Austria Fire Protection Company Directory | fire protection Companies

A comprehensive directory of fire protection companies operating in Austria. Find all types of companies including fire protection product manufacturers, distributors, resellers, installers, fire

ADS-TEC Energy Expands to Austria

May 28, 2025 · The Kötschach-Mauthen location allows the company to deliver quicker response times and localized expertise. Soon after its establishment, ads-tec Energy Austria GmbH

Energy storage systems in Austria

A total of 36 Austrian companies and research institutions were identified that research innovative storage technologies within these technology groups or offer these on the Austrian market.

NGEN commissions Austria''s largest battery storage system

Feb 13, 2025 · Slovenia-based NGEN put Austria''s largest battery energy storage system into operation. It installed it in record time – just seven months.

ADS-TEC Energy expands into Austria

Jun 4, 2025 · ADS-TEC Energy Austria received its first order soon after its foundation: A framework agreement with an Austrian utility company for three large battery storage systems,

Energy storage system companies Austria

Austria has already gained major technological expertisein the field of electricity and heat storage. Numerous Austrian companies (including mechanical engineering,assembling and engineering

Spanish battery startup HESStec backed by Austrian utility

Jun 16, 2025 · Austrian utility Verbund and Swiss electrification company ABB are among the investors to join a funding round held by Spanish hybrid- and battery-energy storage system

Top 87 Electric Power Companies in Austria (2025) | ensun

Austrian Power Grid AG (APG) is the independent high-voltage electricity transmission system operator in Austria, responsible for ensuring reliable electricity supply and integrating

Sumetzberger | Fire Alarm Systems and Safety Technology

Sumetzberger offers state-of-the-art fire alarm technology and fire protection concepts to protect human lives and property. Ideally matched components guarantee professional and

NGEN commissions Austria''s largest BESS facility

Feb 17, 2025 · Slovenian company NGEN has commissioned what is being described as Austria''s largest battery energy storage system (BESS). Located in Fürstenfeld, the facility has 24 MWh

6 FAQs about [Austrian Energy Storage Fire Fighting Systems Company]

Does Austria have a market for energy storage technologies?

A study 1 carried out by the University of Applied Sciences Technikum Wien, AEE INTEC, BEST and ENFOS presents the market development of energy storage technologies in Austria for the first time.

Who is Rag Austria AG?

RAG Austria AG is Austria’s largest energy storage company, and one of Europe’s leading gas storage facility operators. Our business focus is market driven storage, conversion and conditioning of energy in gaseous forms. We also develop leading edge energy technologies related to green gas like hydrogen that partner renewables.

How many photovoltaic battery storage systems are there in Austria?

Of these, approx. 94% were built with public funding and 6% without. The total inventory of photovoltaic battery storage systems in Austria therefore rose to 11,908 storage systems with a cumulative usable storage capacity of approx. 121 MWh.

How many tank water storage systems are there in Austria?

A total of 840 tank water storage systems in primary and secondary networks with a total storage volume of 191,150 m³ were surveyed in Austria. The five largest individual tank water storage systems have volumes of 50,000 m³ (Theiss), 34,500 m³ (Linz), 30,000 m³ (Salzburg), 20,000 m³ (Timelkam) and twice 5,500 m³ (Vienna).

How will energieallianz Austria contribute to the green energy transition?

From June 2025 until the end of 2026, the hydrogen plant will be supplied with three gigawatt hours of green electricity from 100 percent Austrian renewable sources every year. Through this cooperation with RAG Austria, ENERGIEALLIANZ Austria is strengthening its commitment to green hydrogen as a central component of the Austrian energy transition.

Where does Austria's gas come from?

Austria’s gas comes from domestic production and imports under long-term contracts with reliable partners. Austria has a well developed pipeline grid, and due to its geographical location it is linked to the rest of the European grid by large transit systems. Europe’s energy supply sector is facing an exciting future.

Learn More

- Maldives Energy Storage Systems Company

- Austrian energy storage equipment manufacturing

- Investment in peak-shaving energy storage systems

- Jordan stacked energy storage battery company

- Battery company invested by Belmopan Energy Storage Cabinet

- Requirements for battery energy storage systems for high-altitude communication base stations

- Prague Portable Energy Storage Company

- Yemen Energy Storage Project Company

- Malabo Energy Storage New Energy Company

Industrial & Commercial Energy Storage Market Growth

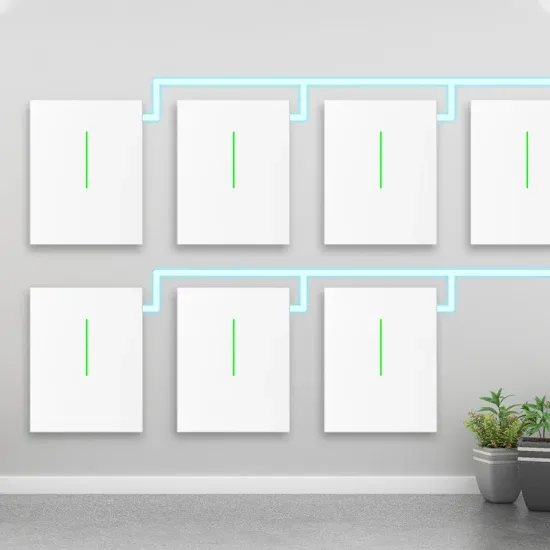

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.