The 13 Best Energy Storage Stocks To Buy For

Oct 5, 2022 · Are you wanting to add energy storage stocks to your investment portfolio? This article lists some of the best energy storage stocks to buy right

12 Best Energy Storage Stocks to Buy in 2025

Apr 4, 2022 · Investing in battery storage stocks can provide exposure to the growing energy storage market and the potential for long-term growth as the demand for renewable energy

Energy Storage Inverter Market''s Evolutionary Trends 2025

Apr 3, 2025 · The global energy storage inverter market is experiencing robust growth, driven by the increasing adoption of renewable energy sources like solar and wind power, coupled with

Energy Storage Investments – Publications

Mar 7, 2025 · As investment in renewable energy generation continues to rise to match increasing demand so too does investment, and the opportunity to invest, in energy storage. Estimates

Cost-Benefit Analysis of Investing in a Home Power Inverter

Nov 6, 2024 · In today''s energy-conscious world, many homeowners are looking for ways to reduce their electricity bills and ensure a stable power supply. A home power inverter system

Battery Energy Storage Inverter Market Size And Projection

Dec 13, 2024 · 5. What are the latest trends in the Battery Energy Storage Inverter market? Some of the latest trends include advancements in inverter technology, strategic partnerships and

Energy Storage Inverter Strategic Market Roadmap: Analysis

Jul 25, 2025 · The energy storage inverter market is experiencing robust growth, driven by the increasing adoption of renewable energy sources like solar and wind power. The need for

Return on Investment for Battery Storage System

Oct 10, 2024 · Discover Innotinum, a leading battery energy storage system manufacturer, offering cutting-edge all-in-one energy storage systems. Our advanced battery energy storage

Home Energy Storage Systems and Inverters: Technological

Mar 4, 2025 · As global energy transition accelerates and household electricity demands diversify, home energy storage systems (HESS), combined with photovoltaic (PV) self-consumption

Europe Energy Storage Battery Inverter Market Investment

Aug 10, 2025 · What are the most popular Energy Storage Battery Inverter market types? Popular types include single-phase electric power, three-phase low power, three-phase medium

Battery Energy Storage Inverter Market Research Report 2033

From a regional perspective, Asia Pacific continues to dominate the global battery energy storage inverter market, accounting for the largest share in 2024. This leadership is attributed to the

Energy Storage Inverter Market Research Report 2033

According to our latest research, the global energy storage inverter market size stood at USD 2.71 billion in 2024, reflecting robust expansion in response to the accelerating transition toward

PCS Energy Storage Inverter Strategic Insights: Analysis 2025

Mar 31, 2025 · The PCS (Power Conversion System) Energy Storage Inverter market is experiencing robust growth, driven by the increasing adoption of renewable energy sources

2025 Energy Storage Inverter Ranking: Top Players and

Jun 1, 2025 · If solar panels are the rockstars of renewable energy, then energy storage inverters are the backstage crew making the show possible. As we dive into the 2025 energy storage

United States Utility Scale Energy Storage Inverters Market

Aug 3, 2025 · Their ongoing investments in infrastructure, talent, and customer experience further solidify their leadership positions within the dynamic and evolving Utility Scale Energy Storage

PCS Energy Storage Inverter Strategic Insights: Analysis 2025

Mar 31, 2025 · While challenges remain, including the high initial investment costs associated with energy storage systems and potential grid integration complexities, the long-term outlook for

Customized Energy Storage Inverters in Italy: Key Trends and

Jan 21, 2022 · A family-owned vineyard in Tuscany struggles with peak-hour electricity prices while solar panels sit idle at noon. Enter customized energy storage inverters – Italy''s secret

What is the importance of inverter compatibility

Feb 12, 2024 · The importance of inverter compatibility in energy storage systems stems from several crucial factors: 1. Efficiency of Energy Conversion, 2.

Battery Storage Inverter Market Expansion: Regional Trends

May 8, 2025 · Battery storage inverters play a crucial role in energy systems by converting direct current (DC) stored in batteries into alternating current (AC) for use in homes, businesses, and

Understanding Energy Storage Inverters: Key to Efficient

Mar 12, 2025 · 6. Challenges of Energy Storage Inverters While Energy Storage Inverters offer many advantages, there are certain challenges associated with their use: Cost: The initial

Energy Storage Inverter Market Report | Global Forecast

The global energy storage inverter market size was valued at approximately USD 1.6 billion in 2023 and is expected to reach around USD 4.5 billion by 2032, growing at a compound annual

What are the energy storage inverter funds? | NenPower

Jun 18, 2024 · Investors are drawn by potential returns linked to the growing demand for efficient energy management solutions. One notable aspect lies in the critical function of inverters

6 FAQs about [Investment in inverter energy storage]

Are battery storage systems a good investment?

