Lithium battery energy storage cabinet manufacturers

Lithium-ion battery manufacturers are influencing the future of energy storage and technology. We need to recognize this industry''s top lithium battery companies as the demand for reliable

Top 10 Energy Storage Companies in Europe

Jul 14, 2025 · Discover the current state of energy storage companies in Europe, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Ranking of companies producing energy storage cabinets

In 2019, among new operational electrochemical energy storage projects in China, the top 10 energy storage system integrators in in terms of installed capacity were Sungrow, CLOU

Energy storage container battery cabinet manufacturer

Is Panasonic a good battery energy storage company? k as a key player in the battery energy storage system field. With a wide range of products and a focus on new ideas, Panasonic has

Global Leaders in Nano Battery Energy Storage Cabinet

CATL (Contemporary Amperex Technology) – The Chinese giant dominates 37% of global EV battery market share, now expanding into modular nano-enhanced storage systems. BYD

Ranking of US Energy Storage Power Cabinets: Who''s

Jun 13, 2021 · Ever wondered which companies are powering America''s clean energy transition behind the scenes? The ranking of US energy storage power cabinets isn''t just industry

National battery storage cabinet manufacturers ranking

Who makes the best battery energy storage system? As the top battery energy storage system manufacturer, The company is renowned for its comprehensive energy solutions, supported by

Global Energy Storage Battery Cabinets Market Research

The report will help the Energy Storage Battery Cabinets manufacturers, new entrants, and industry chain related companies in this market with information on the revenues, production,

New Energy Storage Alliance Company Ranking: Who''s

Aug 19, 2019 · Ever wondered which companies are dominating the new energy storage alliance company ranking this year? Spoiler: It''s not just Tesla hogging the spotlight anymore. As

10 Energy Storage Companies to Know in 2025

Jan 21, 2025 · Below, we spotlight 10 companies innovating in energy storage, categorized by their unique technologies and contributions to the industry. 1. NextEra Energy Resources. Key

Top 10 Energy Storage Companies in 2025

Feb 21, 2025 · Below, we take a closer look at some of the top battery manufacturers and their cutting-edge solutions, with Dawnice standing out as a fast-growing force in the global energy

Lithium battery energy storage cabinet manufacturers

Hithium has been ranked among the top five battery manufacturers in terms of energy storage products shipped in 2023 in a new analysis of 2023 stationary energy storage manufacturer

Top Energy Storage Battery OEM Companies in 2025: Who''s

May 22, 2022 · That''s where energy storage battery OEM companies become the unsung heroes of our green revolution. From powering electric vehicles to stabilizing national grids, these

Residential Energy Storage Battery Cabinets Market Outlook

Jul 21, 2025 · Residential Energy Storage Battery Cabinets Market size is estimated to be USD 7.88 Billion in 2054 and is expected to reach USD 25.

6 FAQs about [Ranking of companies that make new energy battery cabinets]

Who are the top 10 battery energy storage manufacturers in China?

This article will focus on top 10 battery energy storage manufacturers in China including SUNWODA, CATL, GOTION HIGH TECH, EVE, Svolt, FEB, Long T Tech, DYNAVOLT, Guo Chuang, CORNEX, explore how they stand out in the fierce market competition and lead the industry forward. SUNWODA, founded in 1997, is a global leader in lithium-ion batteries.

What are the best battery energy storage companies?

When it comes to the 10 Best Battery Energy Storage Companies, industry leaders like BYD, Tesla, MANLY Battery, and CATL set the benchmark with cutting-edge technology and global market dominance.

Which countries are adopting home energy storage batteries?

In Europe, the market is driven by high electricity costs and strong government support for renewable energy. Countries like Germany, Italy, and Spain are leading the way in the adoption of home energy storage batteries, supported by companies such as Enphase Energy battery storage and Fluence battery energy storage.

Who is CATL battery energy storage?

CATL (Contemporary Amperex Technology Co., Limited) is a global leader in the Battery Energy Storage market, known for its innovative energy storage technologies and extensive product lineup. Founded in 2011 and headquartered in Ningde, China, CATL has quickly become the world’s top supplier of battery energy storage systems.

Who is shaping the future of battery energy storage?

Leading companies, from BYD, MANLY Battery to Johnson Controls, are playing pivotal roles in shaping the future of battery energy storage through strategic expansions and product innovations.

Which country has the most energy storage batteries?

China, in particular, is a major player, with CATL leading globally in battery deliveries for energy storage. The country’s aggressive push to build out its renewable energy capacity is supported by the large-scale implementation of energy storage lithium batteries.

Learn More

- Companies in Cameroon that collect new energy battery cabinets

- Manufacturers of new energy battery cabinets

- What are the companies that make battery cabinets in Malaysia

- Bamako New Energy Storage Battery Pump

- Kuwait City New Energy Battery Cabinet Professional Communication Power Supply

- How many mAh are required for battery storage in energy storage cabinets

- Norway photovoltaic new energy storage battery

- Bridgetown Liquid Cooled Energy Storage Battery Cabinet Manufacturer Ranking

- New Energy Battery Cabinet Photovoltaic Measurement

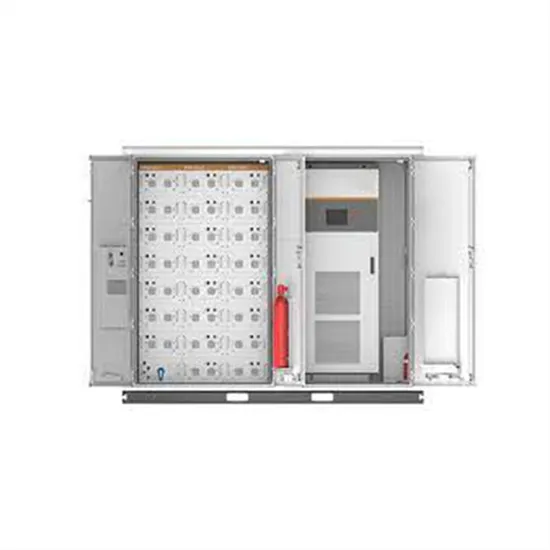

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.