Energy storage power generation income

May 24, 2024 · Although electricity storage technologies could provide useful flexibility to modern power systems with substantial shares of power generation from intermittent

Power Generation Glass 2025-2033 Overview: Trends,

Jan 5, 2025 · The global power generation glass market is projected to reach a value of million by 2033, expanding at a CAGR of XX% from 2025 to 2033. The market growth is primarily driven

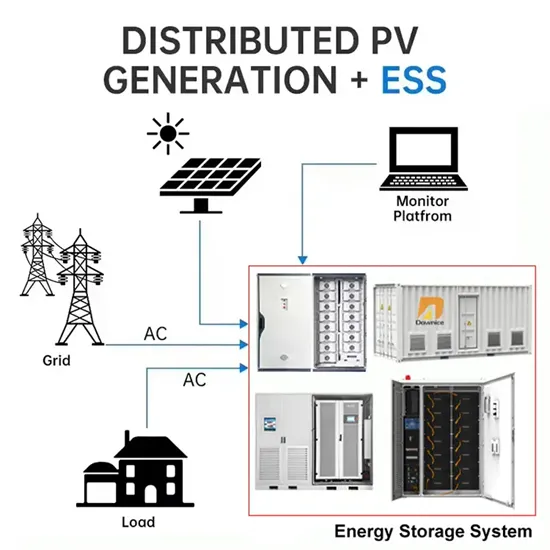

Solar Energy Storage: What It Is & Why Choose It

Jun 3, 2025 · Any unused energy charges the connected storage units, typically lithium-ion batteries. When solar generation drops, stored energy completes or substitutes the grid supply

How power-generating glass helps boost green

Feb 7, 2024 · "The essence of power-generating glass lies in its coating of cadmium telluride thin-film solar cells, which allow light to pass through while

Energy Storage in Power Generation: Trends, Tech, and Real

Let''s cut to the chase - energy storage power generation scenarios aren''t just for engineers in lab coats anymore. From your neighbor with rooftop solar panels to entire cities planning

Technology Strategy Assessment

Jul 19, 2023 · About Storage Innovations 2030 This technology strategy assessment on thermal energy storage, released as part of the Long-Duration Storage Shot, contains the findings from

How power-generating glass helps boost green energy and

"The essence of power-generating glass lies in its coating of cadmium telluride thin-film solar cells, which allow light to pass through while generating electricity, and our current goal is to

Energy storage and power generation glass design

Energy storage systems act as virtual power plants by quickly adding/subtracting power so that the line frequency stays constant. FESS is a promising technology in frequency regulation for

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their profitability

Journal of Energy Storage | ScienceDirect by Elsevier

The Journal of Energy Storage focusses on all aspects of energy storage, in particular systems integration, electric grid integration, modelling and analysis, novel energy storage

Breaking Down the Cost of Chemical Energy Storage Power Generation

Jan 24, 2022 · Let''s face it – when someone says "energy storage costs," most people''s eyes glaze over faster than a Tesla battery drains in sub-zero temperatures. But here''s the kicker:

How to store energy in glass power generation

The entire roof of the factory building is designed in a zigzag and wave shape,and power generation glass is used to construct the three south-facing roofs. According to the data from

Energy storage power generation glass franchise

Power generation glass tores energy through 1. Photo oltaic effect, 2. Thermal e ergy absorption, 3. Energy-efficient design, 4. Integration with building materials. The photovoltaic effect occurs

Power Generation Glass Drivers of Growth: Opportunities to

4 days ago · The power generation glass market is experiencing robust growth, driven by the increasing global demand for renewable energy sources and advancements in solar power

Energy company makes power move with America''s largest

Jan 11, 2025 · The largest proposed solar and storage project to date in the U.S. just got the green light in Oregon, Electrek reported. This means that solar and storage developer Pine

Glass energy storage device for power generation

Why do we need glass-ceramic materials for energy storage systems? The demand for next-generation energy storage systems in modern miniaturized electronic components will require

Energy storage and power generation glass area

Different new energy power generation has different restrictive conditions, such as water storage and peak shaving, which need to meet a certain amount of water and drop. The best solution

Window-Integrated PV Glass: The Future of Solar

Feb 19, 2025 · Window-integrated PV glass represents a significant advancement in building-integrated photovoltaics, offering a compelling blend of sustainable

Ore Energy Makes History With First Grid-Connected Iron

Jul 30, 2025 · Ore Energy''s Iron-Air Long-Duration Energy Storage System Piloted at The Green Village at TU Delft Ore Energy''s pilot system – which uses iron, air, and water to store clean

Comprehensive Overview of Power Generation Glass Trends:

Feb 17, 2025 · This report provides comprehensive coverage of the power generation glass market, including market size, growth drivers, challenges, key players, industry trends, and

China''s "Power-Generating Glass" to Hit the Market

Apr 24, 2018 · After eight years of R&D, the first large-sized "power-generating glass" production line in China was kicked off on April 17, marking a stride in the development of green buildings

6 FAQs about [Energy storage power generation glass makes money]

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Is energy storage a'renewable integration' or 'generation firming'?

The literature on energy storage frequently includes “renewable integration” or “generation firming” as applications for storage (Eyer and Corey, 2010; Zafirakis et al., 2013; Pellow et al., 2020).

Learn More

- Energy storage photovoltaic power generation makes money

- Jordan energy storage power generation glass

- Energy storage power generation glass factory

- Does energy storage power station firefighting make money

- Abkhazia Power Generation and Energy Storage Company

- Price of wind solar and energy storage power generation system in Brno Czech Republic

- Papua New Guinea Solar Power Generation and Energy Storage Company

- Photovoltaic power generation and energy storage in Papua New Guinea

- Beirut Energy Storage Photovoltaic Power Generation Products Wholesale

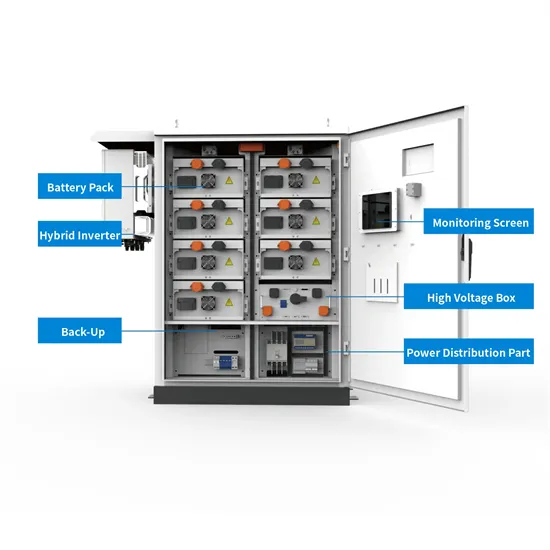

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.