Photovoltaic waste management in sub-Saharan Africa:

Jan 22, 2024 · Sub-Saharan Africa is witnessing a proliferation of photovoltaic (PV) waste due to the increasing number of solar PV power plants. PV waste (panels, batteries, electrical cables,

How do microgrid PV systems help communities respond to

This study investigates the socio-economic consequences of microgrid photovoltaic (PV) systems in and on vulnerable West African communities, with a focus on the food-water-energy and

Top 10 Solar Panel Manufacturers in Africa Powering the

May 23, 2025 · Africa''s solar energy sector is experiencing significant growth, driven by the continent''s abundant sunlight and increasing demand for sustainable energy solutions.

Solar System Installers in Africa | PV Companies List | ENF Company

List of Africa solar panel installers - showing companies in Africa that undertake solar panel installation, including rooftop and standalone solar systems.

West african photovoltaic energy storage inverter

The company showcased its suit of vertically integrated solutions at Africa ''s largest renewable energy exhibitionSolar &Storage Live Africa,which Johannesburg,from March 18 to 20.

Solar System Installers in Africa | PV Companies List | ENF Company

African solar panel installers – showing companies in Africa that undertake solar panel installation, including rooftop and standalone solar systems. 2,343 installers based in Africa are listed below.

West Africa Solar PV Panel Market Size, Share & Trends

Nov 13, 2024 · West Africa Solar PV Panels Market Report Highlights: Based on technology, the thin film segment led the market with the largest revenue share of 51.44% in 2024. Thin-film

Togo inaugurates largest solar plant in West Africa

Aug 13, 2024 · The opening of the Sheikh Mohamed Bin Zayed power plant is the latest in a push to increase access to electricity and develop renewables in the

Mali Begins Construction of Largest Solar Plant

May 30, 2024 · Mali has started construction of West Africa''s largest solar plant with the support of Russia''s NovaWind – a subsidiary of nuclear energy

west african photovoltaic energy storage device maintenance company

West Africa Solar PV Panel Market Size, Share Report, 2030 The West Africa solar PV Panels market size was valued at USD 78.11 million in 2021 and is expected to expand at a

West Africa Solar PV Panel Market Size, Share & Trends [2032]

West Africa Solar PV Panel Market Research Report By Power Output (500 kWp, 500-2 MWp, >2 MWp), By Application (Residential, Commercial and Industrial, Utility-Scale), By Panel Type

Learn More

- West African Photovoltaic Panel Source Manufacturer

- African photovoltaic panel processing manufacturers

- Photovoltaic panel energy storage company

- Tehran Rooftop Photovoltaic Panel Company

- Guinea rooftop photovoltaic panel production company

- Muscat rooftop photovoltaic panel production company

- Minsk regular photovoltaic panel power generation company

- Manila high quality photovoltaic panel manufacturer

- Monocrystalline photovoltaic panel width

Industrial & Commercial Energy Storage Market Growth

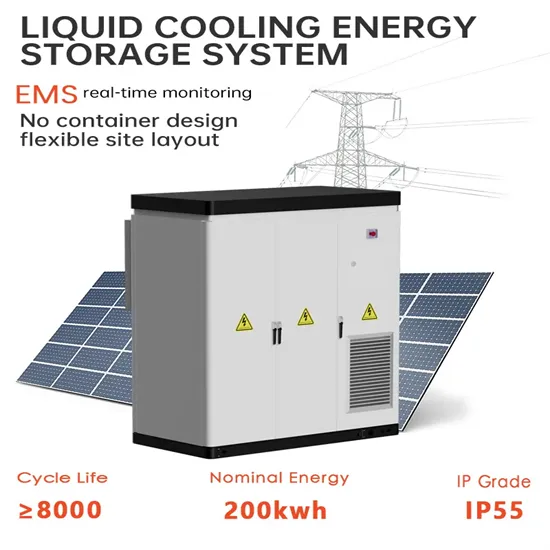

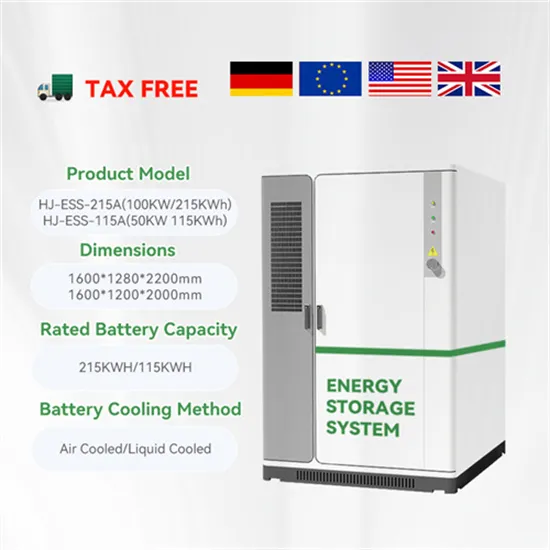

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

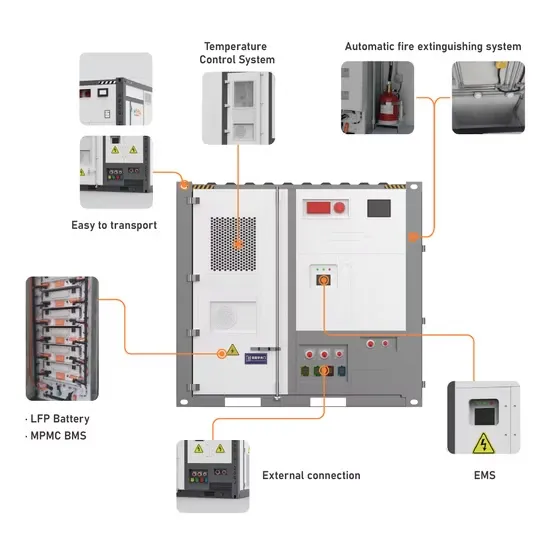

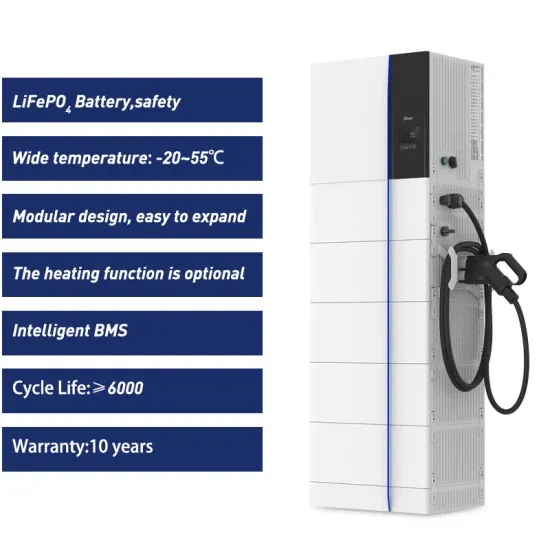

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.