Comparing pricey lithium batteries to cheaper

May 11, 2023 · The cells are one of the biggest price points for manufacturers and determine the cost of lithium batteries, as high-grade Lithium Iron Phosphate

52 Top Lithium Ion Battery Companies in United States

Aug 1, 2025 · Detailed info and reviews on 52 top Lithium Ion Battery companies and startups in United States in 2025. Get the latest updates on their products, jobs, funding, investors,

Lithium Battery Pack Prices Set to Soar | New York Daily Ledger

Lithium battery packs have skyrocketed in price over the past two years, and this surge looks poised to continue with no signs of subsiding through 2023. NEW YORK CITY, NEW YORK,

Ford announces a breakthrough in battery tech

Apr 29, 2025 · In his post, Poon said Ford''s LMR battery technology has the potential to make a "step change," by giving its EVs enhanced safety and

Battery Store | Replacement Batteries

3 days ago · Your Online Battery Store for All Your Replacement Needs Looking for a reliable battery store online? At BatteryMart , we specialize in high-quality replacement batteries

Lithium-Ion Battery Pack Prices See Largest Drop Since

New York, December 10, 2024 – Battery prices saw their biggest annual drop since 2017. Lithium-ion battery pack prices dropped 20% from 2023 to a record low of $115 per kilowatt-hour,

BloombergNEF''s annual battery price survey finds prices

New York, December 6, 2022 – Rising raw material and battery component prices and soaring inflation have led to the first ever increase in lithium-ion battery pack prices since

Lithium Ion Battery Manufacturers in the USA: A

Oct 10, 2022 · The lithium-ion battery market has grown significantly, driven by the need for energy storage in electric vehicles (EVs), consumer electronics,

Lithium Ion battery pack price drops 14% to $139/kWh:

Nov 27, 2023 · According to BloombergNEF''s (BNEF)annual battery survey, lithium-ion battery packs have dropped 14% to $139 per kWh compared to 2022. Based on the information

The Future of EV Battery Replacement Costs

Dec 13, 2024 · Low-priced lithium ion batteries alleviate those fears, because it means that replacement batteries will finally be affordable. Soon enough, it will

Lithium Battery Pack Prices Set to Soar | New York Daily Ledger

After a decade of consistent declines, lithium battery pack prices have taken an unexpected turn, electric vehicle and lithium battery energy storage system (BESS) pack prices have

Build a LiFePO4 battery or buy one already made?

May 14, 2020 · I know from a cost perspective that it''s cheaper to put together your own LiFePO4 battery than buy one ready made, but I''m wonering which is more reliable? Assuming that I

How does the cost of lithium-ion batteries vary

Nov 6, 2024 · China Lowest Prices: China typically offers the lowest lithium-ion battery prices globally. In 2023, average battery pack prices in China were

Prices of Lithium Batteries: A Comprehensive Analysis

Apr 11, 2025 · Raw Materials: Lithium carbonate prices swung from $6,000/ton (2020) to $80,000/ton (2022). Manufacturing Scale: Gigafactories like Tesla''s reduce costs through

6 FAQs about [Which lithium battery pack is cheaper in New York USA]

Which country has the lowest lithium-ion battery pack prices?

China has the lowest lithium-ion battery pack prices at $126/kWh. Contemporary Amperex Technology Co. (CATL) is based in China. CATL dominates the global EV battery industry, holding 37% market share as of October 2023. The United States and Europe’s prices for battery packs were 11% and 20% higher than China’s, respectively.

Will lithium-ion battery prices go down by 2 years?

Since September, producers in China have raised the prices of their LFP cells by 10% to 20%. The analysis firm said that while historical trends imply that an average pack price across the board of lithium-ion battery types are likely to fall below US$100/kWh by 2024, if higher raw material prices persist, this could be put back by two years.

How much does a lithium battery cost in 2024?

Energy Density: NMC 811 batteries cost $98/kWh vs. LFP’s $80/kWh in 2024. Policy Shifts: US Inflation Reduction Act subsidies cut domestic production costs by 12%. How Have Lithium Battery Prices Trended Historically? From 2010–2023, average prices fell from $1,200/kWh to $139/kWh.

