The Green Recruitment Company hiring Project Manager (PV, Wind & BESS

Posted 11:30:36 AM. Project Manager – Utility-Scale Solar PV, BESS & Wind Projects 📍 Milan, Italy | 💼 Salary: €55,000See this and similar jobs on LinkedIn.

Sungrow Sets the Vision for the Future of Energy Storage in Italy

Nov 12, 2024 · During the event, set to take place in Milan on 21st November, industry experts will discuss developments, challenges and solutions associated to the deployment of Battery

Senior Civil Engineer PV/BESS Job Milan Italy,Engineering

About the Role: A major player in the renewable energy industry is looking to strengthen its engineering division in Italy by hiring a Senior Civil Engineer for its Technical Office team. The

BESS in Italy: Huge growth market faces CE mark

Aug 6, 2024 · Italy''s regulations around battery certification, for both smaller-sized battery storage and large-scale BESS, are seeing significant changes. A

Glennmont and Exus agree 800MW Italian battery storage

Apr 9, 2024 · The deal will see Glennmont and Exus commence a series of standalone battery energy storage system (BESS) projects across the Puglia region of Italy. These will constitute

Battery energy storage systems in Italy: current regulation

Feb 7, 2023 · The development of Battery Energy Storage Systems (hereinafter "BESS") in Italy has been limited by the fact that the spread of renewable sources is

Backup power for Europe

Apr 3, 2025 · As of March 2025, Italy has got 1GW of grid-scale BESS capacity online, placing the country in third place in Europe (shared with Ireland) in terms of installed capacity, behind

How Many Photovoltaic Glass Factories Are in Milan Italy

A common question we hear is: "How many photovoltaic glass factories are there in Milan, Italy?" While exact numbers are fluid due to rapid industry growth, Milan hosts several key players

Renewable Energy & Infrastructure Deal Flow Platform | PF

A 96 MW PV with BESS project in Italy with STMG in hand. The project has an attractive position, 31-year land lease agreement with 5 year option to extend, and a nearby grid connection.

Casa Marotta: The Glass House in Val di Noto | Villa For rent

This Glass House, with its expansive glass surfaces and cutting-edge design, enchants the senses and offers a unique experience in the heart of Noto. Crafted by the Milanese

Nidec ASI wins a contract for the accumulation

Oct 21, 2022 · Nidec ASI, world leader in BESS, essential for promoting and optimizing the use of renewables, will be involved in the project with 4 of its

BESS photovoltaic market, Italy is 2a in Europe

Jun 13, 2024 · BESS Photovoltaics, Italy is the 2nd largest European market In terms of total cumulated capacity, Italy does not lose its position. Today with

Photovoltaic Glass for Milan Power Plant Sustainable Energy

Why Photovoltaic Glass Is Reshaping Milan''s Energy Landscape Milan, Italy''s economic powerhouse, has committed to sourcing 60% of its electricity from renewables by 2030.

Recurrent secures financing for Italian solar-plus

Jun 24, 2025 · Independent power producer (IPP) Recurrent Energy has secured €61.5 million (US$71.4 million) in financing for its Italian renewable power

How Many Photovoltaic Glass Factories Are in Milan Italy

Why Photovoltaic Glass Matters for Milan''s Green Transition Photovoltaic (PV) glass integrates solar cells into building materials, enabling structures to generate electricity. For a city like

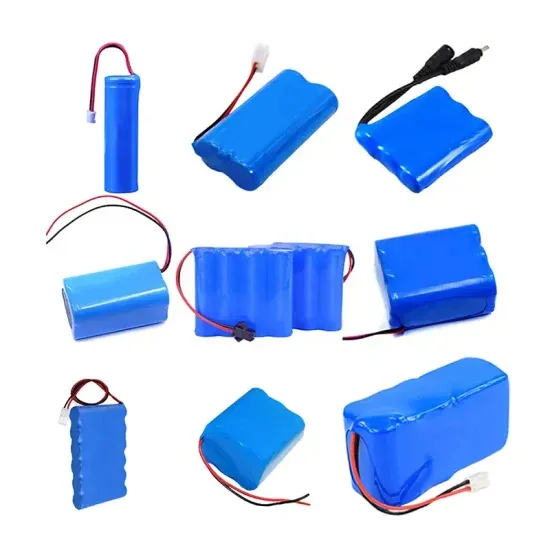

Battery Energy Storage Systems (BESS)

