Lesotho Energy Storage Hydraulic Station Production

In Lesotho there are six power stations: Two hydro-power stations (''''Muela and Mantsonyane), a hybrid diesel-hydro power station in Semonkong, solar mini-grid at Moshoeshoe I international

An optimization approach for the economic dispatch

Apr 1, 2023 · With the abundant renewable energy sources in Lesotho, independent power producers could be incentivized to erect solar PV plants and wind farms to increase local

Lesotho Solar Power Station: A Major Step Toward Energy

Aug 11, 2025 · Lesotho is building its first large-scale solar power station in the Maseru district. The project will be completed in two phases—30 MW and then 40 MW—with the plant set to

70MW Solar Power Project

Nov 23, 2022 · Through Phase I of the project a 30MW solar generation facility will be installed, 132 kV electricity sub-station will be erected and 55km transmission line will be developed

Lesotho solar power Station to Deliver 70 MW of Extraordinary Energy

Jul 21, 2025 · Lesotho''s solar power station is set to generate an astounding 70 MW of energy, marking a significant shift from the country''s current reliance on imports. This development

Lesotho solar power Station to Deliver 70 MW of Extraordinary Energy

Jul 21, 2025 · The solar power station is part of Lesotho''s broader strategy to achieve energy independence and sustainability. By investing in renewable energy, the country is paving the

National University of Lesotho

Apr 23, 2025 · The present study examines the planning of a pumped hydroelectric power station situated in the Quthing district, Lesotho, utilizing the resources of the Likhaebaneng River, and

IS LESOTHO LAUNCHING A SOLAR MINI GRID PROJECT

Solar energy storage pumped water project Pumped storage hydropower is a form of clean energy storage that is ideal for electricity grids reliant on solar and wind power. The technology

Lesotho''s Energy Storage Policy Shift: Solar Integration and

Why Lesotho''s Grid Needs Storage Now More Than Ever You know, Lesotho''s mountainous terrain gives it 3,000+ hours of annual sunshine - perfect for solar power. But here''s the kicker:

Statistical report No10: 2021 2020 Energy Report

May 24, 2021 · 3.1 Generated Electricity Electricity is most often generated at a power plant by electromechanical generators, primarily driven by heat engines fueled by other means such as

Lesotho Jiaotou Energy Storage Power Station

Energy Storage Technologies for Modern Power Systems: A Power systems are undergoing a significant transformation around the globe. Renewable energy sources (RES) are replacing

Lesotho | Africa Energy Portal

4 days ago · The National Policy 2015-2025 guides the sector and envisions the development of the renewable energy sector.The total amount of energy available is 75 MW as against a

Lesotho Wind Power Energy Storage Project

Statistical report No10: 2021 2020 Energy Report the Lesotho Electricity Company (LEC), which is the monopoly transmitter, distributor and supplier of electricity, and the Lesotho Highlands

6 FAQs about [Lesotho Wind and Solar Energy Storage Power Station]

What is the energy sector like in Lesotho?

sformation in LesothoThe energy sector in Lesotho is characterised by an enormous potential of rene able energy resources. Lesotho has the potential to produce up to 6,000 MW from wind and solar, 4,000 MW from pump storage, 400 MW from conventional hydropower, and more than 1,

Can Lesotho produce electricity?

able energy resources. Lesotho has the potential to produce up to 6,000 MW from wind and solar, 4,000 MW from pump storage, 400 MW from conventional hydropower, and more than 1, 00 MW from hydropower.However, the current demand for electricity continues to excee

How much does Lesotho government contribute to solar power project?

Lesotho Government Contribution to this project is estimated at M220 million which will cover the costs of land compensations valued around M57 million, Tax obligations as well as operating costs of Lesotho Electricity Generation Company (LEGCO). The government is implementing 70MW solar electricity generation project at Ramarothole in Mafeteng.

Who is constructing a solar power plant in Lesotho?

The government has also engaged China Sinoma International Engineering and TBEA Xinjiang New Energy to construct solar power plant that will produce 70 MW. Lesotho Electricity and Water Authority (LEWA) Lesotho Electricity Company (LEC) Lesotho Highlands Development Authority (LHDA)

Can Lesotho produce 450 MW of hydropower?