How much does a lithium ion battery cost in 2022?

lithium-ion battery packs have dropped 14% to $139 per kWh compared to 2022. China has the lowest prices while the US' price is 11% higher.

How much does a Li-ion battery cost?

As of Q1 2025, the average li-ion cell price is around $85 per kilowatt-hour (kWh) at the pack level, down from $101/kWh in 2022, according to BloombergNEF. For individual cells, prices vary significantly: 21700 vs 18650 Battery:What Difference is between them? Prices are also affected by order volume.

Why did lithium-ion battery prices drop 20% from 2023?

Lithium-ion battery pack prices dropped 20% from 2023 to a record low of $115 per kilowatt-hour, according to analysis by research provider BloombergNEF (BNEF). Factors driving the decline include cell manufacturing overcapacity, economies of scale, low metal and component prices, adoption of lower-cost lithium-...

Learn More

- USA New York Battery PACK Company

- New lithium battery pack virtual power

- Which brand of power lithium battery pack is good

- Which lithium battery pack

- Lesotho new energy vehicle lithium battery pack

- Which lithium battery pack in ASEAN is reliable

- New Zealand 40A lithium battery pack

- New es replaces lithium battery pack

- New 60v lithium iron phosphate battery pack

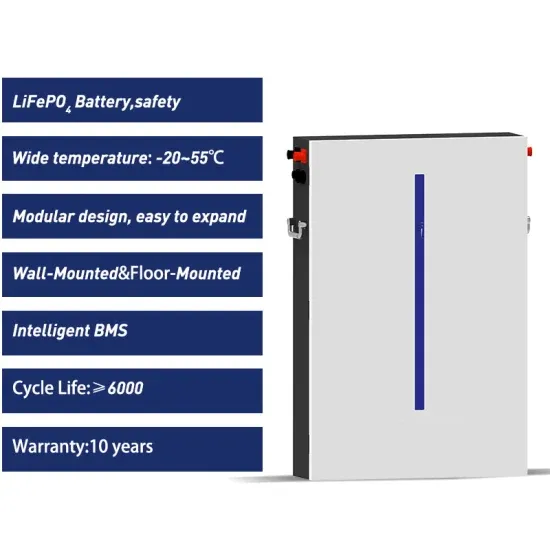

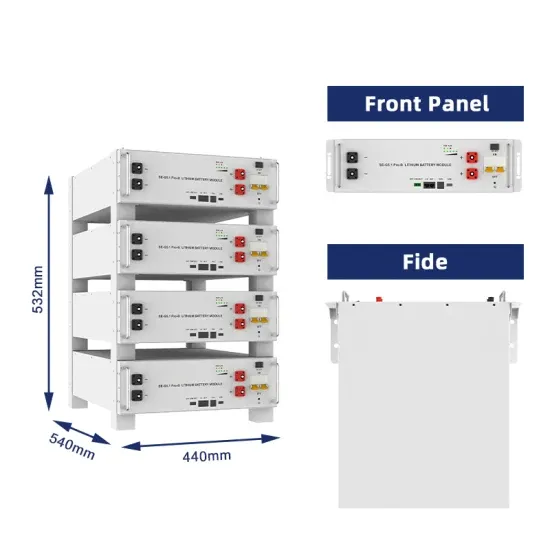

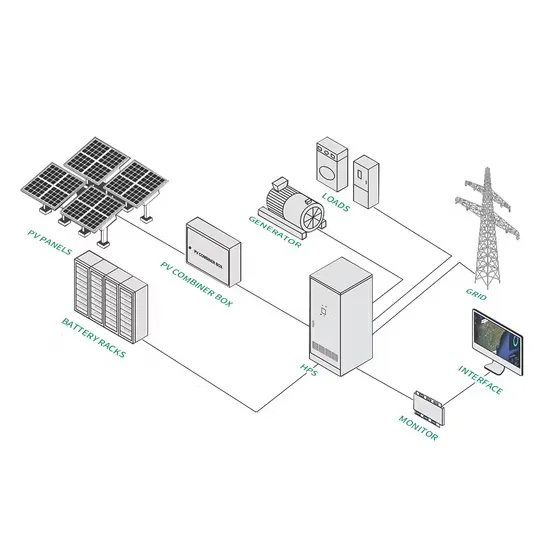

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.