Jun 13, 2024 · Therefore, battery energy storage systems (BESS) are needed in Italy. The Italian market for BESS is growing rapidly and currently amounts to 2.3 GW but it almost exclusively

Italy : BESS wins nearly 600MW in 2027 capacity market

Mar 11, 2025 · Increased Energy Efficiency: BESS can optimize energy usage by shifting non-essential loads to off-peak hours, reducing peak demand and associated costs. ## Enel''s

BESS photovoltaic market, Italy is 2a in Europe

Jun 13, 2024 · In terms of total cumulated capacity, Italy does not lose its position. Today with 6.5 GWh of photovoltaic batteries installed in total, it is the second

Solar and BESS co-location: value streams and technical

Feb 28, 2025 · Solar PV + BESS, with their ability to provide firm capacity, reduce peak demand, and facilitate energy arbitrage, are well-positioned to play a pivotal role in this transition.

6 FAQs about [BESS photovoltaic glass house in Milan Italy]

Why is the Bess photovoltaic market growing?

Parallel to the trend that has investing solar, the growth of the BESS photovoltaic market has been driven mainly by the residential segment as a response to the expensive bill of these years. The European domestic segment “turned on” 12 GWh of stationary battery storage in 2023, accounting for 70% of the total added capacity.

Are battery energy storage systems needed in Italy?

Therefore, battery energy storage systems (BESS) are needed in Italy. The Italian market for BESS is growing rapidly and currently amounts to 2.3 GW but it almost exclusively consists of residential scale systems, associated with small scale solar plants, having an average capacity of less than 20 kWh.

How is the Italian government aiming for 15GW of Bess capacity?

The Italian government is aiming for 15GW of BESS capacity by 2030 to maintain security of supply. The Italian government, regulator, and Transmission Service Operator (TSO) are creating an attractive regulatory environment for BESS by offering multiple incentive schemes and updating the grid code.

How much Bess capacity will Italy have by 2030?

That is why Italy aims to add 15GW of BESS capacity by 2030 (of which 11GW should be standalone and 4GW co-located). As of March 2025, Italy has got 1GW of grid-scale BESS capacity online, placing the country in third place in Europe (shared with Ireland) in terms of installed capacity, behind Germany (1.6GW) and the UK (5.6GW).

Is matrix A Bess partner in Italy?

This partnership is of high strategic relevance to help the parties reach their ambitious growth plans in Italy, and it highlights Matrix as one of the first movers in the Italian standalone BESS market.

Does Italy lose its position on Bess?

In terms of total cumulated capacity, Italy does not lose its position. Today with 6.5 GWh of photovoltaic batteries installed in total, it is the second largest European market for BESS. This is due to the residential segment, which alone provided 3.1 GWh, which is 84% of the capacity added in 2023.

