Grid-Scale Battery Storage: Frequently Asked Questions

Jul 11, 2023 · What is grid-scale battery storage? Battery storage is a technology that enables power system operators and utilities to store energy for later use. A battery energy storage

Brazil bets big on batteries

1 day ago · Energy storage in Brazil is entering a period of accelerated growth. Despite the lack of a legal framework for project operations, companies are moving to expand domestic battery

Brazil''s Energy Storage Auction to Attract $450M in

Feb 4, 2025 · Brazil is set to conduct its first auction for adding batteries and storage systems to the national power grid. The auction, to take place in June 2025, will include 300MW energy

Top 7 Brazilian Solar Lithium Battery Suppliers | 2025 Guide

Mar 13, 2025 · Despite challenges like high initial costs and limited domestic manufacturing, Brazil''s solar lithium battery market is poised for significant expansion. The country''s focus on

The Rise of Sodium-Ion Batteries: Powering Brazil''s Energy Storage

Jul 20, 2025 · Explore sodium-ion batteries—Brazil''s key to affordable, safe energy storage. Ideal for solar farms, agro-industry & backup power. Partner with DLCPO for tailored solutions.

Brazilians ready to embrace storage amid rising

Sep 11, 2024 · With global battery prices having fallen 85% between 2010 and 2018 – and further since – Brazilian home, business, and industrial electricity

Brazil bets big on batteries – pv magazine International

12 hours ago · Energy storage in Brazil is entering a period of accelerated growth. Despite the absence of a legal framework, companies are expanding battery production, diversifying

Brazil plans to include batteries and energy storage solutions

Sep 16, 2023 · The Brazilian government plans to include batteries and other forms of energy storage to compete in energy auctions which are set to happen in the first half of 2024, an

Brazil announces first battery storage auction

October 18, 2024: Brazilian minister of energy and mining, Alexandre Silveira de Oliveira, has announced the country''s first large-scale battery storage auction to be held in 2025.

Cost Projections for Utility-Scale Battery Storage: 2021

Sep 17, 2021 · Executive Summary In this work we describe the development of cost and performance projections for utility-scale lithium-ion battery systems, with a focus on 4-hour

U.S. Tariffs on Chinese Lithium Batteries: Full Breakdown

Apr 15, 2025 · U.S. tariffs on Chinese lithium batteries have become a critical factor shaping the global battery market in 2025. These tariffs directly impact lithium-ion batteries'' cost, supply

Solar Battery Prices: Is It Worth Buying a Battery

3 days ago · Solar batteries bring a lot of significant value to a solar system. How much do they cost? Check out the top 6 factors that affect the solar battery price.

Understanding the Price of Brazilian Energy Storage Batteries

If you''re exploring energy storage solutions in Brazil, you''re likely asking: "How much do Brazilian energy storage batteries cost?" This article breaks down pricing factors, market trends, and

Battery energy storage systems in Brazil: current regulatory

Explore Brazil''s battery energy storage systems, focusing on current regulations, investment opportunities, and the role of these systems in the energy transition.

6 FAQs about [How much is the price of Brazilian energy storage batteries]

Can Brazil be a big battery storage country?

With well-designed policies and regulations, Brazil has significant potential to follow in the footsteps of jurisdictions like California and Chile for large-scale battery storage, Germany for distributed and large-scale storage, and Australia for both pumped hydro and large-scale battery systems.

Will Brazil's lithium battery market grow in 2030?

Sophia Costa, head of new business at Holu Solar said market analysts expect Brazil’s lithium battery sector to grow at a CAGR of 20% to 30% through 2030. “We have observed that the battery energy storage system (BESS) market is booming globally with the use of lithium-ion batteries becoming a reality in many parts of the world,” said Costa.

How much does it cost to import batteries to Brazil?

INMETRO has a maximum deadline of 60 days to analyse the Import License and this process costs BRL 47,39 (as of March 2015). In order to be able to import batteries to Brazil, it is also necessary to be registered on IBAMA’s database for activities that may have an environmental impact, CTF.

Can foreigners invest in battery storage businesses in Brazil?

Investment, incentives and taxation scenarios According to Brazilian law, there are no legal restrictions on direct foreign investment in the battery storage businesses or in the power sector (except in very specific segments or sectors of the economy).

Are energy storage products coming to Brazil?

Holu’s Costa observed batteries were prominent during the Intersolar South America trade show held in São Paulo at the end of August 2024. She added, hundreds of manufacturers are bringing energy storage products to Brazil.

Are battery energy storage systems at a premium in the future?

Flexible generation and correlated solutions, including battery energy storage systems (BESS), are therefore likely to be at a premium in the future.

Learn More

- How much is the price of energy storage batteries in India

- What was the price of energy storage cabinet batteries in the past

- How big are mainstream energy storage batteries

- How long does it take to get a return on investment in energy storage batteries

- How much is the price of energy storage cabinet container in Uruguay

- Price of Regenerative Energy Storage Batteries

- Energy storage price of new batteries

- How many energy storage batteries are needed for 100mw photovoltaic

- How much does a Brazilian energy storage device cost

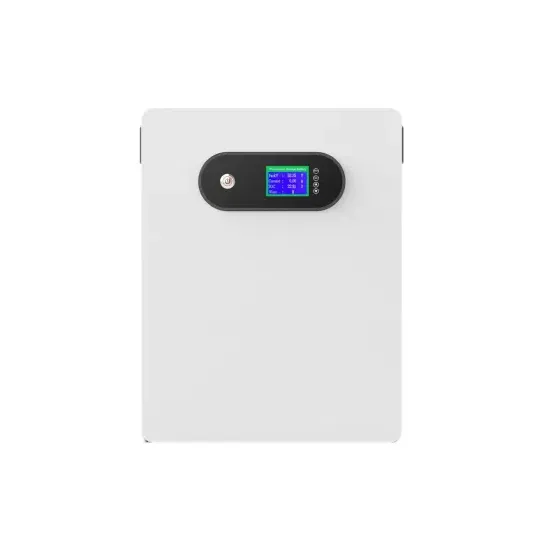

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.