A Guide to United States Electrical and Electronic

Jun 10, 2021 · Together, the enabling acts/laws (published in the United States Code (USC) once passed) and the final regulations (published in the Code of Federal Regulations) provide a

Global and United States Outdoor Power Supply Market

Outdoor Power Supply can provide standby power to quickly charge various electronic devices, so that electronic devices can keep running everywhere. Most portable power stations are

United States Outdoor Lithium Ion Battery Power Supply

Aug 5, 2025 · United States Outdoor Lithium Ion Battery Power Supply Market Size and Forecast 2026-2032 United States Outdoor Lithium Ion Battery Power Supply Market size was valued at

Update notification Philips Hue Outdoor

Oct 20, 2020 · The replacement program involves the power supply units as part of the base kits for Philips Hue Lily, Lily XL, Calla, Econic and Impress, which were sold between 2018 and

200W Lithium Ion Outdoor Power Supply Best Rechargeable

Supplier highlights: This supplier mainly exports to the Philippines, the United States, and Poland, offering full customization, design customization, and sample customization services, excelling

Philips Hue 95W Outdoor Power Supply Black Low Voltage

Nov 26, 2024 · Find many great new & used options and get the best deals for Philips Hue 95W Outdoor Power Supply Black Low Voltage Fully Weatherproof at the best online prices at

Outdoor Power Supply Market Analysis

5 days ago · Outdoor power supplies refer to electrical systems and devices designed to deliver electricity to outdoor locations where traditional grid connections may be unavailable or

Analysis of the Global Outdoor Power Supply and Generator

Dec 18, 2024 · California, USA - Outdoor Power Supply and Generator market is estimated to reach USD xx Billion by 2024. It is anticipated that the revenue will experience a compound

Global Outdoor Power Supply Market 2024 by

Chapter 2, to profile the top manufacturers of Outdoor Power Supply, with price, sales, revenue and global market share of Outdoor Power Supply from 2019 to 2024. Chapter 3, the Outdoor

Outdoor Power Supply Market Size, Share, Industry Trends,

Jul 4, 2024 · The Outdoor Power Supply Market Industry is expected to grow from 12.92 (USD Billion) in 2024 to 36.86 (USD Billion) by 2032. The Outdoor Power Supply Market CAGR

Portable Outdoor Power Supply: Harnessing Emerging

Apr 17, 2025 · The portable outdoor power supply (POPS) market is experiencing robust growth, driven by increasing demand for reliable power solutions in diverse outdoor activities,

Garden equipment and plants in the U.S.

Jun 2, 2025 · Editor''s Picks Gardening Leading suppliers of trees, plants & flowers to the United States 2024 Supply Chain Monthly inventories-to-sales ratio in U.S. building supplies stores

2025 Industry Statistics

Aug 2, 2025 · The total U.S. industry market size for Outdoor Power Equipment Retailers: Industry statistics cover all companies in the United States, both public and private, ranging in size from

Outdoor Power Supply Market Global Size

May 7, 2024 · Outdoor Power Supply Market Size in 2032 |Industry News, Patent analysis And more Outdoor Power Supply market was valued at US$ 1183.2 million in 2023 and is

Unites States Outdoor Power Supply Market Outlook: Key

Aug 4, 2025 · Urban centers are leading the shift toward smart outdoor power solutions, while rural areas favor durable, standalone systems. Regional policies promoting green energy

United States Outdoor Lithium Ion Battery Power Supply

May 23, 2025 · The United States Outdoor Lithium Ion Battery Power Supply Market: Regional Dynamics and Forecast Insights provides an in-depth examination of market performance

United States Outdoor Lithium Ion Battery Power Supply

May 29, 2025 · The United States Outdoor Lithium Ion Battery Power Supply Market: Regional Dynamics and Forecast Insights provides an in-depth examination of market performance

Signify starts replacement program for outdoor power supply

Oct 20, 2020 · A low number of external power supplies may fail due to water ingress and cause a short circuit. The exchange programme includes the enclosed power supplies of the Philips

US Outdoor Power Equipment Market Size, Trends, Share 2033

Jun 19, 2024 · US Outdoor Power Equipment Market was valued at USD 60,141.8 Million in 2024 and is expected to reach USD 1,17,626.4 Million by 2033, at a CAGR of 6.74% during the

6 FAQs about [Outdoor power supply sold in the United States]

Which country has the largest outdoor power equipment market in 2023?

The U.S. accounted for 25.33% of the revenue share in the global outdoor power equipment market in 2023. The country is witnessing a shift towards greener and more efficient offerings to comply with government regulations and lower the emissions caused by conventional gas-powered equipment.

Who makes outdoor power equipment?

