Africa Emerges as New Hotspot for China''s Wind, Solar Energy Exports

May 15, 2025 · Customs data reveal that global PV module exports fell by 8% year-on-year in the first quarter of 2025, while the African market bucked the trend. Specifically, among China''s

Africa sets record 15 GW in solar panel imports as

13 hours ago · For now, Africa remains almost entirely reliant on foreign suppliers. China accounts for 85–90% of installations, and dominance extends well beyond panels to batteries, inverters

China''s prowess in solar aids Africa''s green transition

Sep 6, 2024 · China''s advantages in the renewable energy industry chain complement Africa''s natural environmental endowments, Mao said, adding this opens up vast room for China-Africa

China''s April InvertExport List Released: Top Three,

May 28, 2020 · Century New Energy Network CNE analysis team released the export data of inverters manufactured in China in April 2020. Statistics show that the value of export of

Ember: African imports of Chinese solar panels up to over 15GW

3 hours ago · Africa imported over 15GW of panels from China in the 12 months to June 2025, a 60% increase over the imports recorded in the prior year.

The Export Value of Inverters to Europe is Expected to

Aug 29, 2023 · Europe remains the primary hub for inverter demand, playing a pivotal role in shaping the profitability landscape for inverter enterprises. During the period spanning January

China''s solar PV module exports hit 236 GW in 2024, with

Feb 4, 2025 · China''s solar PV module exports hit 236 GW in 2024, with growth in all regions except Europe China exported 16.63 GW of modules in December 2024, up 9% MoM from

China''s solar PV module exports reach 62 GW in 1Q25, down

May 6, 2025 · InfoLink''s customs data shows that China exported about 23.38 GW of PV modules in March 2025, up 44% MoM but down 5% YoY from 24.51 GW. China''s total module exports

Solar Inverter Market Size, Trends & Forecast | 2033

3 days ago · SOLAR INVERTER MARKET REPORT OVERVIEW Solar Inverter Market Size was estimated at USD 15899.4 million in 2024 and it is expected to grow from USD 17314.45

Photovoltaic inverter Imports in World from China

Apr 30, 2025 · Analyze 3,283 Photovoltaic inverter import shipments to World from China till Apr-25. Import data includes Buyers, Suppliers, Pricing, Qty & Contacts.

How China Invests in Africa''s Solar Sector

Mar 1, 2021 · WHY CHINA WOOS AFRICA Historically, China''s infrastructural involvement in Africa was mostly limited to resource-rich countries that essentially traded their mineral

Africa''s Renewable Energy Boom: A Green Revolution Built

4 days ago · Africa surpasses 70 GW renewables, remains import-dependent. China dominates solar, batteries, inverters; Europe leads in wind. No major local manufacturing; IRENA urges

China Customs PV Export Data Released in April

May 23, 2024 · From the weight of exported goods, January-April China''s cumulative exports to Europe 1,938,800 tons, compared with 1,975,300 tons in the same period last year, a slight

2024 Monthly Solar Photovoltaic Module Shipments

Dec 11, 2024 · Table 8. Destination of photovoltaic module export shipments, 2024 Exports at the national level are published in Table 6. Destination country is not published to protect

Learn More

- Bulgaria Photovoltaic Inverter

- Photovoltaic inverter secondary frequency conversion

- Photovoltaic inverter fire protection device

- Omron photovoltaic inverter

- Bahamas Photovoltaic Power Station Inverter

- Eritrea communication base station inverter grid-connected photovoltaic power generation capacity

- How difficult is photovoltaic inverter

- Photovoltaic inverter emergency repair

- Does the photovoltaic inverter have a battery

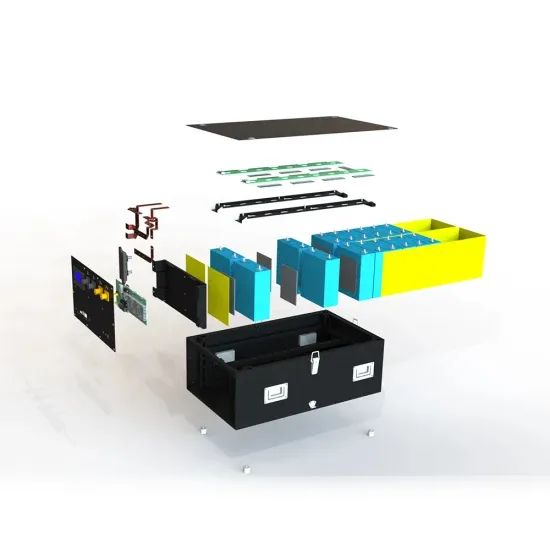

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.