ODM Odm Thai Energy Storage Technology Manufacturer

Jun 6, 2024 · Introducing Odm Thai Energy Storage Technology, a state-of-the-art solution for efficient energy storage and management. Developed by Shenzhen Bicodi New Energy Co.,

Top 3 portable outdoor power supply Manufacturers In Thailand

Sep 9, 2024 · The third supplier is Thailand''s forward-thinking, environmentally conscious alternative power supply mobile solar generator and battery bank serve to support multiple

Top 10 Energy Storage Companies in Thailand (2025) | ensun

Thai Solar Power specializes in energy storage solutions, offering lithium batteries and battery energy storage systems (BESS) for both residential and commercial applications. Their

Energy Outlook and Energy-Saving Potential in East Asia

Thailand uses natural gas as a major energy source for power generation. In 2019, primary natural gas supply registered at 28.6 Mtoe, around 72% of which was sourced from domestic

thai energy storage technology companies

Thailand is increasingly recognizing the importance of energy storage technology as it seeks to enhance its renewable energy capacity. The burgeoning sector offers promising opportunities

Emergency power supply Nuclear industry | KROHNE Thailand

The emergency power supply system in a nuclear power plant is a critical safety feature designed to provide backup power in the event of a primary power loss. This system ensures that

Southern Thailand Wind Power and Battery Energy

Feb 4, 2023 · The Government of Thailand has opened access for private sector participation in the renewable electricity generation business through its programs for small and very small

Motorcycle, Car, Forklift and Truck Batteries in Thailand.

Thai Bellco Battery produces and distributes : Sealed Lead Acid Batteries for emergency lighting, communications equipment, telecommunications back-up, uninterrupted power supplies.

Top 5 Lithium-Ion Battery Energy Storage Manufacturer In Thailand

May 26, 2024 · Brand are quite a lot of different enterprises on production accumulators like it. We need these batteries to store energy This energy can be harnessed, then used to run our

Top 10 Energy Storage Manufacturers in Thailand

9 hours ago · This article will mainly explore the top 10 energy storage manufacturers in Thailand including Amita Technologies, Banpu NEXT, Global Power Synergy Public Company Limited

Top 7 Power Supply Manufacturers in Thailand (2025) | ensun

Fuji Electric (Thailand) specializes in power supply systems that prioritize energy efficiency and environmentally friendly technologies. They offer a range of products and services, including

Learn More

- Pyongyang emergency energy storage power supply manufacturer

- Central Asia Emergency Energy Storage Power Supply Manufacturer

- Swaziland emergency energy storage power supply manufacturer

- Angola emergency energy storage power supply manufacturer

- Multifunctional energy storage power supply manufacturer

- Bissau lithium energy storage power supply manufacturer

- Nassau Energy Storage Emergency Power Supply Customization

- Vietnam Ho Chi Minh Emergency Energy Storage Power Supply

- Indonesia Surabaya Emergency Energy Storage Power Supply

Industrial & Commercial Energy Storage Market Growth

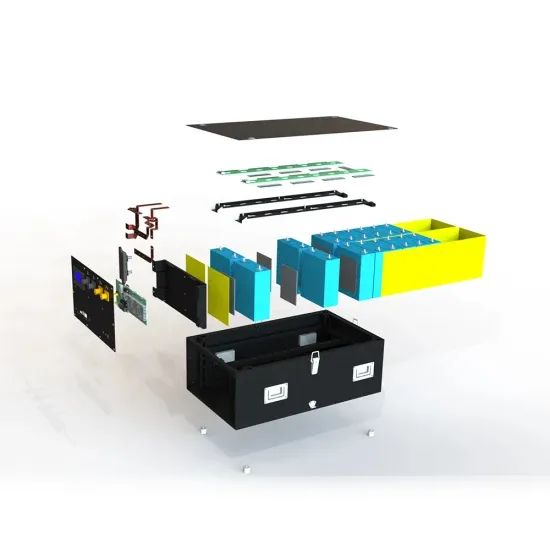

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.