Electricity markets and regulatory developments for storage in Brazil

Jan 1, 2022 · Brazil is taking its first steps toward its ambitions of bringing storage into the energy transition of its electricity sector. The modernization of the electricity sector discussed under

The role and benefits of storage systems in distributed solar

Aug 1, 2024 · In BESS simulations, PU power flows were utilized. The BESS defined operation (charging/discharging schedules) was aimed at the maximum use of the surplus PV energy

The impact of distributed generation and energy storage on

Feb 13, 2025 · Brazil, with its vast solar potential and growing demand for sustainable energy, has the opportunity to follow a similar path, establishing itself as a global leader in the sector.

Brazil''s Distributed Generation Surges to 37 GW,

Mar 5, 2025 · Brazil''s distributed generation (DG) capacity exceeds 37 GW, with 20% growth expected in 2025. This will drive BRL 25 billion in investments

Spotlight on Brazil: A market ready for takeoff

Aug 6, 2025 · As the share of solar power in Brazil''s electricity matrix grows on both transmission and distribution grids, so does the need for flexibility and management of non-simultaneous

Spotlight on Brazil: A market ready for takeoff

Aug 6, 2025 · Simultaneously, solar energy storage could attract R$44 billion (USD $8.46 billion) in investments by 2030, according to a study by ABSAE. This volume would be distributed

''Brazilian solar arrays will include energy storage by 2027''

Dec 3, 2024 · Solar-plus-storage hybrid systems will enter the Brazilian consumer market within two to three years, according to Júlio Bortolini, photovoltaic unit manager at Brazilian

Battery energy storage systems in Brazil: current regulatory

Brazilian law allows small-scale distributed generation projects (capacity not exceeding 3MW or 5MW depending on the technology) to be installed with storage systems, provided certain

Brazil''s Ten-Year Energy Expansion Plan 2034

Jun 25, 2024 · Conclusion The Second Booklet of the Ten-Year Energy Expansion Plan 2034 outlines Brazil''s strategic direction in expanding its energy sector through distributed

Distributed Generation Surpasses 37 GW in Brazil Amid

Mar 9, 2025 · Brazil has reached 37 GW of installed capacity in distributed generation (DG). The Brazilian Association of Distributed Generation (ABGD) projects a 20% growth in installed DG

The impact of distributed generation and energy storage on

Brazil, with its vast solar potential and growing demand for sustainable energy, has the opportunity to follow a similar path, establishing itself as a global leader in the sector.

Distributed energy resources market in Brazil

Jul 19, 2025 · Energy storage: Brazil´s first battery energy storage system (BESS) auction is scheduled for June 2025. This aims to secure approximately 3 gigawatt hours (GWh) of

Transitioning to Distribution System Operators in Brazil

May 19, 2025 · Traditional distribution utilities must transition into dynamic distribution system operators (DSOs) to manage bidirectional power flows, integrate DERs and enhance grid

Brazil Distributed Energy Storage Systems Market Report

2 days ago · The Brazil distributed energy storage systems market is driven by the increasing integration of renewable energy, growing demand for grid stability, and supportive government

The state of battery storage (BESS) in Latin

May 14, 2024 · Brazil''s regulatory framework does not prohibit energy storage solutions, but there are currently no specific regulations on storage. At the end

NEC and Distributed Energy Storage in BrazilCalifornia''s

Jul 6, 2018 · NEC supplies distributed energy storage system for archipelago NEC Energy Solutions is supplying its first distributed energy storage system in Brazil for a research and

Energy Storage Companies in Brazil: Key Players, Trends, and

Jun 25, 2022 · With solar capacity hitting 4GW+ in Q1 2025 alone [5], the country''s energy storage sector is booming faster than a Carnival parade. This article dives into the top energy

The impact of distributed generation and energy storage on

The future of the Brazilian electricity sector points to greater integration between distributed generation and energy storage. With continuous investments in storage technologies and the

Matrix Energia enables storage-as-a-service for

Aug 28, 2024 · To unlock new business in battery energy storage, São Paulo-headquartered Matrix Energia is betting on a model that has been successful

