Hungary Pecs Outdoor Power Supply Manufacturer Reliable

Why Hungary Pecs Leads in Outdoor Power Supply Innovation As demand for sustainable energy grows globally, the Pecs region has emerged as a hub for advanced outdoor power systems.

Grid-connected photovoltaic inverters: Grid codes,

Jan 1, 2024 · Isolated inverters include a galvanic isolation, low-frequency on the grid side or high-frequency inside the topology, but losses of the transformer, especially in high power

Understanding High-Frequency Inverters

6 days ago · In the realm of power electronics, the advent of high-frequency inverters has revolutionized the landscape. These enigmatic devices possess the uncanny ability to

Supercapacitor Module Manufacturer in Pecs Hungary

Looking for reliable supercapacitor solutions in Europe? Pecs, Hungary, has emerged as a hub for advanced energy storage manufacturing. This article explores the growing role of

Understanding Industrial Frequency RV Inverter Prices in

May 18, 2025 · Understanding industrial frequency RV inverter prices in Pécs requires analyzing technical specs, market trends, and supplier capabilities. While initial costs matter, total

A High Performance High Frequency Inverter Architecture

Oct 14, 2021 · In this work, a high frequency inverter system that can work in a wide range of inductive or capacitive load is proposed, which includes Class D inverter, novel

Hungary s Pécs photovoltaic energy storage accounts for 18

What is Hungary''s PV energy potential? Hungary''s PV energy potential portrays her as a country having an average PV power potential in Europe [ 6] (see Table 1 ). In 2017, the installed grid

Hungary Pécs distributed photovoltaic panel manufacturer

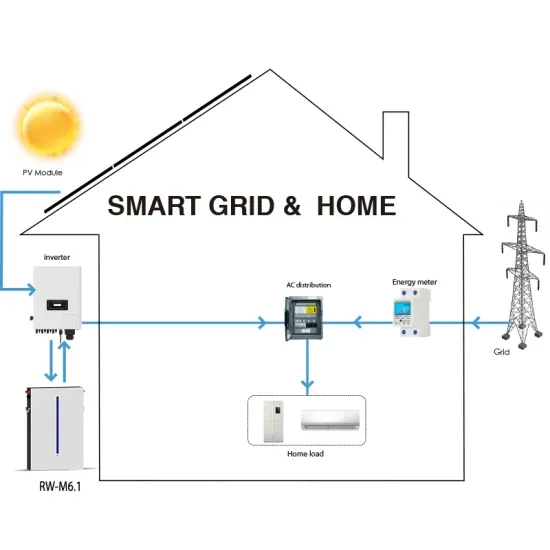

Hungary has decided to allow apartment owners to jointly install solar panels and will only permit solar plants equipped with grid-connected inverters from July 2025.

Solar-Napelem Kft. | Solar System Installers | Hungary

Our office and warehouse are located in Magyarbóly, in the southwest of Hungary and we have another warehouse in Pécs. We have substantial stocks of the following products: - Austrian

Hungary Pécs PV Power Station Inverter Bidding Key Insights

Hungary''s 2023 solar capacity surged to 4.2 GW, with utility-scale projects like Pécs driving 38% of this growth. The current inverter bidding process reveals three crucial market shifts:

800VA Pure Sine Wave Inverter''s Reference Design

Apr 1, 2023 · The pure Sine Wave inverter has various applications because of its key advantages such as operation with very low harmonic distortion and clean power like utility-supplied

Learn More

- Belgian electromagnetic wave high frequency inverter

- High frequency sine wave inverter PD6KVA

- Eritrea High Frequency Inverter

- Inverter power frequency high frequency

- Niamey high frequency power inverter

- Burkina Faso high frequency inverter 12v to 220v

- Mexican High Frequency Inverter Company

- High frequency inverter RV

- Industrial frequency high frequency low frequency inverter

Industrial & Commercial Energy Storage Market Growth

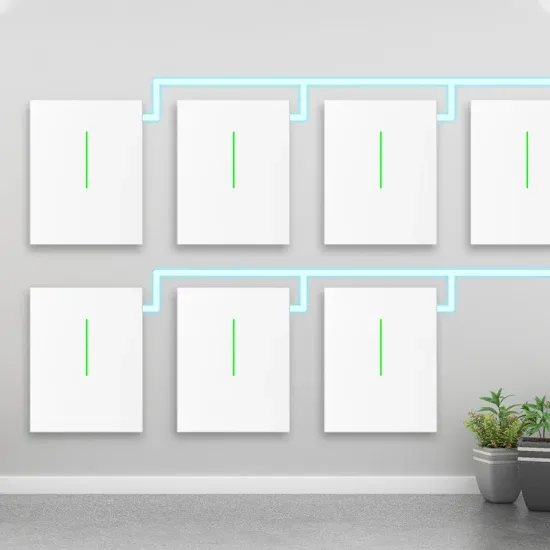

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

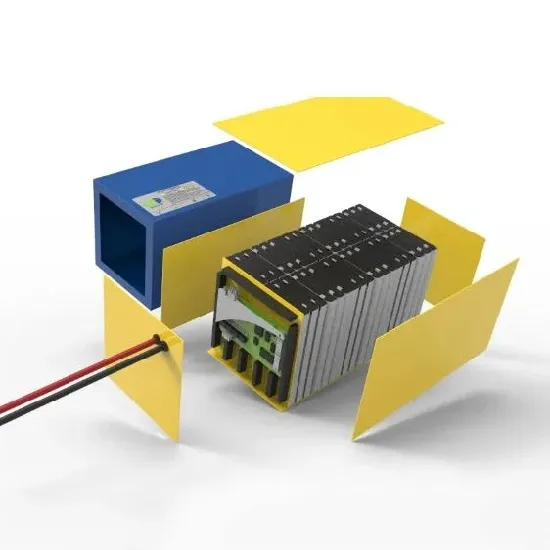

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.