With advancements in technology and decreasing costs, battery storage systems are becoming more accessible and efficient, allowing for greater integration of renewable energy sources into the grid and reducing reliance on fossil fuels. Identifying top energy storage stocks in an industry with many players can be challenging.

Should you invest in battery storage stocks?

Investing in battery storage stocks can provide exposure to the growing energy storage market and the potential for long-term growth. As the demand for renewable energy continues to expand, investing in well-known energy storage companies like Tesla, Panasonic, and LG Chem can be a strategic move.

Is investing in energy storage stocks a good idea?

Given the global shift from fossil fuels to renewable energy, which is expected to take about three decades and require massive investment, investing in energy storage stocks has become an attractive option for investors seeking safer returns.

What is the future of battery storage?

The future of battery storage is promising, as it has the potential to revolutionize the way we generate and consume energy. Battery storage is the use of rechargeable batteries to store electrical energy.

What are energy storage stocks?

Energy storage stocks are companies that design and manufacture energy storage technologies. These include battery storage, capacitors, and flywheels. Electric vehicles, generating facilities, and businesses also form this vast industry.

What does an energy storage ETF invest in?

An energy storage ETF invests in companies involved in the energy storage industry. This ETF provides investors with exposure to a diversified portfolio of companies that are involved in the development, production, and distribution of energy storage technologies and solutions.

Learn More

- Income from integrated photovoltaic and energy storage investment

- Greek Energy Investment Energy Storage Power Station

- San Salvador photovoltaic energy storage 60kw inverter brand

- Base station lithium battery energy storage 50kw inverter manufacturer

- Photovoltaic off-grid energy storage inverter three-phase

- Uzbekistan photovoltaic energy storage inverter integrated machine

- Energy storage inverter from grid-connected to off-grid

- Xuda Energy Storage Inverter

- Energy storage inverter kpop

Industrial & Commercial Energy Storage Market Growth

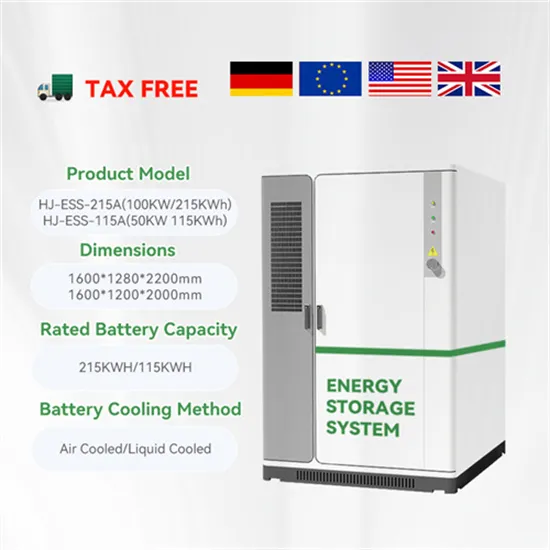

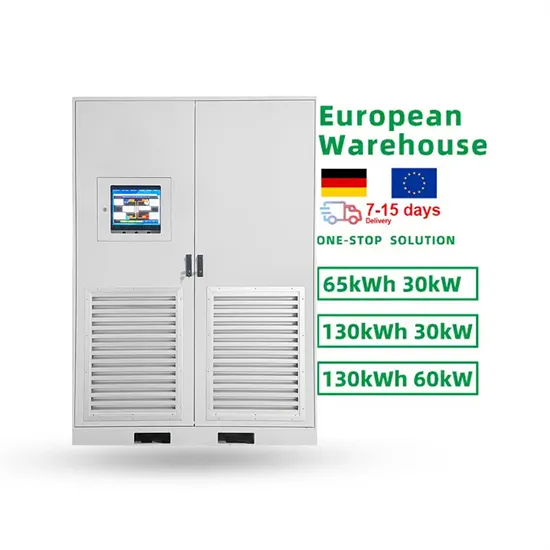

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.