China Solar Communication Base Station Power

Solar Power System for Communication Base Station, Find Details and Price about Solar Power Solar Power System from Solar Power System for Communication Base Station - Shenzhen

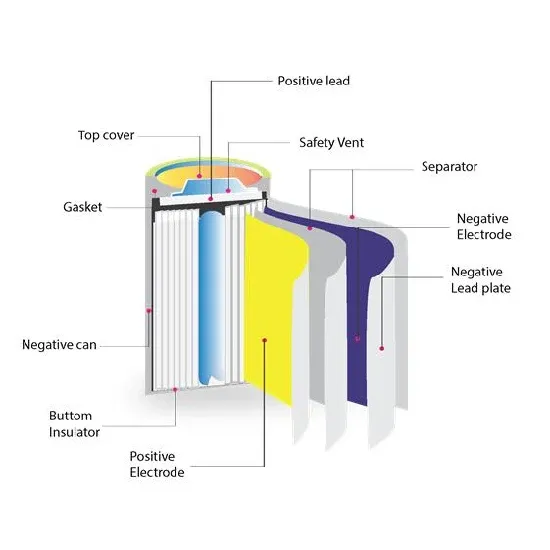

Carbon emission assessment of lithium iron phosphate

Nov 1, 2024 · The demand for lithium-ion batteries has been rapidly increasing with the development of new energy vehicles. The cascaded utilization of lithium iron phosphate (LFP)

2023-2029全球及中国通信基站锂电池行业研究及十四五规划

2023-2029全球及中国通信基站锂电池行业研究及十四五规划分析报告 2023-2029 Global and China Communication Base Station Li-ion Battery Industry Research and 14th Five Year Plan

The Status and Prospects of Offshore Wind in China

Sep 25, 2024 · The offshore wind power industry clusters in China e construction of offshore wind industry clusters. The focus is on building offshore wind bases in Guangdong, Fujian,

China leads global clean energy shift with wind, solar power

Sep 6, 2023 · BEIJING, Sept. 5 -- China is leading global efforts to shift to cleaner energy sources, with robust development in its wind and photovoltaic power industries supported by

Ambitious 5G base station plan for 2025

Dec 28, 2024 · Technicians from China Mobile check a 5G base station in Tongling, Anhui province. [Photo by Guo Shining/For China Daily] China aims to build over 4.5 million 5G base

Mobile communication base station traffic forecast

Jul 21, 2021 · The rapid development of the mobile Internet has brought great convenience to people. At the same time, mobile traffic has exploded, and the traffic load of base stations has

China''s Communication Base Station Energy Storage:

Why Are China''s Communication Base Stations Struggling with Energy Storage? You know, as China expands its 5G network coverage to 99% of urban areas by 2025, communication base

fenrg-2022-1032993 1.

Nov 9, 2022 · By 2030, the installed capacity of wind power and photovoltaic in China is expected to reach over 1.8 billion GW, accounting for about 25% of the total power generation. In 2060,

Wind energy in China: Estimating the potential

Jun 20, 2016 · Persistent and significant curtailment has cast concern over the prospects of wind power in China. A comprehensive assessment of the production of energy from wind has

China''s solar and onshore wind capacity reaches new

China''s offshore wind future — Strategic anchors & policy blueprint China''s offshore wind sector is entering a critical phase of development, requiring a coordinated policy framework that

Research on Offshore Wind Power Communication System

Feb 5, 2024 · In view of the special needs of the communication system, a communication system scheme for offshore wind farms based on 5G technology is proposed. </sec><sec>

An overview of the policies and models of integrated

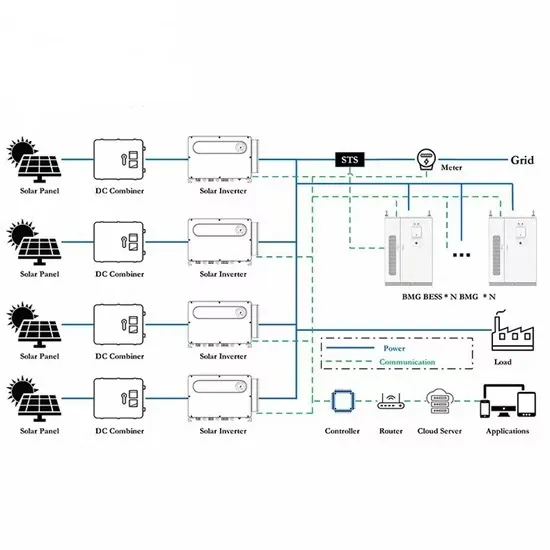

Jun 1, 2023 · With the expansion of communication service coverage and the updating of communication technology in China, the situation of inconvenient power supply of