Assessing the economic viability of BESS in distributed PV

May 1, 2024 · Abstract This paper proposes a method to assess the financial attractiveness provided by adding a Battery Energy Storage System (BESS) in distributed photovoltaic (PV)

Power Generation, Transmission & Distribution 2025

Jul 17, 2025 · The current Brazilian power regulatory framework does not regulate the implementation and operation of battery energy storage systems, nor pumped-storage

Economic analysis of industrial energy storage systems in Brazil

Mar 1, 2023 · Therefore, the proposed methodology is expected to be valuable in increasing the deployment of battery energy storage systems, providing a novel perspective of their

Distributed Generation: Transforming the Future of Energy in Brazil

Dec 27, 2024 · The Brazilian energy matrix is undergoing a significant transformation, driven by the growing adoption of Distributed Generation (DG). This innovative model allows consumers

6 FAQs about [Distributed Energy Storage in Brazil]

Will Brazil install a battery energy storage system in 2024?

A study by Brazilian consultancy Greener has indicated that the country installed 269 MWh of energy storage capacity in 2024, growth of 29% from 2023. Demand for battery energy storage system (BESS) components grew 89% in Brazil from 2023 to 2024 and most of the resulting systems are likely to be installed in 2025.

What is driving Brazilian energy storage demand?

An unreliable grid is driving Brazilian energy storage demand. The world is set to have more than 760 GWh of energy storage capacity by 2030, led by Chinese and United States markets dominated by utility-scale systems.

Are battery storage systems viable in Brazil?

In Brazil, the cost of turn-key battery systems is notably high due to significant tax burdens. However, future projections indicate a potential reduction in battery costs, which could enhance economic feasibility for various applications. The booklet explores the viability of battery storage systems across different scenarios. For instance:

Can dynamic distribution system operators help balancing Brazil's decarbonization goals?

Traditional distribution utilities must transition into dynamic distribution system operators (DSOs) to manage bidirectional power flows, integrate DERs and enhance grid resilience. This shift is critical to balancing Brazil’s decarbonization goals with rising energy demand, which is projected to grow at 3.4% annually through 2034.

How big is Brazil's energy infrastructure?

The transmission network now spans approximately 200,000 kilometers of lines operating at various voltage levels, with a compound annual growth rate of 4.8% between 2018 and 2023.24 This robust expansion highlights Brazil’s exceptional capacity for energy infrastructure planning, particularly in overcoming challenging geographical conditions.

Can foreigners invest in battery storage businesses in Brazil?

Investment, incentives and taxation scenarios According to Brazilian law, there are no legal restrictions on direct foreign investment in the battery storage businesses or in the power sector (except in very specific segments or sectors of the economy).

Learn More

- Basseterre distributed energy storage cabinet wholesale

- Advantages of Distributed Energy Storage in El Salvador

- Pyongyang distributed energy storage lithium battery

- Distributed Energy Storage in Laos

- Belize Distributed Energy Storage Services

- How to calculate the cost of distributed energy storage cabinets

- What energy storage battery is best for Brazil

- Is energy storage a distributed power source

- Lebanon distributed photovoltaic energy storage enterprise

Industrial & Commercial Energy Storage Market Growth

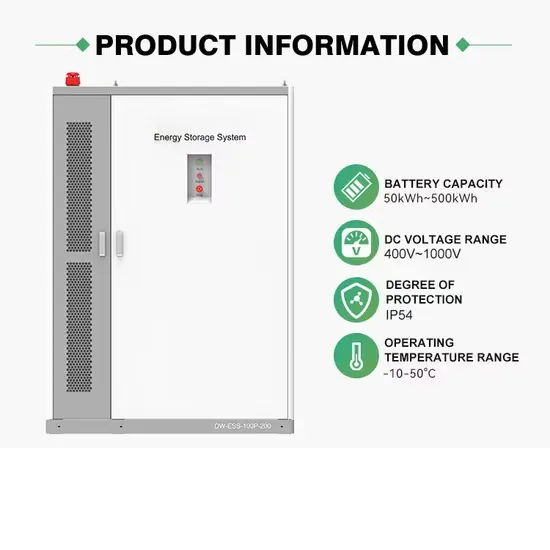

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.