Canberra Energy Storage Reservoir Progress: Powering

Why the Canberra Energy Storage Project Is Making Headlines Australia''s capital is stepping into the renewable energy spotlight with its ambitious Canberra energy storage reservoir project.

OFFSHORE WIND ENERGY

Nov 26, 2021 · A site is considered to be suitable for an ofshore wind project if it has high and relatively consistent wind speeds, water depths are appropriate, and the site is either able to

Australia''s green energy future: Offshore wind

Jul 24, 2025 · With offshore wind, Australia is looking to capitalise on the growing global demand for green metals. For the Illawarra, that''s steel made with

Australia''s Offshore Wind Revolution: Progress,

Feb 3, 2025 · Gippsland Offshore Wind Zone The government has taken significant steps to accelerate offshore wind development in the Gippsland Offshore Wind Zone off the coast of

Storage of wind power energy: main facts and feasibility −

Sep 2, 2022 · Energy storage is nothing new to the world. Early human civilisation practised energy storage in numerous ways, including stocking firewood for day-to-day energy needs

Onshore wind farm guidance

May 3, 2024 · Inadequate consideration of avoidance measures during project planning may have significant biodiversity implications and compromise your project''s viability and EPBC Act

An investment decision framework for offshore wind-solar

Sep 15, 2023 · Offshore wind-solar-seawater pumped storage (wind-PV-SPS) power system will be a very competitive offshore new energy project in the future because it can realize the

Huanyang Offshore Wind Project Renamed as Wei Lan Hai Changhua Offshore

Oct 21, 2023 · The "Huan Yang Offshore Wind Power Project" is now renamed "Wei Lan Hai Changhua Offshore Wind Power Project," focusing on sustainable energy in Taiwan.

Asia-Pacific''s largest offshore wind project Greater

Apr 24, 2024 · The 900 MW Greater Changhua 1 and 2a are Asia-Pacific''s largest offshore wind project in operation. The project doubles Taiwan''s installed capacity of offshore wind. It can

European offshore energy sector launches project OESTER to

Feb 11, 2025 · Sixteen partners from the European offshore renewable energy sector have launched project OESTER (Offshore Electricity Storage Technology Research) to accelerate

Canberra Energy Storage Reservoir Progress: Powering

Australia''s capital is stepping into the renewable energy spotlight with its ambitious Canberra energy storage reservoir project. Designed to tackle the intermittency of wind and solar power,

Global offshore wind: Australia

Jan 10, 2024 · While Australia''s offshore wind energy sector is still in its infancy, offshore wind appears set to join onshore wind and solar as a key component of the country''s renewable

Labor committed to wind power after project blocked | The Canberra

Jan 10, 2024 · The hub would have supported state targets of at least two gigawatts of offshore wind capacity by 2032 - enough to power 1.5 million homes - as coal-fired electricity

6 FAQs about [Canberra offshore wind power storage project]

How many offshore wind projects are proposed in Australia?

As of the end of November 2022, around 40 offshore wind projects with a total capacity of 77.58GW are proposed in Australia – this includes 1 development zone stage project, 38 early planning stage projects, and 1 dormant project. This paper provides the readers with updated project information with developer and development status listings.

Are offshore wind turbines a viable option in Australia?

Australia has an abundance of suitable onshore sites for wind (and solar) developments at a lower cost of production. Ocean water depth increases rapidly around most of the Australian coastline and several of the proposed offshore wind development zones require the development of floating offshore wind turbines.

Does Australia support offshore wind?

The Australian government is actively supporting the offshore wind sector. Energy Minister Chris Bowen has emphasised the importance of offshore wind in Australia's renewable energy future, stating that it could provide up to 20% of the country's energy needs.

Could offshore wind power help Australia achieve a low-carbon future?

Australia stands on the cusp of a renewable energy revolution, with offshore wind power emerging as a key player in the nation's transition to a low-carbon future. As the country seeks to diversify its energy portfolio and meet ambitious climate targets, the vast potential of its extensive coastline is coming into focus.

Will Oceanex delay offshore wind projects in Western Australia?

Oceanex Energy has also signalled that it will delay further west coast developments on order to focus on its Hunter Valley offshore wind project. Western Australia's Energy Minister, Bill Johnston, has recently expressed scepticism about the federal government's ambitious offshore wind targets for the state.

How has the government accelerated offshore wind development in the Gippsland zone?

The government has taken significant steps to accelerate offshore wind development in the Gippsland Offshore Wind Zone off the coast of Victoria. In May 2024, the government awarded the first six feasibility licences for offshore wind projects in the Gippsland zone.

Learn More

- Penang Republic Wind Power Energy Storage Project in Malaysia

- Andorra wind power project with energy storage

- Vilnius Wind Power Storage Configuration Company

- Poland Krakow wind power energy storage system quotation

- Classification of wind solar and energy storage power stations

- Dhaka wind power storage and charging

- Apia Wind Power Energy Storage System Manufacturer

- Dakar wind and solar energy storage project construction

- Shore power storage wind power

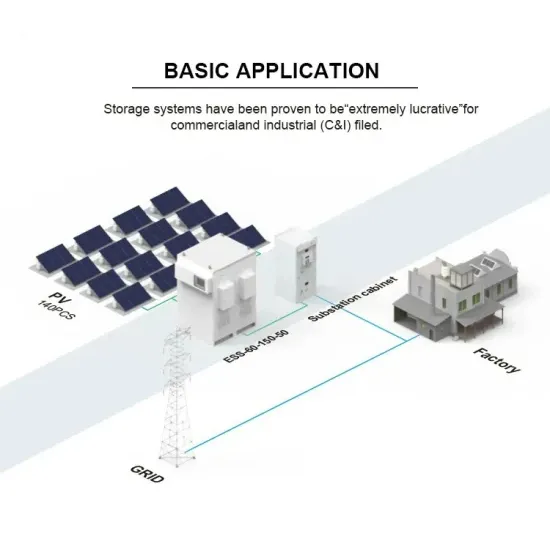

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.