5G network deployment and the associated energy

Jul 1, 2022 · The simulation results show that 700 MHz and 26 GHz will play an important role in 5G deployment in the UK, which allow base stations to meet short-term and long-term data

China to accelerate 5G revolution, 6G innovation

Dec 27, 2024 · China plans to build 4.5 million 5G base stations and develop more future industries in 2025, said the Ministry of Industry and Information

5G Base Station Radio Frequency Device Market Growth and

Global 5G Base Station Radio Frequency Device market size is projected at USD 2.43 Billion in 2025 and is expected to hit USD 5.99 Billion by 2033 with a CAGR of 11.9%.

What is 5G base station architecture?

Dec 1, 2021 · 5G network architecture is a vast improvement upon previous architectures. Huge leaps in performance are made possible by large cell-dense networks. One of the features of

Multi‐objective interval planning for 5G base

Jul 23, 2024 · Large-scale deployment of 5G base stations has brought severe challenges to the economic operation of the distribution network, furthermore,

Optimal configuration of 5G base station energy storage

Feb 1, 2022 · A multi-base station cooperative system composed of 5G acer stations was considered as the research object, and the outer goal was to maximize the net profit over the

Ericsson and Nokia 5G Base Station volume and massive

Jul 30, 2025 · At the end of 2022, China Mobile had 1.3 million 5G base stations, 805,000 of which were mid-band, with plans to add another 360,000 base stations by the end of 2023. In

5G Base Station Equipment Market

Oct 15, 2024 · The global 5G base station equipment market size is projected to grow significantly, from $10.5 billion in 2023 to an estimated $73.2 billion by 2032, at an impressive

Optimal capacity planning and operation of shared

May 1, 2023 · A bi-level optimization framework of capacity planning and operation costs of shared energy storage system and large-scale integrated 5G base stations is proposed to

Lithium Battery for 5G Base Stations Market

Feb 9, 2025 · Energy Consumption Intensity of 5G Infrastructure The transition to 5G networks requires base stations to handle exponentially higher data throughput and lower latency,

5G Base Station Equipment Market Size, Share, SWOT

Base station equipment forms the backbone of 5G infrastructure, enabling seamless connectivity, low latency, and high-speed data transfer. As govements, telecom operators, and private

Optimal configuration of 5G base station energy storage

Mar 17, 2022 · it, in the case of a power failure. As the number of 5G base stations, and their power consumption increase significantly compared with that of 4G base stations, the demand

5G Power: Creating a green grid that slashes

Jun 6, 2019 · Base stations with multiple frequencies will be a typical configuration in the 5G era. It''s predicted that the proportion of sites with more than five

Optimal configuration of 5G base station energy storage

Jun 21, 2025 · The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries.To maximize overall

Optimal configuration for photovoltaic storage system capacity in 5G

Oct 1, 2021 · In this study, the idle space of the base station''s energy storage is used to stabilize the photovoltaic output, and a photovoltaic storage system microgrid of a 5G base station is

5G Base Station Equipment Market Report 2025: 5G Base

Mar 11, 2025 · The 5G base station equipment market is set to grow from $29.87 billion in 2025 to $52.73 billion by 2030, at a 12.0% CAGR. Increasing urbanization, rising smartphone

6 FAQs about [5g base station and power equipment investment]

How big is the 5G base station market?

The 5G Base Station Market size was valued at USD 28.92 Billion in 2024 and the total 5G Base Station revenue is expected to grow at a CAGR of 37.2% from 2025 to 2032, reaching nearly USD 363.13 Billion. The global 5G Base Station market report is a comprehensive analysis of the industry, market, and key players.

Which segment dominates the 5G base station market in 2024?

The industrial segment maintains its dominance in the global 5G base station market, commanding approximately 27% market share in 2024. This significant market position is driven by the accelerating adoption of Industry 4.0 initiatives and the growing integration of IoT devices in manufacturing facilities.

Who are 5G base stations suppliers?

Suppliers of 5G base stations were benefited from the rapid development of 5G technology. Huawei, Ericsson, Nokia, ZTE, and Samsung are among the world's leading suppliers. In 2024, these five vendors control almost 96.12 % of the global market. China has installed around 12 times as many 5G base stations as the United States.

Which countries are leading the 5G base station market?

Globally, 5G is being deployed at two different paces, with China supporting half of the base transceiver station (BTS) market while the rest of Asia, Europe, the U.S. and late 5G entrant India dominate the balance of the market. Figure 1 shows our latest base station forecast by region. Figure 1 Macro/Micro regional BTS forecast.

What is the fastest growing segment in 5G base station market?

The 5G macro cell segment is emerging as the fastest-growing segment in the 5G base station market, projected to grow at approximately 40% during the forecast period 2024-2029.

What is 5G radio access network (ran)?

The deployment of 5G antenna systems and 5G radio access network (RAN) components further underscores these benefits, ensuring comprehensive coverage and connectivity. The 5G small cell segment continues to dominate the global 5G base station market, commanding approximately 60% of the market share in 2024.

Learn More

- Power supply type of 5G base station equipment

- China Mobile 5g base station power supply equipment supplier

- 5g base station equipment power consumption comparison

- Lilongwe 5g base station power equipment manufacturer

- 5G base station power equipment cabinet

- Construction of 5G base station photovoltaic power generation system in Tuvalu

- Skopje Base Station Power Cabinet Power Supply Equipment

- What is the power consumption mode of 5g base station

- Uninterrupted power supply for Nordic base station equipment room

Industrial & Commercial Energy Storage Market Growth

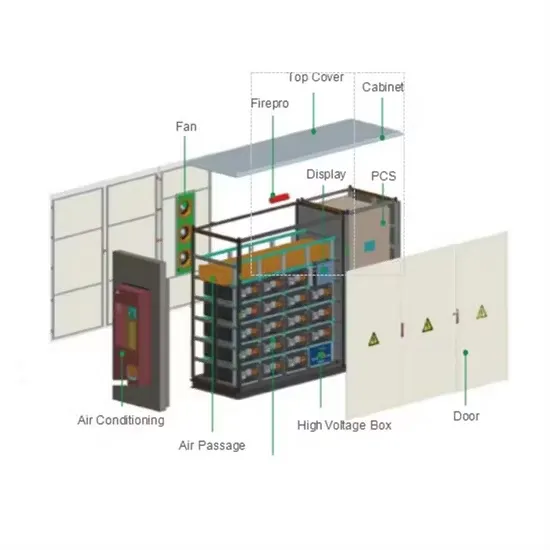

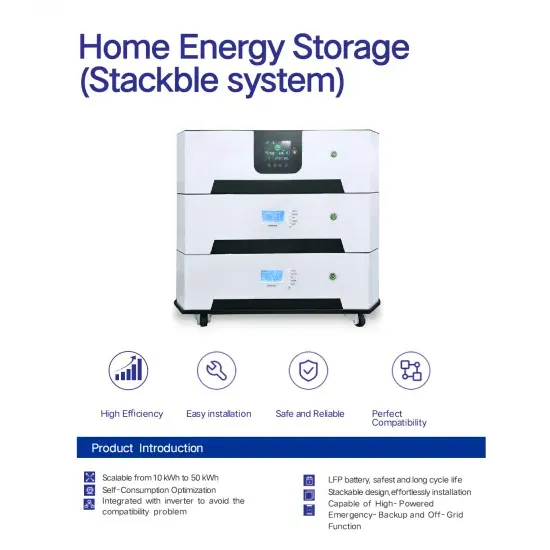

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.