Learn What a 5G Base Station Is and Why It''s Important

A 5G base station is the heart of the fifth-generation mobile network, enabling far higher speeds and lower latency, as well as new levels of connectivity. Referred to as gNodeB, 5G base

Modeling and aggregated control of large-scale 5G base stations

Mar 1, 2024 · The limited penetration capability of millimeter waves necessitates the deployment of significantly more 5G base stations (the next generation Node B, gNB) than their 4G

Modeling and aggregated control of large-scale 5G base stations

Mar 1, 2024 · The increasing penetration of renewable energy sources, characterized by variable and uncertain production patterns, has created an urgent need for enhanced flexibility in the

Building better power supplies for 5G base stations

May 25, 2025 · Building better power supplies for 5G base stations Authored by: Alessandro Pevere, and Francesco Di Domenico, both at Infineon Technologies Infineon Technologies -

5g base station architecture

Dec 13, 2023 · 5G (fifth generation) base station architecture is designed to provide high-speed, low-latency, and massive connectivity to a wide range of devices. The architecture is more

Selecting the Right Supplies for Powering 5G Base Stations

As a result, a variety of state-of-the-art power supplies are required to power 5G base station components. Modern FPGAs and processors are built using advanced nanometer processes

Optimal microgrid dispatch with 5G communication base stations

With the development of communication technology, 5G base stations are being widely deployed. Currently, high operating costs impede 5G base station deployment, despite these facilities

5G Base Station Power Supply System: NextG Power''s

May 21, 2025 · The 5G rollout is changing how we connect, but powering micro base stations—those small, high-impact units boosting coverage in cities and beyond—is no small

Unveiling the 5G Base Station: The Backbone of Next-Gen

Jun 3, 2025 · The arrival of 5G, the fifth generation of wireless technology, ushers in an era of unprecedented connectivity, speed, and innovation. At the heart of this transformative shift lies

Synergetic renewable generation allocation and 5G base

Dec 1, 2023 · The growing penetration of 5G base stations (5G BSs) is posing a severe challenge to efficient and sustainable operation of power distribution systems (PDS) due to their huge

A Survey of Energy-Efficient Techniques for 5G Networks

Apr 4, 2016 · After about a decade of intense research, spurred by both economic and operational considerations, and by environmental concerns, energy efficiency has now become a key pillar

Improving Energy Efficiency of 5G Base Stations:

Jun 27, 2023 · To fulfil such requests, the fifth generation (5G) network evolved [3]. The 5G network operates in the range of 28–60 GHz and this spectrum is

Energy-efficiency schemes for base stations in 5G

In today''s 5G era, the energy efficiency (EE) of cellular base stations is crucial for sustainable communication. Recognizing this, Mobile Network Operators are actively prioritizing EE for

Renewable energy powered sustainable 5G network

Feb 1, 2021 · This survey specifically covers a variety of energy efficiency techniques, the utilization of renewable energy sources, interaction with the smart grid (SG), and the

China plans to upgrade its 5G network, accelerate 6G

Jan 6, 2025 · China will continue to accelerate the research, development, and innovation of 6G cellular technology and upgrade its 5G mobile network to reach 5G-A level in its new data

China''s 5G-Powered Unmanned Army! PLA Bets On 1st Mobile 5G

6 days ago · By August 2025, the country had deployed about 4.49 million 5G base stations, meaning more than one-third of all its mobile sites now run on 5G. The Ministry of Industry and

Types of 5G NR Base Stations and Their Roles in

May 7, 2025 · As 5G continues to evolve, understanding these base stations will be essential for optimizing network design and achieving the full potential of

Which RF Technologies Are Shaping 5G Base Stations?

Apr 24, 2025 · At the heart of this revolution lies a complex infrastructure powered by advanced radio frequency (RF) technologies. Among all the components that build a 5G network, RF

Research on Performance of Power Saving Technology for 5G Base

Jun 28, 2021 · Compared with the fourth generation (4G) technology, the fifth generation (5G) network possesses higher transmission rate, larger system capacity and lower tran

Optimal Backup Power Allocation for 5G Base Stations

Feb 18, 2022 · As the first step shifting to the 5G era, the 5G base station (BS) needs to be built. With shorter signal range compared to that of 4G, the deployment of 5G network is expected

Integrating distributed photovoltaic and energy storage in 5G

Feb 12, 2025 · This paper explores the integration of distributed photovoltaic (PV) systems and energy storage solutions to optimize energy management in 5G base stations. By utilizing IoT

Modelling the 5G Energy Consumption using Real-world

Jun 26, 2024 · This paper proposes a novel 5G base stations energy con-sumption modelling method by learning from a real-world dataset used in the ITU 5G Base Station Energy

5G Power: Creating a green grid that slashes

Jun 6, 2019 · Base stations with multiple frequencies will be a typical configuration in the 5G era. It''s predicted that the proportion of sites with more than five

Power Consumption Modeling of 5G Multi-Carrier Base

Jan 23, 2023 · In this paper, we present a power consumption model for 5G AAUs based on artificial neural networks. We demonstrate that this model achieves good estimation

6 FAQs about [5g base stations need power generation]

Why do we need a 5G base station?