According to Lesotho’s Department of Energy, Lesotho could potentially produce 450 MW in hydropower and several hundred more with wind power. However, only 17 percent of this potential is being exploited, 96 percent of it at the ‘Muela hydro-power plant and the rest from mini hydro-power plants at Mants’onyane, Mokhotlong, Tsoelike, and Semonkong.

Can Lesotho export wind power?

Breeze Power, a company owned jointly by GOKL and Harrison & White Investments, is investigating twelve sites for wind power generation. Energy demand is growing in South Africa and the rest of the region, and Lesotho has the potential to export renewable power.

Learn More

- Design of wind and solar energy storage power station

- Paris Wind and Solar Energy Storage Power Station

- Wind solar and energy storage power station investment

- Canada Island Wind and Solar Energy Storage Power Station

- Sofia Wind and Solar Energy Storage Power Station

- Morocco Casablanca Wind and Solar Energy Storage Power Station

- Palau Wind and Solar Energy Storage Power Station

- Home solar wind power energy storage integrated machine

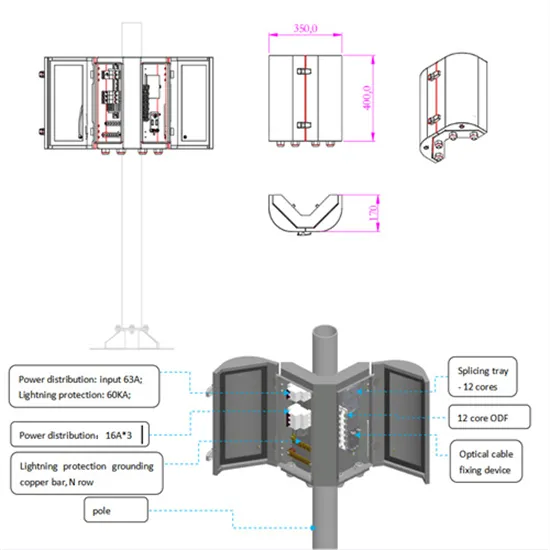

- Guatemala City communication base station wind and solar hybrid power generation energy efficiency

