Top 100 Switchgear Manufacturers in Netherlands (2025)

Information about Switchgear in Netherlands When exploring the Switchgear industry in the Netherlands, several key factors are crucial. The regulatory environment is stringent, with

Netherlands Switchgear and switchboard apparatus Market

Netherlands Switchgear and switchboard apparatus Top Companies Market Share Netherlands Switchgear and switchboard apparatus Competitive Benchmarking By Technical and

Switchgear Meaning in Construction in the Netherlands

Mar 9, 2025 · Future Trends in Switchgear for Dutch Construction The Netherlands is at the forefront of technological advancements in switchgear, with a focus on: Smart Switchgear

Netherlands Switchgear manufacturers | Electrical companies

Hapam is an independent manufacturer of High Voltage Disconnectors and Earthing Switches for outdoor and indoor substations up to 800kV. So far Hapam has supplied more than 200.000

Wholesale High Voltage Switchgear Products at Factory Prices

Find wholesale high voltage switchgear manufacturers from China, India, Korea, and so on. Source good quality high voltage switchgear products for sale at factory prices from online

Electrical wholesaler DTC Elektro | The real specialists

We supply all products for electrical installations in utility construction. So you can come to us for your wire and cable, cable support systems, lighting, switchgear, distributors, home

Lugao Gck Low Voltage Switchgear Electrical Cabinet Factory Price

Jul 31, 2025 · The KYN28 indoor metal armored withdrawable switchgear (hereinafter referred to as the switchgear) developed and produced by LUGAO is the company''s signature product, a

Gas Insulated Switchgear

Jul 25, 2025 · This factory-installed solution reduces the amount of labor-intensive, individually terminated copper wire connections with pre-terminated copper and fiber optic cables that

Electrical Panel Box Netherlands Control Cabinet Low

May 1, 2025 · Electrical Panel Box Netherlands Control Cabinet Low Voltage Power Distribution Switchgear Panel Power Distribution Equipment, Find Details and Price about Power Box Low

Real Factory OEM Customized Solid Insulated Metal-Enclosed Switchgear

Jun 24, 2025 · Real Factory OEM Customized Solid Insulated Metal-Enclosed Switchgear No Sf6 Rmu Gas Insulated Switchgear, Find Details and Price about Insulated Switchgear Rmu Ring

Price & Supply Challenges in Switchgear Market: Know Why

Jan 7, 2025 · Find out why the switchgear market is facing the rise in price and supply challenges. Discover the key pricing pressures and the causes of delay in switchgear lead times in this blog

Low Voltage Residential Switchgear Market Size, Report 2034

The low voltage residential switchgear market size crossed USD 17.7 billion in 2024 and is estimated to grow at a CAGR of 9.3% from 2025 to 2034, driven by the rising urbanization,

Switchgear Manufacturers, Suppliers & Factory Directory on

Switchgear manufacturers & suppliers, China Switchgear manufacturers, suppliers & factory directory, find Chinese Switchgear manufacturers, suppliers, factories, exporters and

Switchgear Accessories Imports in Netherlands

Oct 2, 2024 · Grow Your Switchgear Accessories Import Business in Netherlands Volza''s Big Data technology scans over 2 billion import shipment records to identify new Buyers,

Price & Supply Challenges in Switchgear Market: Know Why

Jan 7, 2025 · The global switchgear industry is struggling with rising pricing and longer lead times. The post–COVID economic recovery has led to a surge in demand for switchgear, particularly

Wholesale Switchgear Products at Factory Prices from

Shop online for wholesale switchgear? Global Sources has a full-scale list of wholesale switchgear products at factory prices featured by verified wholesalers & manufacturers from

Switches and switchboards manufacturers in Netherlands

Aqualectra has been their panel builder since November 1, 1979. A brand-independent supplier with all the freedom to apply the best and most progressive components. Their calculators and

Real Switchgears & Cables Pvt. Ltd.