Learn More

- Andorra Photovoltaic Glass House BESS

- Vanuatu Photovoltaic Glass House BESS Information

- Solar photovoltaic panels installed in Milan Italy

- Which company is professional in photovoltaic power generation glass house

- Tokyo photovoltaic container house BESS

- BESS house photovoltaic energy storage

- Install solar photovoltaic panels in glass house

- Uzbekistan EK photovoltaic glass

- Huawei Mozambique Photovoltaic Glass Factory

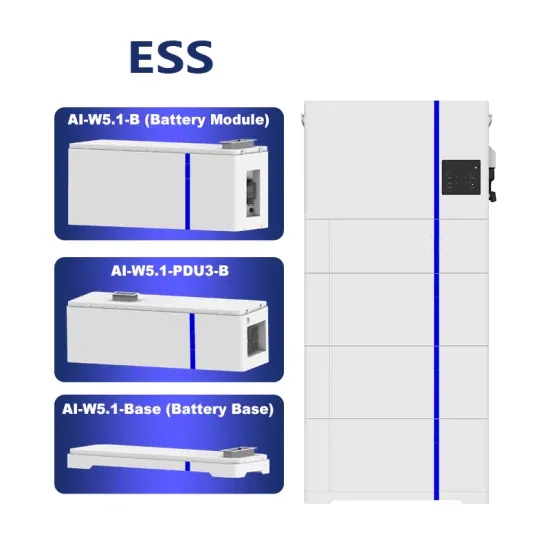

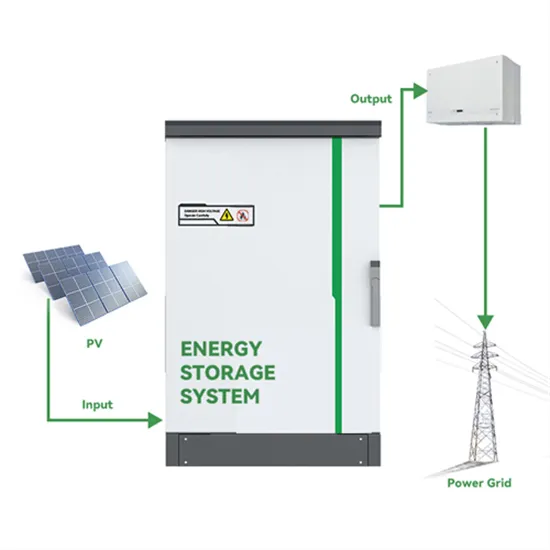

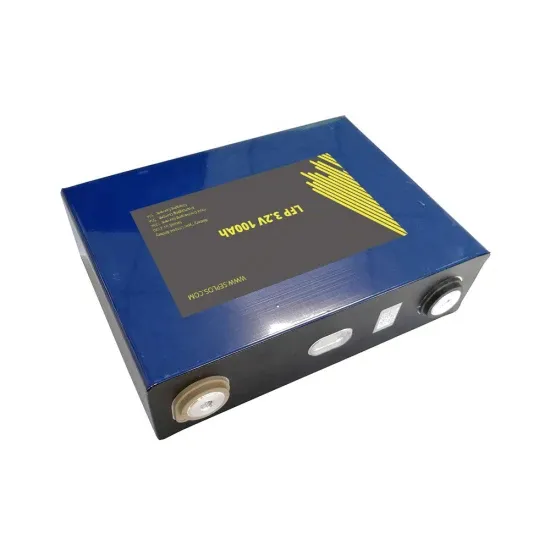

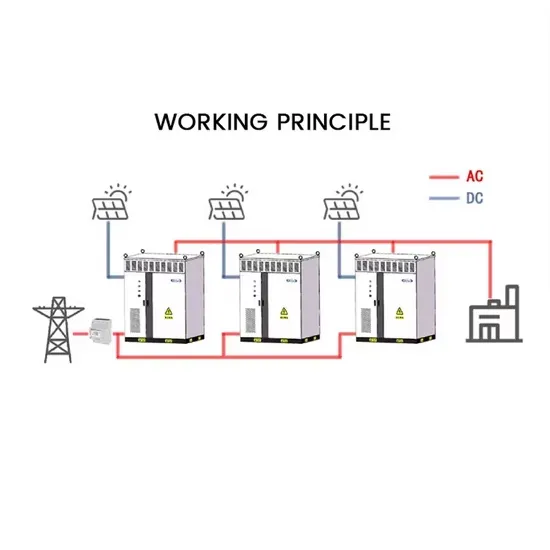

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.