9 Findings from the 2022 Gas vs Battery OPE Usage and

Nov 17, 2022 · For the 2022 edition of the Gas vs. Battery OPE Usage and Perceptions Report, the primary research team at The Farnsworth Group surveyed hundreds homeowners and

Outdoor Safe Charging Energy Storage Price: Your Ultimate

The Price Spectrum: From Budget to Premium When it comes to outdoor energy storage prices, options range from "wallet-friendly" to "investment-grade." Here''s a quick snapshot:

Indoor Vs Outdoor Electrical Panel: Differences

Jan 6, 2025 · A service panel functions by maintaining the proper distribution of power throughout a property. But what is the difference between an indoor vs

Outdoor Power Supply vs Generator: Which Wins?

Aug 14, 2025 · 相比户外电源,发电机的工作压力更高,对机械部件的强度和硬度要求更高,喷油泵、喷嘴的制造精度要求也更高。 因此,它的成本并不便宜

Difference between Indoor and Outdoor Substations

May 20, 2024 · An indoor substation is one in which the entire substation is built inside a building, whereas an outdoor substation is a substation in which the equipment are installed in an open

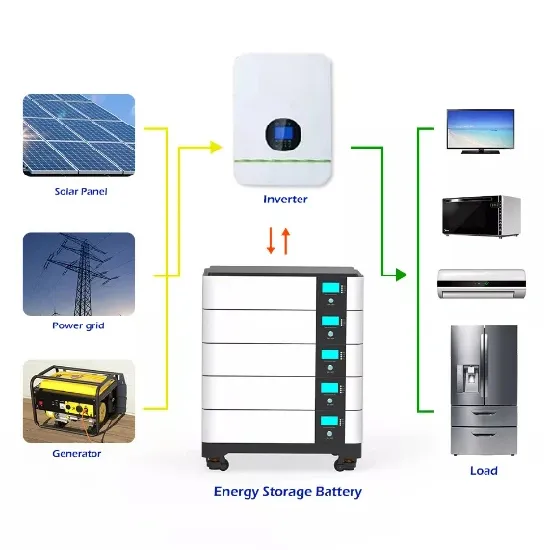

Solar Lithium Energy Storage System Brochure

Oct 30, 2024 · When the time-of-use tarif is at its peak segment: The energy storage cabinet automaically discharges, realizing the arbitrage of price difference and improving the economic

Outdoor Power System Design and Cost Considerations

Jun 14, 2012 · Reduce the size and cost of equipment. In traditional outdoor power applications, existing indoor power systems use long and oversized electrical wires that supply the remote

Malabo Outdoor Energy Storage System Price: A

Outdoor energy storage systems like Malabo''s are becoming the Swiss Army knives of power solutions – and guess what? The global energy storage market is projected to hit $86 billion by

How Much Does Outdoor Lighting Really Cost in 2025?

Aug 8, 2025 · As outdoor living spaces continue to rise in popularity across the U.S., one question consistently comes up: how much does outdoor lighting really cost in 2025? Whether you''re a

6 FAQs about [Outdoor power price difference]

What is outdoor power equipment?

Meaning: Outdoor Power Equipment refers to a category of tools and machinery powered by engines or electricity, designed for outdoor applications. These include lawnmowers, chainsaws, leaf blowers, trimmers, and other equipment that aid in various outdoor tasks.

What is the outdoor power equipment market?

In conclusion, the Outdoor Power Equipment Market is a vibrant and evolving sector, integral to the upkeep of outdoor spaces. The industry’s ability to innovate, adopt sustainable practices, and cater to the diverse needs of residential and commercial users positions it for continued success.

Should you buy or rent outdoor power equipment?

Rental Services: The growing trend of renting outdoor power equipment instead of purchasing provides an opportunity for service providers to offer cost-effective solutions to a wider customer base.

What factors influence the outdoor power equipment market?

The Outdoor Power Equipment Market is influenced by factors such as seasonal demand variations, consumer preferences, technological disruptions, and regulatory initiatives promoting sustainable and low-emission equipment. Understanding these dynamics is essential for stakeholders to navigate challenges and capitalize on emerging trends.

How is the outdoor power equipment market segmented?

The Outdoor Power Equipment Market can be segmented based on various criteria: Power Source: Gasoline-powered, electric-powered (corded), electric-powered (cordless/battery-operated). Product Type: Lawnmowers, chainsaws, trimmers and edgers, blowers and vacuums, snow throwers, and other specialized equipment.

What is the future outlook for the outdoor power equipment market?

Future Outlook: The Outdoor Power Equipment Market is poised for steady growth, driven by ongoing technological advancements, the shift towards sustainable practices, and the increasing recognition of the importance of outdoor spaces.

Learn More

- What is the difference between outdoor power supply and battery

- Outdoor power supply price 1224 yuan

- Middle East outdoor mobile power box price

- Manama outdoor mobile power box price

- Outdoor power storage price

- Outdoor communication power supply BESS platform price

- Kazakhstan mobile outdoor power supply price

- Port Moresby outdoor mobile power box price

- Dushanbe outdoor power supply local BESS price

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.