China''s Largest Grid-Forming Energy Storage Station

Apr 9, 2024 · On March 31, the second phase of the 100 MW/200 MWh energy storage station, a supporting project of the Ningxia Power''s East NingxiaComposite Photovoltaic Base Project

The Mobile Economy Report China 2023 ENG

Mar 24, 2023 · The number of 5G base stations in China exceeded 2.3 million at the end of 2022, including approximately 887,000 built during the year. China will be the first market with 1

Carbon emissions and mitigation potentials of 5G base station in China

Jul 1, 2022 · This study aims to understand the carbon emissions of 5G network by using LCA method to divide the boundary of a single 5G base station and discusses the carbon emission

mobile communication base stations

Apr 21, 2021 · Forecasting Growth: Future Trends and Opportunities in China''s Mobile Communication Base Station Market China''s mobile communication base station market is

Communication Base Station Industry Outlook | HuiJue

China''s Smart Grid Integration Breakthrough State Grid Corporation''s collaboration with ZTE has yielded base stations that automatically switch between grid and battery power during peak

China''s solar and onshore wind capacity reaches new

China is advancing a nearly 1.3 terawatt (TW) pipeline of utility-scale solar and wind capacity, leading the global effort in renewable energy buildout. This is in addition to China''s already

Overview of wind power generation in China: Status and development

Oct 1, 2015 · Wind power generation has increased rapidly in China over the last decade. In this paper the authors present an extensive survey on the status and development of wind power

征稿 | 通信网络内生智能,《China Communications》英文版

4. Native Intelligence of Mobile CommunicationsCo-chairs:Jin Shi, Southeast University (China) Yang Kun, NanjingUniversity (China) Zhang Yan, University of Oslo (Norway) Li Rongpeng,

China s communication base station household rooftop

China s communication base station household rooftop solar power genera of 0.3 GWp by 2010, and The country added 120 gigawatts of utility-scale solar projects, exceeding the 96.3

5G Mobile Communication Base Station Electromagnetic

Dec 15, 2023 · Abstract. The current national policies and technical requirements related to electromagnetic radiation administration of mobile communication base stations in China are

6 FAQs about [China s communication base station wind power trend]

Why is the power consumption of communication base station increasing in China?

With the expansion of communication service coverage and the updating of communication technology in China, the situation of inconvenient power supply of communication base station in remote areas and the sharp increase of power consumption of the base station equipment is becoming more and more prominent.

How big is China's Wind power?

This is roughly four times the global average for capacity under construction (9%). China’s wind capacity follows a similar rate of growth as solar, according to Global Energy Monitor’s Global Wind Power Tracker, with over 590 GW in prospective phases — nearly 530 GW of onshore capacity and 63 GW of offshore capacity.

Does China have a natural advantage of offshore wind power?

China has the natural advantage of developing offshore wind power, with a coastline of 18,000 km and a useable sea area of more than 3 million square kilometers, and abundant offshore wind energy resources. In 2021, the cumulative installed capacity of offshore wind power was 26.39 GW, with 16.9 GW newly installed (Chen, 2011; Liu et al., 2021).

Is China a global leader in offshore wind?

China has established itself as the global leader in offshore wind through rapid and large-scale development. In 2024, China added 4.4 GW of offshore wind capacity, accounting for nearly 55% of all global additions that year. China’s offshore wind capacity grew from less than 5 GW in 2018 to 42.7 GW by March 2025.

How big is China's offshore wind powerhouse?

Of this, 510 GW is already under construction, primed to be added to China’s 1.4 TW solar and wind capacity already in operation. As of March 2025, China has emerged as the world’s offshore wind powerhouse — growing from under 5 GW in 2018 to 42.7 GW in 2025 (50% of global capacity).

How much wind power does China have in 2021?

In 2021, onshore wind power added 30.67 GW and offshore wind power added 16.9 GW. Provinces and regions with large new installed capacity included Jiangsu (5.02 GW), Guangdong (4.69 GW), and Henan (3.22 GW). By the end of 2021, the grid-connected wind and PV power installed capacity reached 328 GW and 306 GW respectively.

Learn More

- Communication base station wind power chip China

- Beijing Wireless Communication Base Station Wind Power

- Belarusian Communication Base Station Wind Power Company

- Abu Dhabi communication base station wind power construction standards

- Victoria Communication Base Station Inverter Grid-connected Wind Power

- Fire emergency network communication base station wind power

- Remote communication base station wind power network

- Malawi communication base station wind power cost

- What equipment does communication base station wind power consist of

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.