With a power output of 262 MW and a storage capacity of around 981 MWh, the facility will be by far the largest battery energy storage facility in Poland and one of the largest in Europe.

What happened to energy storage in Poland?

The Energy Regulatory Office said in a report last year on electricity storage in Poland that, as a result of the main power market auctions for 2021-2028 and the supplementary auctions for 2012-2025, contracts for energy storage with a total capacity of 9.5 GW were concluded.

Learn More

- The latest energy storage power station planning

- Planning for building energy storage power station in Tirana

- Service life of wind and solar energy storage power station

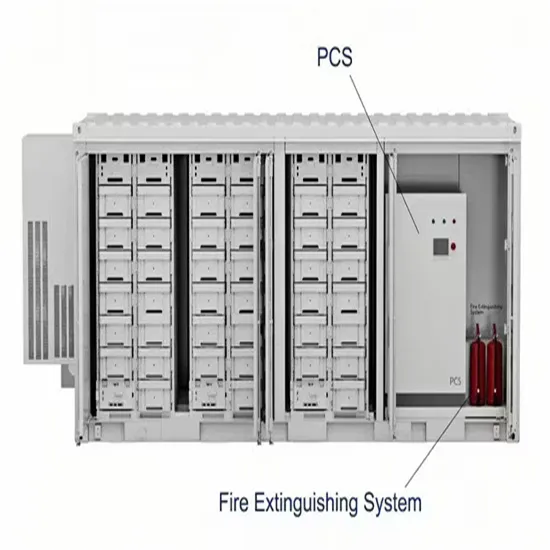

- Containerized energy storage power station production

- Bhutan energy storage power station profit model

- Power station energy storage integration

- Energy storage power station grid connection

- Does the energy storage power station have photovoltaic and wind power

- Italian photovoltaic off-grid energy storage power station company

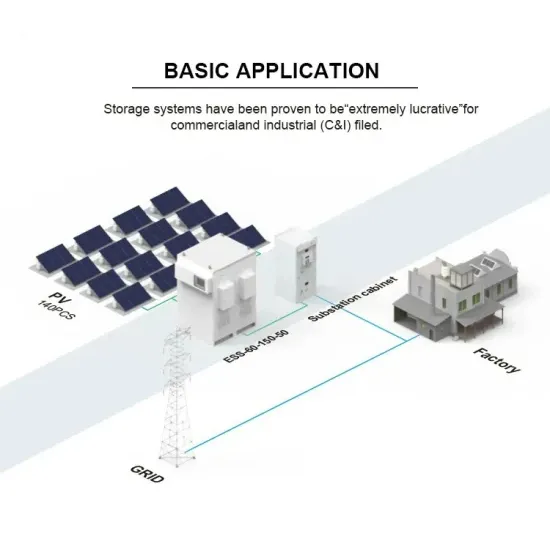

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.