China DC Circuit Breaker, DC SPD, Solar Connector, PV

Aug 3, 2025 · Wenzhou Naka Technology New Energy Co., Ltd: We''re known as one of the most professional DC Circuit Breaker, DC SPD, Solar Connector, PV Combiner Box, DC lsolator

GE Renewable Energy signs strategic partnership

Dec 14, 2022 · Hyundai Electric to build factory, invest in tooling, and hire and train local team to produce Haliade-X turbines and generators in South Korea

Construction of Solar PV Module Production Line for Gimje Factory in Korea

Mar 7, 2025 · First PV Module Successfully Produced at Gimje Plant in Korea The construction of a solar PV module production line at the Gimje plant in Korea is an important part of the SMM

Top Electric Breaker Suppliers in South Korea

Mar 15, 2024 · When installing a solar panel system, you have to be familiar with the electric breakers and how it works with a solar PV system to avoid future electric problems.

HD Hyundai Electric to build 3rd circuit breaker factory

Sep 3, 2024 · HD Hyundai Electric Co., a South Korean electric power distribution equipment manufacturer, will spend 120 billion won ($89 million) to build its third factory of low and

China Solar Breakers Manufacturer, Supplier, Factory

May 15, 2025 · Solar Breakers, With the first-class products, excellent service, fast delivery and the best price, we have won highly praise foreign customers''. Our products have been

Solar Circuit Breaker Manufacturer and Wholesale Supplier in

Jan 27, 2025 · Shandong Ys Electric Co., Ltd. is a leading manufacturer and supplier of quality solar circuit breakers in China. Our factory is dedicated to providing reliable and efficient circuit

South Korea Low Voltage DC Circuit Breaker Market Growth

Nov 27, 2024 · South Korea low voltage DC circuit breaker market is expected to grow at a CAGR of 6.7% during the forecast period. Increasing solar panel installations in South Korea is

Top Electric Breaker Suppliers in South Korea

Mar 15, 2024 · Electric Breakers When installing a solar panel system, you have to be familiar with the electric breakers and how it works with a solar PV system to avoid future electric

South Korea Solar DC Circuit Breaker Market By Application

Aug 18, 2024 · The South Korean solar DC circuit breaker market segmented by application showcases distinct trends across various sectors. In the residential segment, there is a

Top 10 RCCB Brands in the World (2025 Edition)

Aug 16, 2025 · See our review of the top 10 RCCB brands in world. We compare Schneider, ABB, Siemens, GEYA, and more to help you choose the best device for your project.

SOUTH KOREA''S SOLAR POWER INDUSTRY: STATUS

Jan 2, 2024 · domestic solar PV market is among the top 10 in the world. In 2022, South Korea had the ninth-largest cumulative installed capacity, at 24.8 GW.1 Nevertheless, the country''s

HD Hyundai Electric breaks ground on 3rd circuit

Sep 4, 2024 · South Korean electric power distribution equipment manufacturer HD Hyundai Electric is building a smart factory for low- and medium-voltage

South Korea Solar DC Circuit Breaker Market 2026: Size

Jun 5, 2025 · South Korea Solar DC Circuit Breaker Market size was valued at USD 0.1 Billion in 2024 and is projected to reach USD 0.2 Billion by 2033, growing at a CAGR of 8.7% from

Hyosung Heavy Industries Surpasses 10 Trillion Won in

Nov 27, 2024 · Hyosung Heavy Industries has reached a significant milestone, surpassing 10 trillion won in cumulative circuit breaker production. The company, which began producing

China Solar Circuit Breaker Manufacturers and Suppliers, Factory

May 2, 2025 · solar circuit breaker Manufacturers, Factory, Suppliers From China, Good quality and aggressive prices make our products get pleasure from a significant name all around the

Hyosung Heavy Industries

Aug 13, 2025 · In 1977, we succeeded in developing the 362kV gas circuit breaker (GCB), which was cutting-edge technology at the time, and expanded our production base by completing the

