Top 5 solar battery storage companies in Indonesia –

Jan 22, 2024 · This article will introduce to you the top 5 solar battery storage companies in Indonesia, namely PT Adaro Power, TYCORUN, UPS PASCAL, Xurya, PT New Indobatt

Recommended Manufacturers of Home Energy Storage and

Jul 22, 2025 · Indonesia''s Energy Challenge: Why Solar Battery Storage Is the Key to Reliable Power Indonesia, the largest archipelago in the world, faces a unique set of energy

Top 51 Solar Battery Companies in Indonesia (2025) | ensun

CNGR Advanced Materials specializes in new energy materials for lithium batteries, playing a crucial role in the advancement of sustainable energy solutions, including battery energy

Top 25 Energy Storage Companies in Indonesia (2025) | ensun

Top Energy Storage Companies in Indonesia The B2B platform for the best purchasing descision. Identify and compare relevant B2B manufacturers, suppliers and retailers Supplier discovery

Indonesia Surabaya Power Storage Project Bidding

Why Surabaya''s Energy Storage Market Matters Surabaya, Indonesia''s second-largest city, faces a 17% annual growth in electricity demand driven by industrialization and urbanization. The

Rept Battero to develop 8GWh Indonesia BESS cell gigafactory

Jan 17, 2025 · Image: REPT via LinkedIn Chinese battery manufacturer Rept Battero has announced plans to develop an 8GWh gigafactory in Indonesia specialising in lithium-ion cells

Surabaya s Lithium Battery Ban Shifting Trends in Energy Storage

Why Surabaya Says No to Lithium Batteries In late 2023, Surabaya - Indonesia''s second-largest city - implemented a groundbreaking ban on lithium-ion batteries for stationary energy storage

9 Top Renewable Energy Companies in Indonesia · August

Aug 1, 2025 · Detailed info and reviews on 9 top Renewable Energy companies and startups in Indonesia in 2025. Get the latest updates on their products, jobs, funding, investors, founders

EVE Energy Made a Stunning Appearance at Solartech Indonesia

From April 23 to 25, 2025, Solartech Indonesia 2025 was grandly held in Jakarta, Indonesia. EVE Energy made a stunning appearance with its full range of energy storage solutions, injecting

Indonesia Clean Energy Battery Storage System

Apr 19, 2024 · PLN and Indonesia Battery Corporation (IBC), the state-owned battery company, are working on another pilot project with a 5 MW energy storage system. PLN indicated that

Recommended Manufacturers of Home Energy Storage and

Jul 22, 2025 · As Indonesia accelerates its energy transition, demand is rising for reliable, scalable, and cost-effective battery energy storage systems (BESS). From homes and resorts

Battery Energy Storage System (BESS) market di Indonesia

Apr 21, 2021 · Mineral ore export ban reinstatement (in Jan 2020) has accelerated Indonesia''s nickel downstream industrialisation and led the formation of strategic ventures in stainless

The Grand Opening of Greenway Indonesia Subsidiary: A

Nov 29, 2024 · Surabaya, Indonesia, (ANTARA/PRNewswire)- On November 22, PT GREENWAY ENERGY INDONESIA, the Indonesian subsidiary of Greenway (SHSE:688345),

6 FAQs about [Indonesia Surabaya also has energy storage battery companies]

Who are Indonesian solar battery storage companies?

Indonesian solar battery storage companies mainly include energy storage system integrators, charging infrastructure providers, battery manufacturers, energy storage project developers and energy storage product traders. These companies focus on different aspects such as development, design, construction, production and trade.

What are the opportunities in Indonesia's battery storage sector?

Opportunities in Indonesia's battery storage sector are significant, driven by the growing demand for renewable energy sources and the government's ambitious targets for transitioning to cleaner energy.

Why is battery storage important in Indonesia?

Renewable Energy Integration: With Indonesia’s commitment to increasing renewable energy generation, battery storage systems are crucial for storing excess renewable energy and ensuring its smooth integration into the grid.

What is the Indonesia battery market?

The Indonesia battery market refers to the industry involved in the production, distribution, and sale of batteries used for various applications. Batteries are energy storage devices that convert chemical energy into electrical energy, providing portable and reliable power sources.

Who are the top Indonesia battery companies?

PT. New Indobatt Energy Nusantara This report lists the top Indonesia Battery companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research and identified these brands to be the leaders in the Indonesia Battery industry.

Why is Indonesia a leader in the lithium battery industry?

In 2024, Indonesia stands at the forefront of the rapidly evolving lithium battery industry, catalyzed by its significant reserves of raw materials essential for battery production and a growing focus on renewable energy sources. As Southeast Asia's largest economy, Indonesia has strategically positioned itself as a

Learn More

- Modern Energy Storage Battery in Surabaya Indonesia

- Price of photovoltaic off-grid energy storage in Surabaya Indonesia

- Local energy storage battery companies in West Asia

- EK Large-Scale Lithium Energy Storage in Surabaya Indonesia

- Energy storage and energy storage battery companies

- Energy storage battery companies in South Sudan

- North African energy storage battery companies

- Lithium energy storage battery companies

- Sodium energy storage battery companies

Industrial & Commercial Energy Storage Market Growth

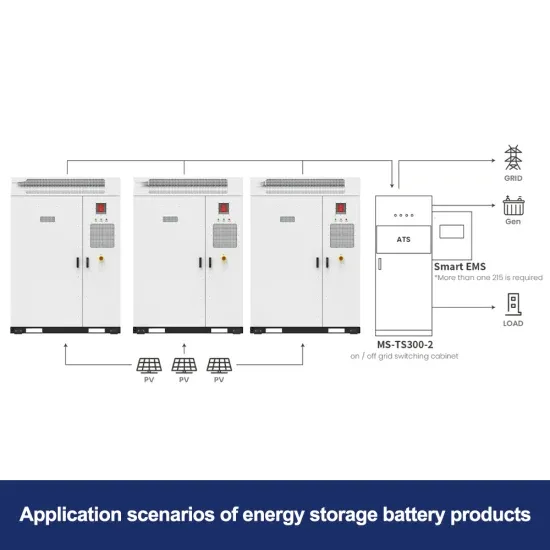

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.