France Rooftop Solar Country Profile

Apr 15, 2024 · France remains one of the top performing countries when it comes to the development of Rooftop solar policy and practices, but deliverables still need to be achieved.

What aid is available to install home solar panels

Feb 21, 2024 · MaPrimeRénov'' Installation of solar thermal panels and combined solar panel systems (système solaire combiné) can be eligible for the

Top 100 Solar Energy Companies in France (2025) | ensun

EDF Energies Nouvelles Reparties (EDF ENR) is a prominent provider of photovoltaic solar systems in France, specializing in the entire value chain of solar energy solutions, from R&D to

Agrivoltaics in France: the multi-level and uncertain

Feb 20, 2024 · France''s energy decarbonisation policy today rests on two pillars: nuclear power and renewable energies (RE; Poupeau, 2020; Douillet 2023). Since the 2000s and the

Renewable Market Watch™ published a new report titled "France Solar

Feb 28, 2025 · Solar photovoltaic systems can now be installed along major roads and highways, on coastal wastelands, and on parking lots. A revised version of the initial MAEP, adopted in

France''s VAT Adjustment: A Catalyst for Solar Growth –

Feb 11, 2025 · The French government has approved a reduction in VAT for photovoltaic systems up to 9 kW to 5.5%. INVITAIC analyzes the impact of this policy shift on the solar industry and

Optimization of the integration of photovoltaic systems on

Apr 1, 2021 · The massive deployment of Photovoltaic (PV) energy in cities, which is expected in the coming years, brings new challenges when it comes to controlling power variations

France moves toward PV self-consumption amid feed-in

Jun 2, 2025 · The solar energy market in France is changing quickly. In 2024, the French government introduced significant cuts to feed-in tariffs (FITs) – the rates paid to PV system

More details on France''s new FIT for PV projects

Oct 11, 2021 · The provisions for a fixed feed-in tariff (FIT) for all PV systems up to 500 kW in size have finally been published in France''s Official Journal – after

Solar photovoltaic energy in France

Mar 26, 2025 · In 2023, the PV energy capacity in France amounted to approximately 20.5 gigawatts, making France the fifth European country for cumulative PV capacity that year.

Solar PV Analysis of France, France

Ideally tilt fixed solar panels 39° South in France, France To maximize your solar PV system''s energy output in France, France (Lat/Long 45.605, -0.8369) throughout the year, you should

France plans to slash feed-in tariffs for rooftop

Feb 17, 2025 · France''s Ministry of Ecological Transition has outlined a proposal to slash the feed-in tariffs (FiTs) for all rooftop PV systems with a capacity of

Solar power generation in France

This graph provides an annual and monthly overview of solar power generation in France. The evolution of solar photovoltaic generation is an important parameter in the energy transition, as

6 FAQs about [Solar Photovoltaic Systems in France]

Does France have a solar energy sector?

The exponential growth of the solar photovoltaic energy sector in France has never stopped since its inception in the early 2000s. In 2023, the PV energy capacity in France amounted to approximately 20.5 gigawatts, making France the fifth European country for cumulative PV capacity that year.

How many solar panels are installed in France in 2023?

Total Installed Capacity: In 2023, France installed 4.0 GW of new PV capacity, bringing the cumulative total to 24.6 GW. This includes 2.5 GW of decentralized PV and 1.45 GW of centralized PV.

What is solar power generation in France?

This graph provides an annual and monthly overview of solar power generation in France. The evolution of solar photovoltaic generation is an important parameter in the energy transition, as it is a renewable and low-carbon energy. In 2022, solar power generation rose sharply on the back of expanded capacity and good sunlight.

What are France's photovoltaic policies?

France's photovoltaic (PV) policies are developed within the National Low Carbon Strategy and the Energy Programme Decree. The current Energy Programme Decree aims for 20 GW of PV capacity by 2023, rising to 35-44 GW by 2028.

How much solar power does France have in 2025?

In the first quarter of 2025, France added 1.4 GW of solar capacity, marking a 60% increase from the previous quarter. This expansion brought the country’s total solar capacity to 25.5 GW. Solar production in mainland France also rose by 48% year-on-year, contributing 5.1% to the national electricity mix.

Why is solar PV mandatory in France?

Mandatory solar: Solar PV is mandatory for living roofs for commercial and industrial buildings or covered car parks occupying 500 m2 or more of ground surface. Power to the people: France’s current policy framework is supportive of collective self-consumption and energy communities, with flexible regulations supporting prosumers.

Learn More

- Residential Photovoltaic Solar Systems

- Nicaragua Solar Photovoltaic Systems Company

- Costa Rica Photovoltaic Solar Systems Company

- Photovoltaic Solar Systems for Sale in the Cook Islands

- Kuala Lumpur Xuzhou Solar Photovoltaic Panel Factory

- 3MW photovoltaic solar panel

- 250w solar photovoltaic panel

- Does solar photovoltaic require energy storage

- Solar Photovoltaic Panel Battery Cabinet

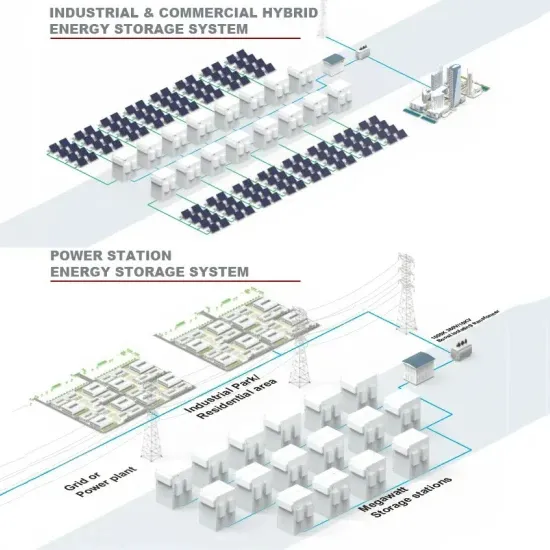

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

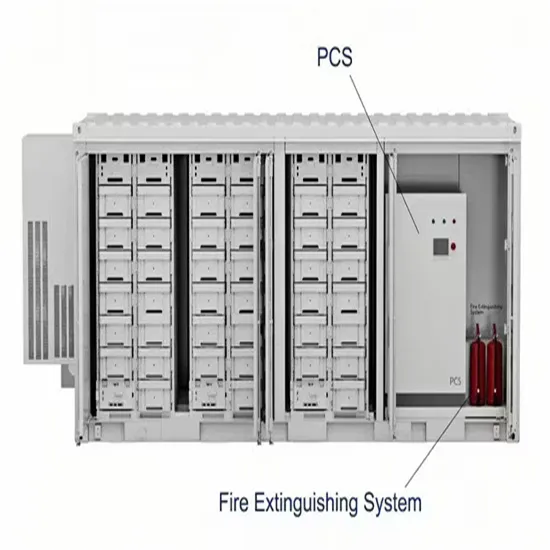

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.