The limited penetration capability of millimeter waves necessitates the deployment of significantly more 5G base stations (the next generation Node B, gNB) than their 4G counterparts to ensure network coverage . Notably, the power consumption of a gNB is very high, up to 3–4 times of the power consumption of a 4G base stations (BSs).

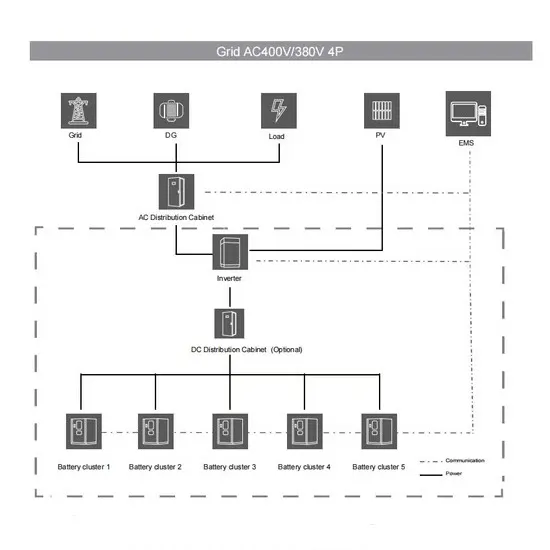

How a 5G network can support a power system?

The 5G network and power system are coupled energetically by power feeders. Based on gNB-sleep actions and mode switching of their BESSs, 5G network can provide power support to the power system when the grid frequency deviation reaches the threshold.

How does 5G ran work?

In 5G-RAN, the gNB systems within designated areas are combined into gNBs-clusters by aggregators. All gNBs-clusters are powered by the power system plane through power feeders, so switching the modes of a certain number of gNBs (sleep/active) and BESSs (charge/idle/discharge) can alter the power injection of the power system.

Can a 5G network provide energy incentives?

Collaborating with the power system can provide energy incentives for 5G networks. On the other hand, the existing communication infrastructure in 5G networks allows network operators to participate in demand response without the need for additional investments in flexibility modifications. 1.2. Literature review

Are 5G network operators motivated to cooperate with the power system?

On the one hand, 5G network operators are highly motivated to cooperate with the power system in energy matters, given that the numerous gNBs with their high energy consumption result in significant electricity bills that can be troublesome for the operators , .

How will 5G be used in the future?

Reprinted, with permission, from ref. . In the foreseeable future, 5G networks will be deployed rapidly around the world, in cope with the ever-increasing bandwidth demand in mobile network, emerging low-latency mobile services and potential billions of connections to IoT devices at the network edge .

Learn More

- Solar power generation solves the power consumption of 5g base stations

- 5G base station power generation solution

- Power consumption of 5g base stations and charging piles

- Maintenance plan for wind power and photovoltaic power generation at communication base stations

- Distributed power generation at communication base stations in Bucharest

- The importance of energy storage and power generation in communication base stations

- Photovoltaic power generation 5g base station

- Construction of 5G base station photovoltaic power generation system in Tuvalu

- Accra 5g base station photovoltaic power generation system communication cabinet

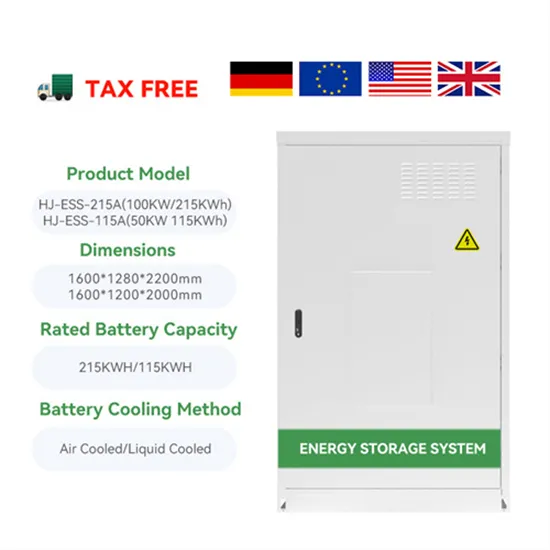

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.