5 FAQs about [Solar circuit breaker factory in Korea]

Who makes solar panels in South Korea?

gical lead over South Korean and other global competitors.About a dozen South Korean companies produce PV modules, including Hanwha Solutions (H

Will expanding South Korea's solar PV market help secure global competitiveness?

rs in South Korea’s domestic PV industry have collapsed. Some hope that expanding South Korea’s solar PV market will help secure global competitiveness for domestic cell and module manufacturers, but

Which companies manufacture solar cells in the world?

nwha Q CELLS), Hyundai Energy Solutions, and Shinsung E&G. The total production capacity of these companies is 9.4 GW/year, or 5.2% of the global market.26 As in the solar cell sector, China’s wafer-manufacturing dominance and its change in wafer sizes

Which country exports the most solar panels in 2021?

domestic PV installation market were domestic products.28From 2021 to 2022, the value of South Korea’s solar panel and module exports increased by 43.7%, reaching $1.55 billion.29 The United States accounted for 92.2% of exports by value, at $14.3 billion, followed by the Netherlands ($350 million), China ($210 mil

What is the value chain for silicon-based solar PV?

The value chain for silicon-based solar PV has six steps. Silicon-based cells comprise 95% of the global solar PV market, in part because silicon is so widely available (after oxygen, it the most common element in Earth’s crust).11 Figure 1 illustrates the progression of the value chain for silicon-based solar PV, from polysilicon m

Learn More

- China solar circuit breaker factory Buyer

- Solar circuit breaker factory in Mauritania

- Solar circuit breaker factory in Namibia

- Solar circuit breaker factory in Azerbaijan

- Reset circuit breaker factory in El-Salvador

- Nader circuit breaker factory in Mexico

- Cheap motor circuit breaker factory distributor

- High quality rcb circuit breaker in China Factory

- Motor circuit breaker factory in Auckland

Industrial & Commercial Energy Storage Market Growth

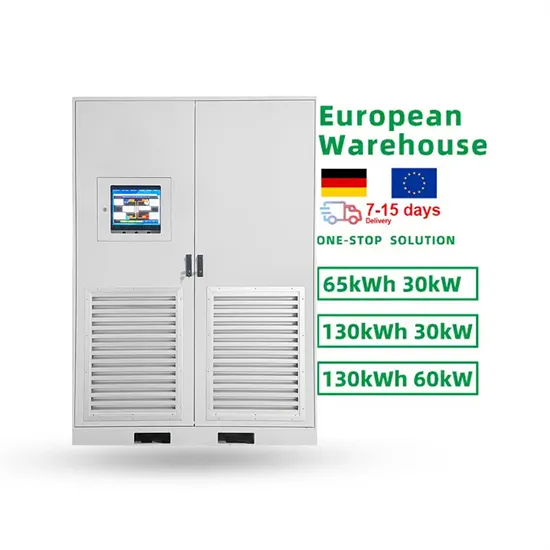

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

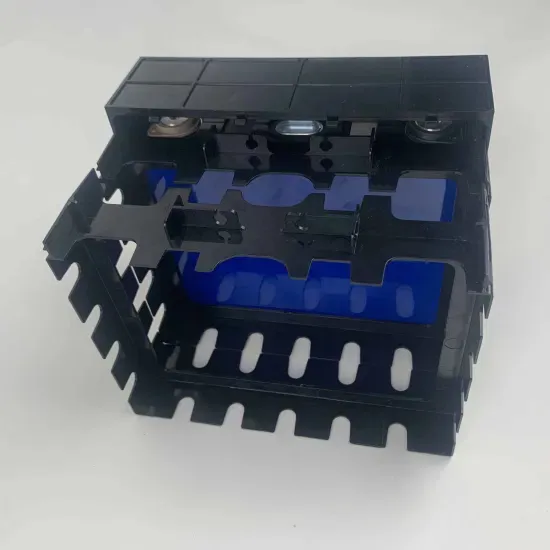

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.