Black Mountain Energy Storage: A Leader in the Field

Mar 31, 2025 · Black Mountain Energy employs a comprehensive array of energy storage technologies, including: Advanced Battery Energy Storage Systems: Optimize power output

Canadian Solar''s Recurrent buys 400MWh storage projects in

Jun 17, 2022 · Canadian Solar subsidiary Recurrent Energy has acquired two standalone energy storage projects in development totalling 400MWh in the ERCOT, Texas market. Recurrent

Black Mountain Energy Storage: A Leader in the Field

Mar 31, 2025 · Black Mountain Energy Storage has established itself as a pioneering entity within the dynamic realm of energy storage solutions, focusing on both utility-scale and project

VPP Programs Expand to Battery Storage Owners – FutureGrid

Feb 25, 2025 · Virtual power plant (VPP) programs are expanding to battery storage owners in the US and Canada through a partnership between inverter-manufacturer Solis and Derapi, an

black mountain energy storage products

Feb 16, 2025 · The market for distributed energy storage is projected to grow at a compound annual growth rate of 30.3% and reach $54 billion by 202_black mountain energy storage

Black Mountain Energy Storage Power Station

The Black Mountain Energy Storage Power Station represents a critical piece of the clean energy puzzle. By addressing intermittency challenges and improving grid resilience, it paves the way

Cypress Creek Renewables Acquires 400MW from Black Mountain Energy

Jul 26, 2022 · About Black Mountain Energy Storage Black Mountain Energy Storage is a team of energy experts who develop and operate battery energy storage facilities. Founded in 2021,

black mountain energy storage Archives

Jan 21, 2025 · Developer-operator GridStor has acquired a battery energy storage system (BESS) project in Oklahoma, US totalling 200MW/800MWh from Black Mountain Energy Storage

VITIS ENERGY ACQUIRES 200MW ENERGY STORAGE

Aug 30, 2024 · Black Mountain Energy Storage is a team of energy experts who develop and operate battery energy storage facilities. Founded in 2021, BMES was established to bring

BLACK MOUNTAIN ENERGY STORAGE

An Energy Management System (EMS) serves as the "brain" of a battery energy storage system (BESS), responsible for monitoring, controlling, and optimizing its operation.. It allows grid

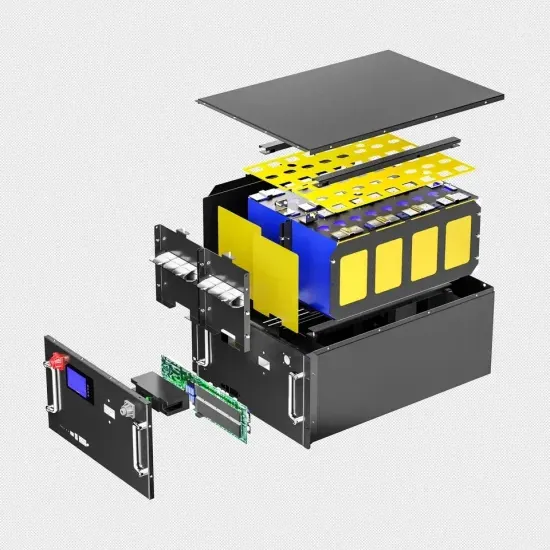

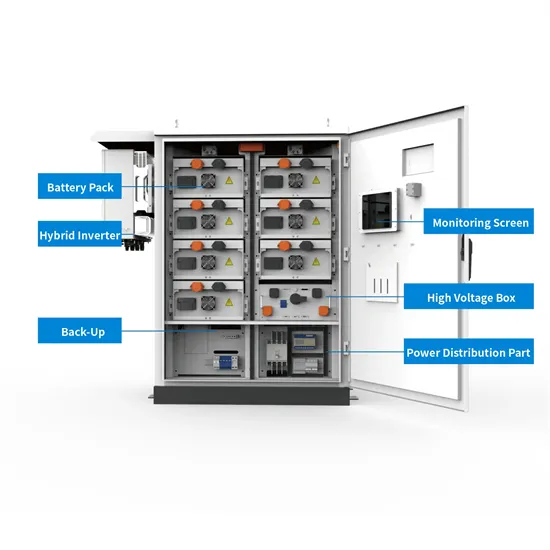

Industrial and commercial energy storage BMS series-TU Energy Storage

Products Base Station BMS Household ESS BMS Industrial and commercial energy storage BMS series Energy Storage lnverter(Single Phase) Energy Storage lnverter(Three Phase)

Black Mountain公司在威斯康星州部署一个300MW/1400MWh

Oct 7, 2023 · 据外媒报道,储能系统开发商Black Mountain Energy Storage储能公司日前表示,已经获得威斯康星州密尔沃基市政府的批准,将部署一个规模为300MW/1400MWh电池储能项

Learn More

- Black Mountain Lithium Battery Energy Storage Equipment Company

- Black Mountain Photovoltaic Energy Storage Manufacturer

- Black Mountain Photovoltaic Energy Storage Battery Cabinet

- Energy storage inverter for photovoltaic power source

- Zagreb lithium battery energy storage system inverter

- Dominican photovoltaic energy storage 15kw inverter

- Does the energy storage system need an inverter

- Vatican off-grid energy storage inverter

- San Salvador photovoltaic energy storage 60kw inverter brand

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.