Environmental Impact of Hybridization

Nov 25, 2022 · A scalable life cycle inventory of an automotive power electronic inverter unit – Technical and methodological description, version 1.0. 2017, Gothenburg, Sweden:

PCB Flipper and Inverter manufacturers in Gothenburg, Sweden

The leading PCB Flipper and Inverter Manufacturers in Gothenburg, Sweden are listed in this directory. You can narrow down the list of manufacturers based on their location and

Battery industry in Gothenburg | Invest in Gothenburg

Aug 11, 2025 · Ensuring skills supply for a sustainable battery industry With 120,000 employees, Gothenburg''s county accounts for 20% of Sweden''s manufacturing workforce - significantly

Inverters in Gothenburg | Best Inverters from Gothenburg

Discover a wide selection of high-quality Inverters in Gothenburg from trusted suppliers. Explore our range of Best Inverters from Gothenburg and find the perfect fit for your needs.

Smart Inverter Manufacturer in Gothenburg Powering Sweden

May 12, 2025 · As a smart inverter manufacturer in Gothenburg, we''re proud to bridge Sweden''s engineering heritage with tomorrow''s energy needs. From grid support to EV charging

Top OEM Automotive Part Manufacturers in Sweden

Autoliv, Inc. is a leading manufacturer of automotive safety systems, producing essential components like airbags and seatbelts for major automotive manufacturers worldwide. Their

No 1 inverter parts manufacturer in Gothenburg Sweden

The leading PCB Flipper and Inverter Manufacturers in Gothenburg, Sweden are listed in this directory. You can narrow down the list of manufacturers based on their location and

Photovoltaic micro inverter company in Gothenburg Sweden

Inverter Manufacturer Companies And Suppliers Serving Sweden Established in 2006, SolarEdge developed the DC optimized inverter solution that changed the way power is

A scalable life cycle inventory of an automotive power

Abstract Purpose A scalable life cycle inventory (LCI) model, which provides mass composition and manufacturing data for a power electronic inverter unit intended for controlling electric

Largest Companies in Gothenburg| Invest in Gothenburg

Gothenburg´s largest companies The Gothenburg region has long been a hub for global trade and openness to the world. An unusually large number of major companies thrive here, many of

Tata Technologies Nordics AB hiring Inverter System Design

Jul 25, 2025 · Due to our continuous grow Tata Technologies Nordics AB is now looking to recruit Inverter System Design Engineers to join our team in Gothenburg, Sweden. The role

Learn More

- 48v power frequency inverter in Gothenburg Sweden

- Photovoltaic panel rail manufacturer in Gothenburg Sweden

- Bhutan home inverter manufacturer

- BYD inverter manufacturer

- Vietnam Multi-Electric Inverter Manufacturer

- 3kw inverter manufacturer

- Luxembourg photovoltaic inverter manufacturer

- Power inverter manufacturer in Johannesburg South Africa

- Georgia High Voltage Inverter Manufacturer

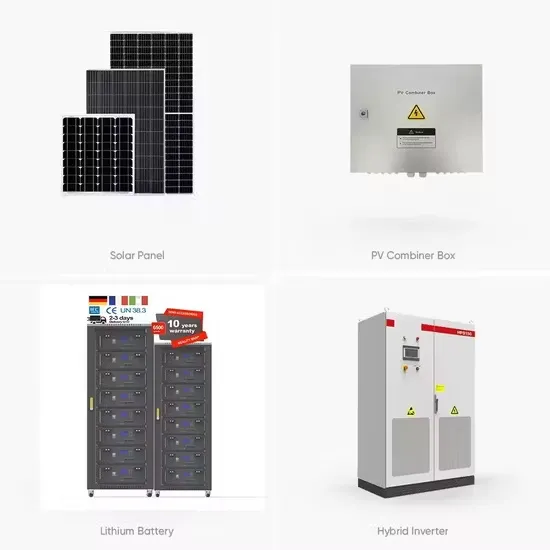

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.