REAL SWITCHGEARS principally competes on the basis of product quality and performance, reliability of supply, timely delivery, customer service and price. Established with sole objective

Wholesale Switchgear Products at Factory Prices from

Find wholesale switchgear manufacturers from China, India, Korea, and so on. Source good quality switchgear products for sale at factory prices from online Chinese, Indian, Korean, and

Vertiv Switchgears and Switchboards

Our custom-built switchgear and electrical switchboards guarantee the proper flow of power and protection for your equipment. Discover the best power distribution solutions to protect your

China Switchgear, Switchgear Wholesale, Manufacturers, Price

China Switchgear wholesale - Select 2025 high quality Switchgear products in best price from certified Chinese Sensor Switch manufacturers, Pushbutton Switch suppliers, wholesalers and

Brass Fuse Gear and Switchgear Manufacturer in Netherlands

We not only comply with the quality and price but also they assure full proof tendency in delivering power supply through the terminals fitted to the equipments. Our Brass Fuse Gear and Switch

Learn More

- Factory price real switchgear in Cebu

- Factory price real switchgear in Bahamas

- Factory price real switchgear in Honduras

- Factory price 480v switchgear in Brisbane

- Best factory price 480v switchgear Seller

- Factory price 33kv switchgear in Costa-Rica

- Factory price 33kv switchgear in Austria

- Factory price 11kv switchgear in Romania

- Hot sale factory price acme switchgear producer

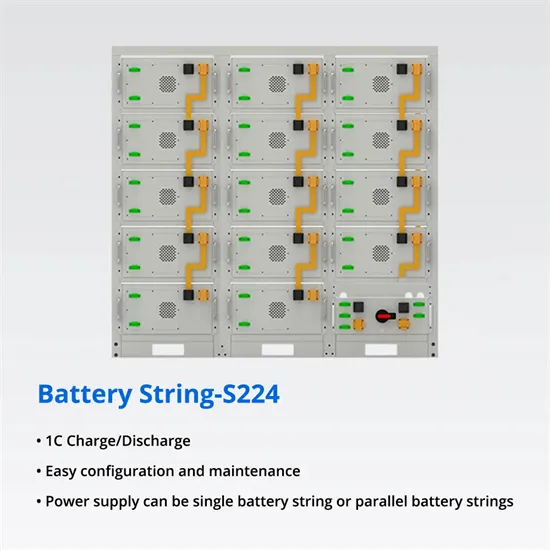

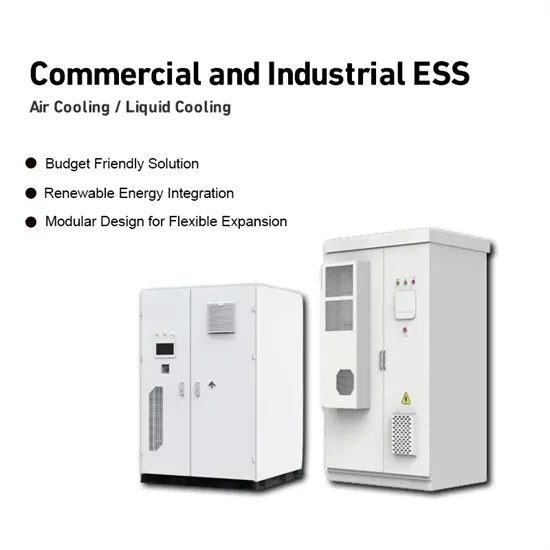

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

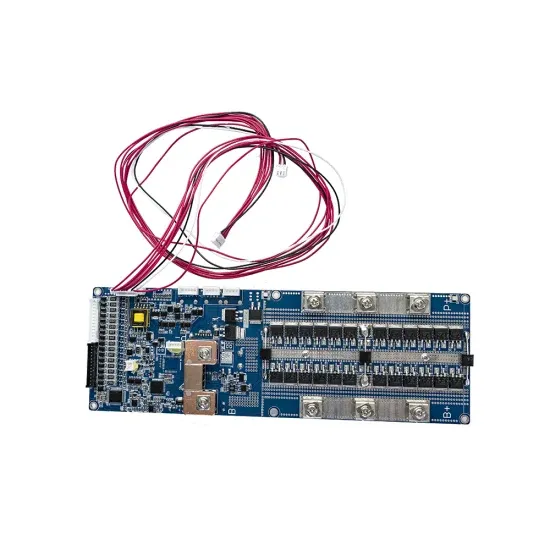

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.