slovenia photovoltaic energy storage

About slovenia photovoltaic energy storage As the photovoltaic (PV) industry continues to evolve, advancements in slovenia photovoltaic energy storage have become critical to optimizing the

Slovenia energy storage companies list released

Slovenia state-owned utility Dravske elektrarne Maribor (DEM) is planning two battery storage units totalling 60MW co-located with an existing hydroelectric unit, as well as a new pumped

Top Solar Equipment Manufacturers in Slovenia

Aug 10, 2025 · There are a few local suppliers and manufacturers of solar power equipment in Slovenia. However, most of the solar panels and components that are used for solar

Slovenia Industrial Energy Storage Supplier

Here are some energy storage system manufacturers in Slovenia:Atlas Copco Slovenia: Offers a full portfolio of energy storage systems, including ECO, the Energy Controller

Sellers in Slovenia | PV Companies List | ENF Company

Slovenian wholesalers and distributors of solar panels, components and complete PV kits. 11 sellers based in Slovenia are listed below. List of Slovenian solar sellers. Directory of

Ljubljana Photovoltaic Energy Storage Companies: Powering

Ljubljana, Slovenia''s fairytale-like capital with its iconic dragon bridge, is quietly becoming Europe''s photovoltaic energy storage laboratory. While tourists admire the Baroque

Energy Storage Tech Startups in Slovenia

Jul 12, 2025 · There are 20 Energy Storage Tech startups in Slovenia which include ReCatalyst, REC, EV Matrix, Etrel, Cryo Energy. Out of these, 4 startup s are funded, with 1 having

Slovenia energy storage battery replacement prices

Slovenia state-aid for BESS, renewables gets EU green light June 15, 2023: The European Commission said on June 9 it had approved a €150 million ($163 million) state-aid scheme to

Slovenia lithium energy storage power customization company

Specialized energy storage battery customization Hour Lithium Battery in locking steel enclosure) A Customer-Centric Company Specialized Power is a reseller of energy storage products on

Slovenia energy equipment and solutions

Roughly one-third of Slovenia''s electricity comes from hydroelectric sources, one-third from thermal sources, and one-third from nuclear power (with non-hydro renewables constituting

Solar Manufacturers, Suppliers & Companies In Slovenia

BISOL Group is active in the solar industry since 2004, when we started with the manufacturing of solar photovoltaic (PV) modules. We are considered to be a pure solar company that has in

Slovenia''s PV installed capacity in 2022 will be nearly

Recently, the signing ceremony Mongolia of investment promotion and cooperation of Alxa energy storage and industrial chain equipment manufacturing demonstration project in Alxa was

Slovenia greenhouse photovoltaic panel manufacturer

The Illusion of a Green Transition in Slovenia by 2050 Photovoltaic panels (PV) and hydropower plants are used for the majority of renewable electricity generation. To bridge the winter period

Learn More

- Libya photovoltaic energy storage equipment manufacturer

- Port Moresby Photovoltaic Energy Storage Power Station Equipment Manufacturer

- Kuwait City Photovoltaic Energy Storage Equipment Manufacturer

- San Jose Photovoltaic Energy Storage Equipment Manufacturer

- 3kw photovoltaic energy storage equipment

- Integrated energy storage equipment manufacturer

- Guatemala high efficiency energy storage equipment manufacturer

- BESS a Kinshasa energy storage equipment manufacturer

- Photovoltaic energy storage equipment company container

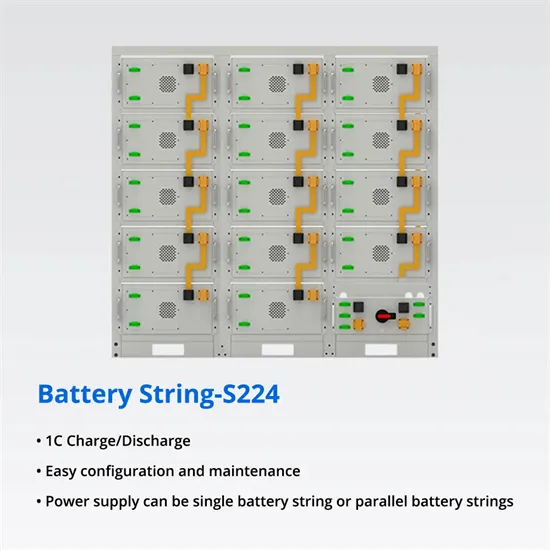

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.