Global Photovoltaic Inverter Market Research Report 2024

Jan 16, 2024 · The global Photovoltaic Inverter market was valued at US$ 5776.2 million in 2023 and is anticipated to reach US$ 5889.2 million by 2030, witnessing a CAGR of 0.2% during the

How to make profit from photovoltaic inverter

For a solar farm with $500,000 in annual revenue and $425,000 in annual costs,the profit margin would be 15%,in line with the typical industry range for solar farms which ranges from 10-20%.

Huawei s photovoltaic inverter revenue share

Global PV inverter shipments grew by 56% to 536 gigawatts alternating current (GWac) in 2023, reflecting a strong year for the broader solar industry. The top 10 global PV inverter vendors

How is the profit of photovoltaic inverter

Do ground-mounted commercial PV systems benefit from low inverter costs? Ground-mounted commercial PV systems also benefit from lower inverter costsas a result of the rapid shutdown

Transformative Trends in the Photovoltaic Inverter Market:

May 7, 2025 · For instance, Yuneng Technology''s net profit was 29 million yuan, down about 28% year-on-year. HeMai reported a loss of 10.36 million yuan, a staggering 115% decline, making

Sungrow Releases Annual Report 2023: Operating Revenue

Apr 25, 2024 · Sungrow Releases Annual Report 2023: Operating Revenue Witnessed a Robust Growth of 79.5% Hefei, China, April 25, 2024 -- Sungrow, the global leading PV inverter and

Photovoltaic (PV) Inverter Market Size, Share and Forecast

Jun 19, 2025 · The Photovoltaic (PV) Inverter Market size was valued at USD 14,692.13 million in 2018, increased to USD 25,361.38 million in 2024, and is anticipated to reach USD 54,650.92

A refined method for optimising inverter loading ratio in

Dec 1, 2024 · This paper proposes a novel approach for designing the inverter loading ratio (ILR) for utility-scale PV systems. As the first of its kind, a determin

PV Inverter Market Size, Share & Forecast Report, 2025-2034

The PV inverter market size crossed USD 34.6 billion in 2024 and is set to grow at a CAGR of 9.5% from 2025 to 2034, driven by positive outlook toward clean energy

Single-Phase Non-Isolated Inverter With Shared-Ground and

Feb 4, 2025 · The produced voltage of photovoltaic (PV) system is largely affected by environmental variables, such as light intensity and temperature. The PV power conditioning

The size, share, and projected growth rate of the Distributed

Jan 31, 2025 · The size, share, and projected growth rate of the Distributed Photovoltaic Inverter Market with the projected profits with a CAGR of 5.9% between 2025

Photovoltaic Inverters Strategic Business Report 2025:

May 21, 2025 · Photovoltaic (PV) inverters play a critical role in the solar energy sector, converting direct current (DC) electricity generated by solar panels into alternating current (AC) electricity

Financial report interpretation|What are the main reasons

Nov 15, 2024 · In the first three quarters of 2024, compared with the "big blood loss" of the performance of the four main chain links of photovoltaics, the overall revenue and profit

How high is the profit of photovoltaic inverter

How big is the solar PV inverters market? The Solar PV Inverters Market size is estimated at USD 13.68 billionin 2024,and is expected to reach USD 17.23 billion by 2029,growing at a CAGR of

6 FAQs about [Inverter photovoltaic profit share]

What is the global PV inverter market share?

A growing number of solar installations in developing nations has also significantly contributed to growth of market in the region. Europe: The PV Inverter Market in Europe holds 10% share in the market and the presence of major players in the region. Figure 1. Global PV Inverter Market Share (%), By Region, 2025

How much is the PV inverter market worth?

The PV inverter market was valued at USD 25.5 billion, USD 29.9 billion, and USD 34.6 billion in 2022, 2023, and 2024, respectively. The string inverter market is expected to grow at a CAGR of 9.8% between 2025 and 2034 due to their cost-effectiveness, scalability, and ease of installation.

What is the growth rate of solar PV inverter market in 2024?

By inverter type, central systems commanded 55% revenue share in 2024, while microinverters are projected to register the fastest 8.1% CAGR by 2030. By application, utility-scale installations accounted for 63% of the solar PV inverter market size in 2024, while residential is set to grow at a 7.6% CAGR through 2030.

How is the solar PV inverters market segmented?

The solar PV inverters market is segmented by inverter type, application, and geography. By inverter type, the market is segmented into central inverters, string inverters, and micro-inverters.

What are the trends in the PV inverter market?

PV Inverter Market Trends Rising demand for storage along with PV systems: The growing demand for battery storage solutions in conjunction with photovoltaic or solar systems is having a substantive impact on the PV Inverter Market.

What drives the PV inverter market?

The PV inverter market is poised to grow significantly over the next five years, driven by declining prices of solar panels and supportive government policies and regulations around the world. Major drivers for the market include countries mandating renewable energy generation targets and incentives for rooftop solar installations.

Learn More

- Photovoltaic inverter enterprise profit margin

- Photovoltaic inverter electronic control

- Huawei 125k photovoltaic inverter

- Nordic communication base station inverter photovoltaic power generation equipment

- Photovoltaic universal inverter

- Photovoltaic power supply light storage inverter

- Brussels photovoltaic energy storage 40kw inverter

- Three-phase bipolar photovoltaic inverter

- Alofi 30kw photovoltaic inverter price

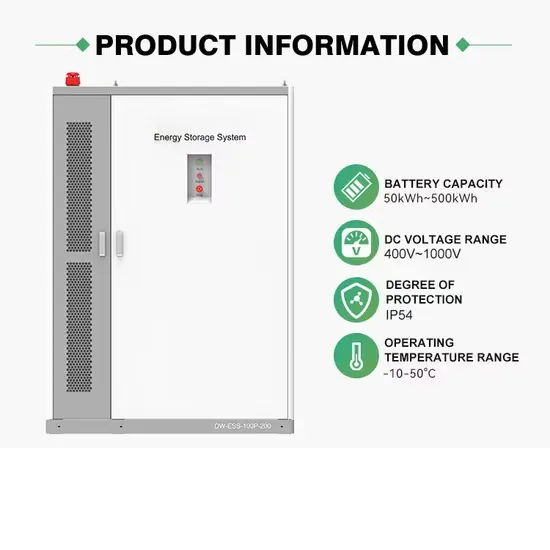

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.