Shenzhen, Shanghai top new energy cities in China

Jun 30, 2025 · Shenzhen and Shanghai remain China''s top cities in terms of new energy industry concentration level, according to the list of Hurun China New Energy Cities 2023 that was

Site Selection for Renewable Energy Projects: What Matters

Apr 10, 2025 · Discover what matters most in renewable energy site selection - from grid access to zoning - and how we drive smarter project development.

Smart Cities 2030: How Energy Systems Are Reshaping

Apr 30, 2025 · By 2030, smart cities will fundamentally transform how 68% of the global population lives, works, and interacts with urban infrastructure. These intelligent urban

2024 Smart Grid System Report

Feb 21, 2024 · An Observation "Currently, individual states, such as California and New York, are developing their own distribution-level solutions to DER integration. While these efforts are

Shanghai becomes magnet for new energy, smart car

Mar 10, 2023 · The city of Shanghai in East China has emerged as a hotspot for new energy and smart car manufacturers in response to its open and inclusive environment, according to a

Renewable Energy and Its Role in Site Selection for

Feb 24, 2025 · As the world moves toward sustainability, renewable energy is becoming a key factor in site selection for development. Whether for residential, commercial, or industrial

Smart Energy for a Smart City | Encyclopedia MDPI

Dec 5, 2022 · Smart Energy is a key element of a Smart City concept and understanding the current state and prospective developments of Smart Energy approaches is essential for the

New energy technology research

Mar 16, 2021 · Global research in the new energy field is in a period of accelerated growth, with solar energy, energy storage and hydrogen energy receiving extensive attention from the

Smart cities lighting the way: Optimizing energy structure

Jan 1, 2025 · Smart cities significantly optimizes energy structure and enhances energy efficiency in border areas. Smart cities alleviate energy inequality by strengthening government

How Smart Cities are Utilizing Renewable Energy

Mar 4, 2025 · At the heart of many smart cities is the integration of renewable energy sources. Utilizing clean, sustainable energy solutions allows these

Key technologies for smart energy systems: Recent

Jan 10, 2022 · Thus, comprehensive integration of new energy and information technologies, as well as the establishment of a highly intelligent, information-transparent, open and connected

Eco-Friendly Tech Innovations and Sustainable Solutions for

Feb 3, 2025 · From energy-efficient lighting and renewable energy sources to waste management systems and smart technology, modern construction sites are embracing sustainable solutions

Smart Energy Systems

Feb 12, 2021 · Rethink Technology Research is an analyst firm, based in Bristol, UK, considered a leader in video, wireless, IoT, and new energy technologies. Best known for its weekly news

Fostering renewable energy use through smart city

Mar 1, 2025 · The results indicate that smart city construction significantly enhances renewable energy use, particularly in regions with previously low utilization levels. For instance, in the

6 FAQs about [What are the smart new energy sites ]

How do smart cities use solar power?

Smart cities utilize solar power not only to supply energy but to increase urban resilience. By embracing bi-directional electricity flow—where buildings equipped with solar arrays can supply excess energy back to the grid—cities foster an integrated power network capable of meeting local demands efficiently.

Could wind energy be a viable renewable option for smart cities?

Wind energy offers another viable renewable option for smart cities, providing substantial power generation capabilities. Cities are beginning to install wind turbines within urban boundaries and connect to offshore wind farms.

What is geothermal energy & why should smart cities use it?

Geothermal energy, though lesser-known, provides a reliable and consistent power source that smart cities are beginning to utilize. The earth’s internal heat can be harnessed for direct heating solutions or converted into electricity.

How do smart cities use wind energy?

Smart cities utilize vertical-axis wind turbine technology, which is more suited to urban environments, as it’s quieter and can generate power even at lower wind speeds. Innovations such as these make the integration of wind energy in cityscapes increasingly feasible.

What is a smart grid?

Smart grids represent a transformative approach to energy management in smart cities, seamlessly integrating renewable energy sources into the wider electric grid. By utilizing real-time data analytics and connectivity, smart grids effectively manage and distribute power, optimizing the energy flow within the urban environment.

How can smart cities improve water quality?

By optimizing their water infrastructure, smart cities like Portland, which has implemented in-pipe hydropower turbines, contribute to cleaner and more sustainable energy production while also enhancing the resilience of their energy sources.

Learn More

- New quote for smart energy storage system

- Distribution of new energy photovoltaic sites in Serbia

- What are the types of new energy storage

- What does the new energy customized battery cabinet include

- What are the new energy storage base stations in the Dominican Republic

- What are the heat dissipation methods of new energy storage cabinets

- What are the main aspects of new energy storage

- What are the specifications of new energy battery cabinets

- What is ESS for new energy

Industrial & Commercial Energy Storage Market Growth

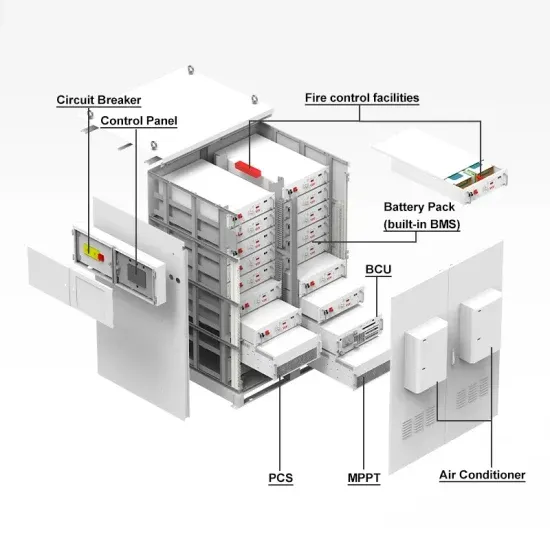

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

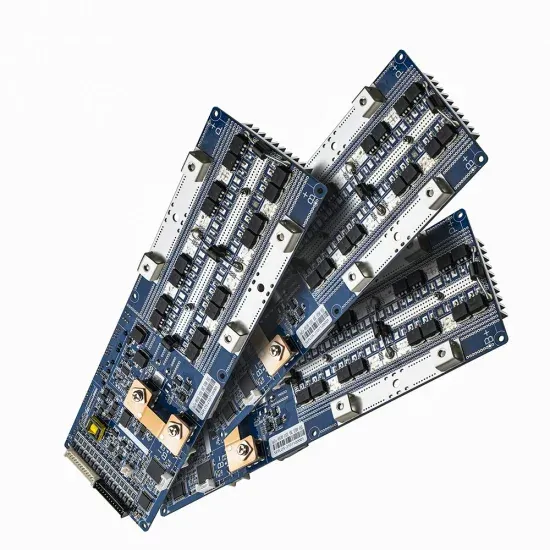

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.