Industrial & Commercial Energy Storage Market Growth

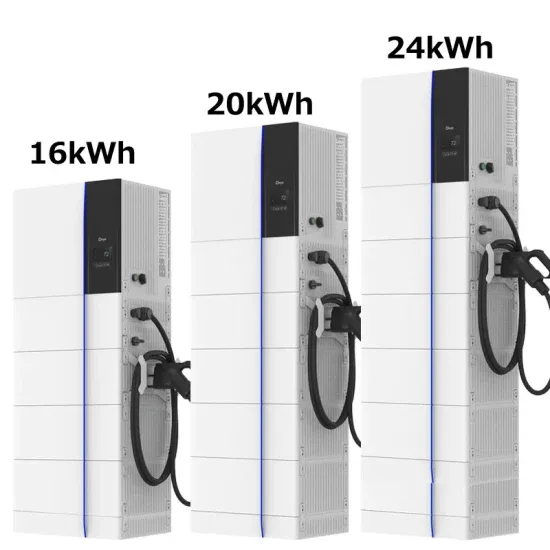

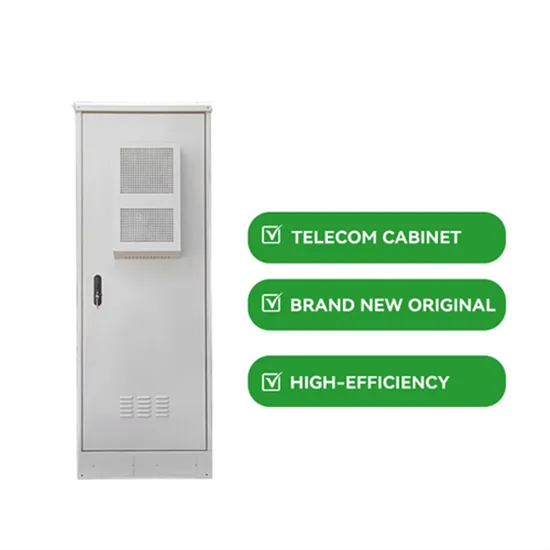

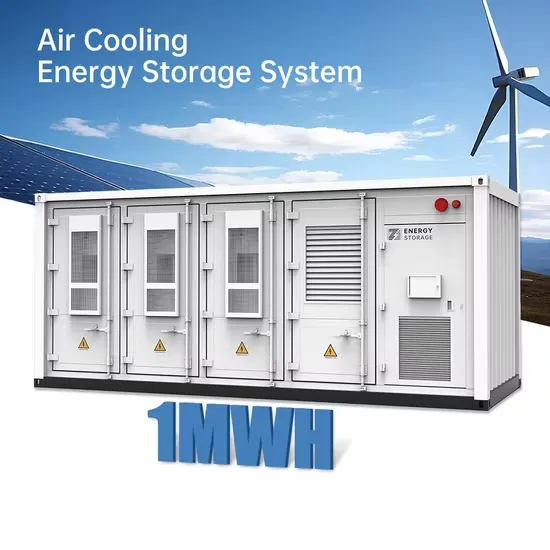

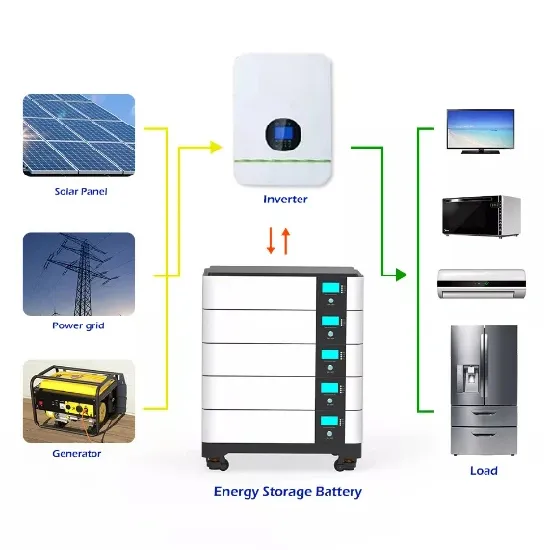

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

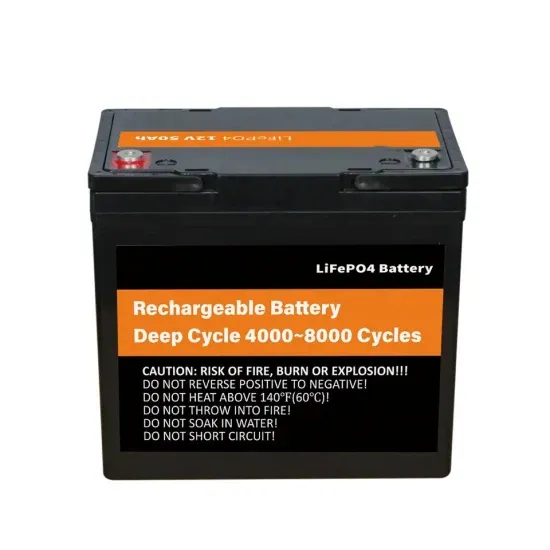

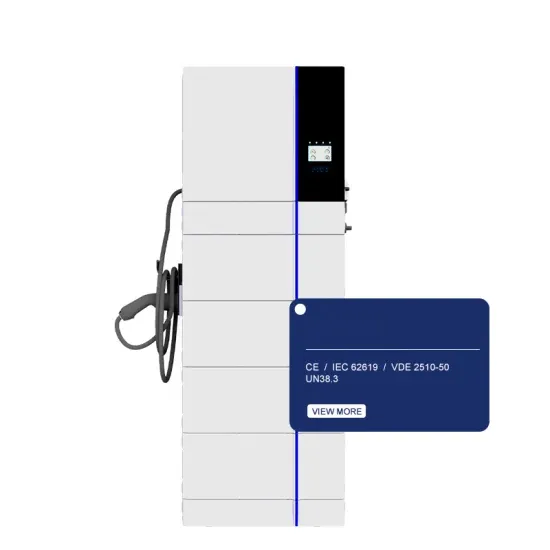

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.