Power plant profile: Busan Solar PV Park, South Korea

Apr 28, 2023 · Busan Solar PV Park is a 10MW solar PV power project. It is located in Busan, South Korea. According to GlobalData, who tracks and profiles over 170,000 power plants

Offshore Wind in South Korea

Aug 16, 2022 · Under the Green New Deal, the Government has committed to investing 9.2 trillion South Korean won (USD 7.7 billion) by 2025 in wind, solar, and hydrogen, and establishing

South Korea: Low Renewable Energy Ambitions Result in

To ensure a successful integration of renewable energy into the electrical network, South Korea pursues batery storage to keep supply and demand in balance, and domestic power grid

Optimal renewable power generation systems for Busan metropolitan

Apr 1, 2016 · A simulation using 2013 Busan electricity demand data produces this optimal configuration, which includes photovoltaic panels, wind facilities, converters, and batteries with

Optimal renewable power generation systems for Busan metropolitan city

Apr 1, 2016 · Among them, South Korea''s government has developed electricity generation facilities, most of which use renewable resources such as photovoltaic and wind energy. This

Korean auto parts giant invests in lead expansion – Batteries

February 28, 2025: DN Automotive is expanding its lead battery manufacturing in South Korea by building a new plant under an agreement signed with the Busan metropolitan government. The

Busan Wind Power System Battery Plant in South Korea

LAWI goes Busan - LAWI Engineering has been awarded and signed the contract for the design and supply of the LAWI EtaComb® incineration system together with the EtaPlant® boiler

Firefly Floating Wind Farm – Firefly Floating Wind Farm

Nov 23, 2024 · The Firefly/Bandibuli floating wind farm project is being developed by Equinor South Korea, as part of the Ulsan floating offshore wind farm. Equinor plans to reach an

Power plant profile: Dadaepo Offshore Wind Power Project, South Korea

Oct 21, 2024 · Dadaepo Offshore Wind Power Project is a 96MW offshore wind power project. It is planned in Sea of Japan (East Sea), Busan, South Korea. According to GlobalData, who

South Korea Accelerates Offshore Wind Power with New

South Korea is making significant strides in developing its offshore wind energy sector. The country''s Ministry of Trade, Industry, and Energy (MOTIE) is launching key initiatives to bolster

South Korea: Exploding lithium batteries spark

Jun 24, 2024 · A massive factory fire that began after several lithium batteries exploded has killed at least 22 people in South Korea. The blaze broke out on

MoU to develop sea wind power in Busan, South Korea

Jul 24, 2023 · GS Entec, an energy equipment manufacturing subsidiary of GS Global, signed a Memorandum of Understanding with Corio Generation to exploit eco-friendly energy in Busan.

Floating offshore wind projects development in South Korea

Jun 26, 2023 · The South Korean government is encouraging the active participation of power generation companies in the offshore wind power project by announcing the renewable energy

6 FAQs about [Busan Wind Power System Battery Plant in South Korea]

Does Busan have a renewable power generation system?

Therefore, this study investigates an optimized renewable power generation system for Busan metropolitan city, South Korea's second-largest city, by using its electricity consumption data.

Can wind power be used in Busan Metropolitan City?

However, this research shows that using wind power for Busan metropolitan city is highly economically feasible and that a hybrid system using solar and wind power is most economically feasible. Thus, the best way to offer clean and economical energy is to expand wind generation and use more PV–wind hybrid system.

What is the optimal renewable power generation system for Busan Metropolitan City?

The HOMER simulation recommends a system employing 258 wind turbines, 4130 PV panels, 1482 converters, and 5525 batteries as the optimal renewable electricity generation system at a 1/500 scale for Busan metropolitan city. The results of the simulation are shown in Table 7. Table 7. The suggested optimal renewable power generation system.

Who owns Busan offshore wind power?

The project is being developed by Busan Offshore Wind Power and is currently owned by Corio Generation with a stake of 100%. The turbines will be mounted on fixed type foundations. The wind power project consists of 12 turbines, each with 8MW nameplate capacity. The project construction is expected to commence from 2025.

How to calculate wind energy in Busan?

The power produced in the wind energy is calculated by the following equation:(2) P w i n d = 1 2 × ρ × A × V 3 Where “ A is the area crossed by flow of wind”, ρ is “the air density”, and V is “the wind speed” . Fig. 4. Monthly wind speed for Busan metropolitan city. 3.3.3. Temperature information

What is Korea doing about wind energy?

The national focus for wind energy is on offshore wind power, as Korea has world-class technologies for shipping and floating structures. Several offshore wind power development plans have been proposed by the government, which plans to supply 9.4% of the nation's electricity through wind energy by 2030.

Learn More

- UPS outdoor power supply service in Busan South Korea

- 30kw energy storage for Busan power grid in South Korea

- Modular uninterruptible power supply in Busan South Korea

- UPS battery cabinet is 3p wind power

- Wholesale price of mobile energy storage vehicle in Busan South Korea

- Built-in base station battery wind power

- South Sudan Power Plant Energy Storage Equipment Manufacturer

- Wind power method of battery energy storage system for Naypyidaw communication base station

- Lima wind power storage battery

Industrial & Commercial Energy Storage Market Growth

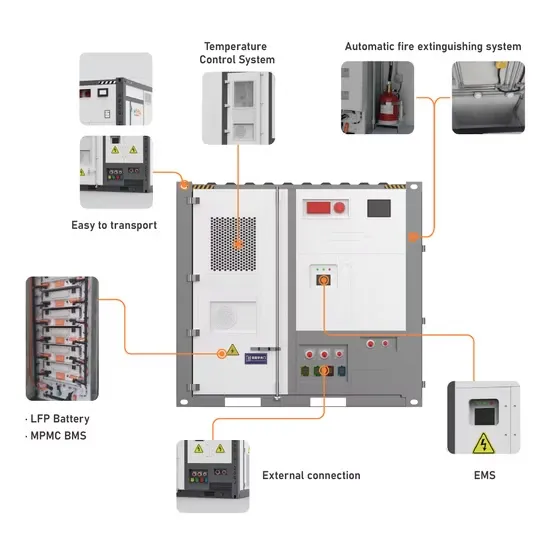

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.