The U.S. market for outdoor power equipment is populated with several global and country manufacturers, leading to a high frequency of product launches. For instance, in February 2023, Ariens, a brand of AriensCo, launched the RAZOR walk-behind mower.

Which segment dominated the outdoor power equipment market in 2023?

The residential segment held a larger share in the U.S. outdoor power equipment market in 2023, owing to increasing sales of products such as lawn movers, chainsaws, and trimmers to homeowners.

Why is outdoor power equipment so popular?

The current trends of remote and hybrid working models, as well as flexible working hours among businesses in the U.S., have ensured that people have more free time on their hands to indulge in gardening and landscaping, thus strengthening the U.S. market demand for outdoor power equipment.

What are the different types of outdoor power equipment?

There is a significant demand for different types of outdoor power equipment such as lawn mowers, chainsaws, and blowers among the U.S. population, due to which companies are increasingly focusing on launching advanced products in the market.

Do outdoor power equipment run on batteries?

Outdoor power equipment that run on batteries offer benefits such as zero fuel usage, zero engine exhaust generation, and much lower noise when compared to gas-powered equipment. As a result, modern homeowners looking to contribute to better environment health are major buyers of such products.

Learn More

- United Arab Emirates outdoor mobile energy storage power supply

- Outdoor power supply sold on EK worldwide

- Vaduz mobile outdoor power supply sales

- Nicosia Outdoor Telecommunication Power Supply 5kWh BESS

- Male outdoor power supply work recommendation

- Outdoor power supply comparison zendure

- New Energy Vehicle Outdoor Power Supply

- Dn outdoor power supply

- Outdoor power supply water cooling

Industrial & Commercial Energy Storage Market Growth

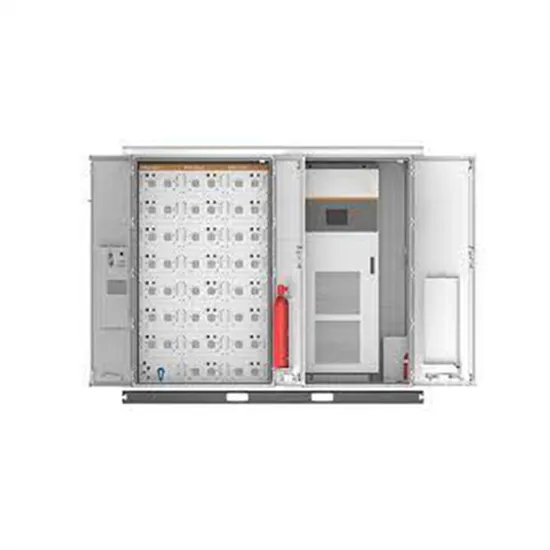

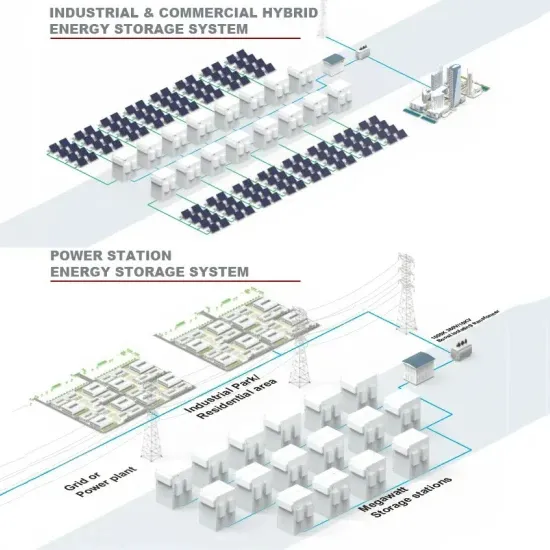

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

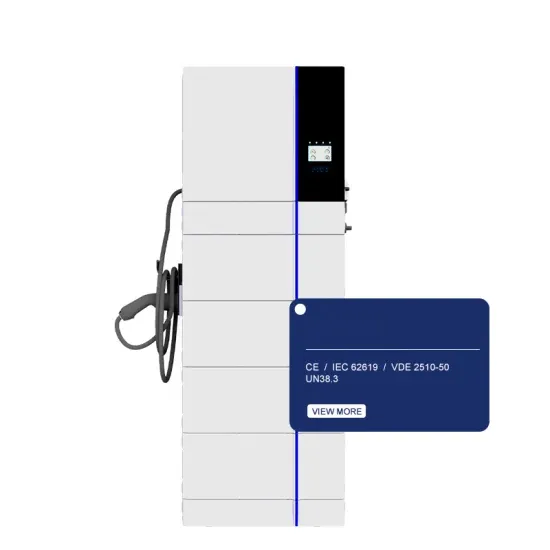

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.