19 Supercapacitor Manufacturers in 2025

19 Supercapacitor Manufacturers in 2025 This section provides an overview for supercapacitors as well as their applications and principles. Also, please take a look at the list of 19

Largest Banks in Norway by total assets

Oct 1, 2024 · The Largest Banks in Norway Following are the largest banks in Norway ranked by total assets. DNB is the biggest Norwegian bank with assets of over $328 billion. SpareBank 1

Top 7 Supercapacitor & Ultracapacitors Manufacturers

Aug 16, 2024 · Explore the top 7 supercapacitor manufacturers that are leading the way in energy storage innovation. Discover industry leaders, cutting-edge technologies, and their global impact.

Top Supercapacitor technology companies | VentureRadar

Top companies for Supercapacitor technology at VentureRadar with Innovation Scores, Core Health Signals and more. Including Skeleton Technologies, Capacitech Energy, LLC etc

Supercapacitor bank manufacturer in Bergen Norway

What is supercapacitor technology? Being an international leading research group for supercapacitors, we have developed supercapacitor technology with more than 2 times higher

nanoCaps electrode supercapacitors superbatteries

Jun 13, 2025 · A Norwegian startup with the aim to manufacture leading edge supercapacitors for High energy density supercapacitors and superbattieries supercapacitor High energy

Norway Supercapacitor Market (2024-2030) | Trends,

Norway`s supercapacitor market is witnessing growth due to advancements in energy storage technology. Supercapacitors, known for their rapid charging and discharging capabilities, are

Supercapacitor management system: A comprehensive

Mar 1, 2022 · In addition, due to the uncertainty in the manufacturing processes, the characteristics between different batches or even the same batch of supercapacitor cells will

Recent advancement of supercapacitors: A current era of supercapacitor

Feb 1, 2025 · Supercapacitors are promising energy devices for electrochemical energy storage, which play a significant role in the management of renewable electric

How to Quickly and Safely Charge Supercapacitors

Apr 14, 2023 · This application note provides a design for charging supercapacitors using either dedicated supercapacitor chargers or simple modifications to Li-ion battery chargers.

High power energy storage solutions | Skeleton

Aug 19, 2025 · Supercapacitors in industry standard D60 and D33 form factors, offering reliable high power, low ESR (1S 0.2-1.6mΩ) with 20+ years of lifetime. SuperBatteries fills the gap

Top 7 Supercapacitors Manufacturers in the World

CDE has earned its name in the list of the top 7 supercapacitors manufacturers in the world. CDE offers one of the world''s broadest selections of aluminium electrolytic capacitors, mica

6 FAQs about [Supercapacitor bank manufacturer in Bergen Norway]

What is supercapacitor technology?

Being an international leading research group for supercapacitors, we have developed supercapacitor technology with more than 2 times higher energy density than the state-of-the-art technology. The supercapacitors are well demanded as the energy management device with power boost function.

What is a capacitor bank?

A Capacitor bank is a grouping of several capacitors of the same rating. Capacitor banks may be connected in series or parallel, depending upon the desired rating. As with an individual capacitor, banks of capacitors are used to store electrical energy and condition the flow of that energy.

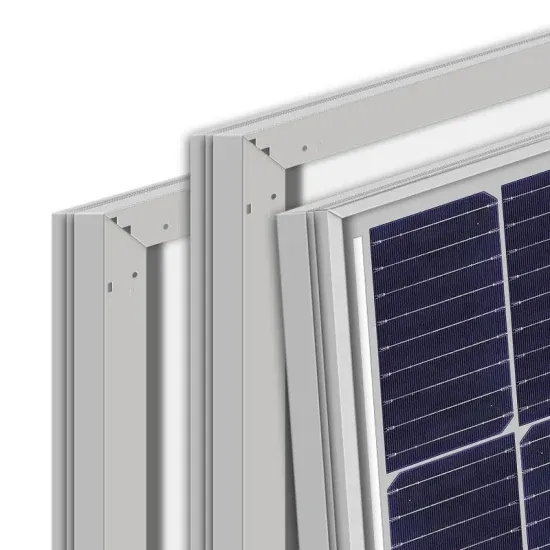

What is a compact supercapacitor?

Compact supercapacitor designs cater to niche markets with specific needs. Focus on miniaturization of supercapacitors for electronic devices and wearables. Engages in diverse technological solutions, including advanced energy storage products. Integrates supercapacitor technology into solar energy systems, improving energy efficiency.

What are the key trends influencing the supercapacitors market?

Key trends influencing the Supercapacitors Market include the ongoing shift toward sustainable energy solutions and increasing investments in energy efficiency. Companies are exploring pathways toward integrating supercapacitors with renewable energy systems, particularly in energy grids and electric vehicles.

What is the supercapacitors market?

The Supercapacitors Market is characterized by its fragmented nature, consisting of various specialized companies that emphasize innovation and niche applications. While global players are present, several local firms shape the landscape, indicating a diverse competitive environment where specialized manufacturers often cater to targeted needs.

What is the difference between a supercapacitor and a battery?

The difference is that a supercapacitor stores energy in an electric field, whereas a battery uses a chemical reaction. Supercapacitors have many advantages over batteries, such as safety, long lifetime, higher power, and temperature tolerance, but their energy density is lower compared to batteries. Learn more. What are SuperBatteries?

Learn More

- Estonian supercapacitor bank manufacturer

- Electricity storage prices in Bergen Norway

- Professional supercapacitor manufacturer in Lome

- Norway supercapacitor price

- Mogadishu supercapacitor bank price

- Photovoltaic hybrid inverter in Bergen Norway

- New Energy Storage in Bergen Norway

- Argentina supercapacitor manufacturer

- User-side energy storage power station in Bergen Norway

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.