SolarPower Europe extends its reach to storage and

Mar 27, 2025 · SolarPower Europe marks its 40th anniversary with a new tagline ''SolarPower Europe: Solar, Storage, and Flexibility'' and plans to establish a dedicated European battery

Renewable Power Generation Costs in 2023

Renewable power generation has become the default source of least-cost new power generation. The progress made in 2023 is a significant step toward transitioning to a system based on

Economic assessment and grid parity analysis of photovoltaic power

Mar 15, 2025 · A PV power generation Levelized Cost of Electricity (LCOE) assessment model is presented that incorporates the impact of TGC on the economic viability of PV projects. The

EU Market Outlook for Solar Power 2022-2026

SolarPower Europe''s annual EU Market Outlook helps policy stakeholders in delivering solar PV''s immense potential to meet the EU''s 2030 renewable energy targets. Produced with the

PPA Insights: European solar and wind power prices

Jun 13, 2025 · What are the current long-term solar and wind power prices? Find these prices every quarter in our PPA Insights report, where we assemble solar and on-shore wind power

New report: European battery storage grows 15% in 2024, EU energy

May 7, 2025 · 21.9 GWh of battery energy storage systems (BESS) was installed in Europe in 2024, marking the eleventh consecutive year of record breaking-installations, and bringing

Renewable Power Generation Costs in 2023

Power generation from renewable energy technologies is increasingly competitive, despite fossil fuel prices returning closer to the historical cost range. The most dramatic decline has been

Perspectives of photovoltaic energy market development in

May 1, 2023 · The PV installation (PV) developed into large-scale centralized PV generation in areas with intensive technology and building-integrated and building-applied PV (BIPV and

''Solar-plus-storage is the answer'': What record

Sep 15, 2021 · Record-breaking power prices across Europe have turned the spotlight on the role fossil fuel plants play in generating electricity and how the

Recommendations on energy storage

Energy storage is a crucial technology to provide the necessary flexibility, stability, and reliability for the energy system of the future. System flexibility is particularly needed in the EU''s

Solar photovoltaics in Europe

May 8, 2025 · Solar energy pipeline capacity in Europe 2025, by status and region Prospective solar power capacity in Europe as of February 2025, by status and region (in gigawatts)

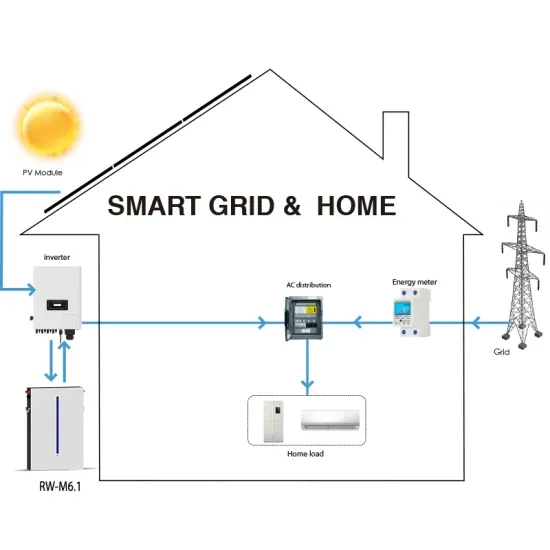

Efficient energy storage technologies for photovoltaic systems

Nov 1, 2019 · For photovoltaic (PV) systems to become fully integrated into networks, efficient and cost-effective energy storage systems must be utilized together with intelligent demand side

Renewable energy costs continue to fall across

Mar 8, 2023 · Opinion Renewable energy costs continue to fall across Europe Wind and solar will attract the lion''s share of energy investment in Europe and

Cost accounting and economic competitiveness evaluation of photovoltaic

Feb 1, 2024 · Accelerating the penetration of photovoltaics (PV) oriented renewables is a vital mainstay in climate mitigation. Along with continuous growth of PV generation in the power

eu-market-outlook-for-solar-power-2024-2028

Dec 17, 2024 · The EU Market Outlook for Solar Power 2024-2028 is SolarPower Europe''s comprehensive annual report that outlines the current status and forecasts the trajectory of the

6 FAQs about [Prices of photovoltaic power generation with energy storage in Western Europe]

Does Europe have a slowdown in photovoltaic growth?

The new European market report from SolarPower Europe shows a sharp decline in the growth of photovoltaics. After four years of soaring growth, the EU solar sector has hit its first deployment slowdown of the 2020s, dropping from 53% growth in 2023 to 4% in 2024. This represents a 92% slowdown of solar growth.

How many solar panels are installed in Europe in 2024?

SolarPower Europe’s annual EU Market Outlook for Solar Power reveals that 65.5 GW of solar has been installed in 2024, just beating the 2023 record of 62.8 GW of new solar. The total EU solar fleet now stands at 338 GW, quadrupling from 82 GW a decade ago. Also see: Central and Eastern Europe increasingly in the solar gigawatt class

Is solar growth slowing down in Europe?

This represents a 92% slowdown of solar growth. SolarPower Europe’s annual EU Market Outlook for Solar Power reveals that 65.5 GW of solar has been installed in 2024, just beating the 2023 record of 62.8 GW of new solar. The total EU solar fleet now stands at 338 GW, quadrupling from 82 GW a decade ago.

Will Europe's PV market grow in 2024?

The only marginal growth of the European PV market in 2024 is well below earlier forecasts. More widely, the market slowdown is attributed to system conditions. Europe’s electrification rate has been stuck at 23% for the past five years, leaving most of the energy system dependent on fossil fuels and combustion.

Are solar PV projects reducing the cost of electricity in 2022?

Between 2022 and 2023, utility-scale solar PV projects showed the most significant decrease (by 12%). For newly commissioned onshore wind projects, the global weighted average LCOE fell by 3% year-on-year; whilst for offshore wind, the cost of electricity of new projects decreased by 7% compared to 2022.

Will low-cost solar bring Europe into a new era of competitiveness?

Amongst other flexibility tools, this will require a 16-fold growth from 48 GWh of EU battery storage today to 780 GWh of battery storage in 2030. Dries Acke, Deputy CEO at SolarPower Europe said: “Low-cost solar is the best option for bringing Europe into a new era of competitiveness.

Learn More

- Madagascar photovoltaic power generation and energy storage prices

- Palau Photovoltaic Energy Storage Power Generation Project

- Photovoltaic power generation energy storage pump in Algeria factory

- Guatemala communication base station flywheel energy storage photovoltaic power generation capacity

- Can photovoltaic power generation with energy storage be connected to the grid

- One gigawatt of photovoltaic power generation and energy storage

- The best energy storage method for photovoltaic power generation

- Gabon photovoltaic energy storage power generation

- South Korea s solar power generation and energy storage prices

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.