Backup power for Europe

Apr 3, 2025 · The need for additional BESS capacity in Italy is clear and confirmed by the target set by the Italian government. The incentive schemes offered by the Italian regulator and TSO

Recurrent Energy Secures 6 MW BESS Capacity in Italy''s 2026

Jan 23, 2025 · Recurrent Energy has secured 6 MW of battery energy storage system (BESS) capacity for its Montalto project in Italy''s Lazio region through the country''s Capacity Market

Battery Energy Storage Systems (BESS)

Jun 13, 2024 · The Italian market for BESS is growing rapidly and currently amounts to 2.3 GW but it almost exclusively consists of residential scale systems, associated with small scale

Stora Designing a 200MW/800MWh BESS project in Italy

Mar 25, 2024 · Project overview: Battery energy storage system (BESS) project in Friuli Venezia Giulia, Italy, designed by Benny Energia Power installed: 200MW Energy capacity: 800MWh

Battery Energy Storage Systems (BESS)

Jun 13, 2024 · Therefore, battery energy storage systems (BESS) are needed in Italy. The Italian market for BESS is growing rapidly and currently amounts to 2.3 GW but it almost exclusively

Italian BESS & MACSE state of play

Jul 7, 2025 · Total BESS installations in Italy now exceed 6 GW / 14 GWh, but this is mostly behind-the-meter storage co-located with rooftop solar in the North zone. Terna''s plans aim for

Source Galileo sells 40MW BESS Project to Trina Solar

Feb 6, 2025 · Source Galileo, a leading European renewable energy developer, has announced the sale of a 40MW Battery Energy Storage System (BESS) project to Trina Solar International

Italy Accelerates Solar Energy and Industrial Energy Storage

Apr 15, 2025 · As the penetration of solar power increases, grid stability has become a critical issue. In response, Italy is prioritizing the development of grid-scale battery energy storage

Everything You Need to Know About Utility-Scale BESS

5 days ago · Learn how to develop utility-scale BESS: site selection, grid access, layout design, and faster feasibility, all in one platform with Glint Solar.

BESS plants for a more flexible power system | Enel Group

Jun 25, 2025 · In the first three months of 2025, five new battery storage plants went into operation, bringing the installed capacity of our battery energy storage systems (BESS) in Italy

''Italy is Europe''s most interesting battery market''

Mar 5, 2025 · Italy is the most interesting European battery market, followed by Great Britain and Germany, according to a report released earlier this week by

Italy greenlights 361 MW of new battery storage projects

Aug 7, 2025 · Italy''s Ministry of the Environment and Energy Security (Mase) has issued final approvals for five new battery energy storage system (BESS) projects, paving the way for 361

Italian BESS & MACSE state of play

Jul 7, 2025 · Italy has emerged as one of the most attractive European markets for Battery Energy Storage System (BESS) investment. Much of the attention has centered around the bankability

Glennmont and Exus agree 800MW Italian battery storage

Apr 9, 2024 · The deal will see Glennmont and Exus commence a series of standalone battery energy storage system (BESS) projects across the Puglia region of Italy. These will constitute

6 FAQs about [Bess system for solar factory in Italy]

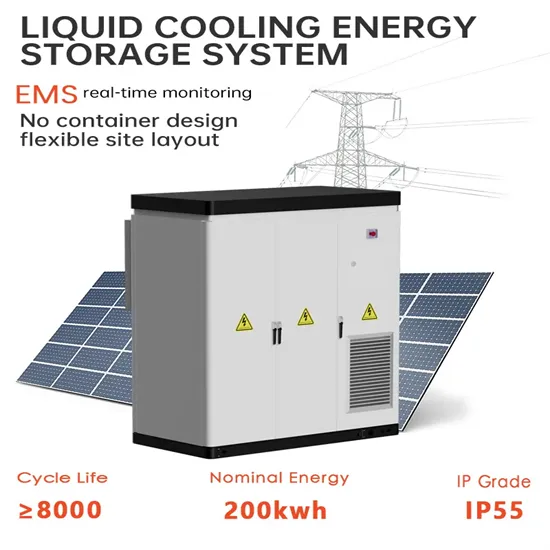

What is a Bess energy storage system?

BESS, or battery energy storage systems, are an essential element of the energy transition: the Enel Group is playing an important role in the growth of the sector, in Italy and in the other countries where it is present. There can be no real energy transition in Italy without electricity storage systems.

Why is a grid-scale battery energy storage system important in Italy?

As the penetration of solar power increases, grid stability has become a critical issue. In response, Italy is prioritizing the development of grid-scale battery energy storage systems (BESS Italy) alongside new industrial and commercial energy storage projects.

How big is Bess in Italy?

BESS capacity development Total BESS installations in Italy now exceed 6 GW / 14 GWh, but this is mostly behind-the-meter storage co-located with rooftop solar in the North zone. Terna’s plans aim for over 70 GWh by 2030 to achieve Italy’s NECP RES targets — a fivefold energy capacity increase (Chart 2).

Are battery energy storage systems needed in Italy?

Therefore, battery energy storage systems (BESS) are needed in Italy. The Italian market for BESS is growing rapidly and currently amounts to 2.3 GW but it almost exclusively consists of residential scale systems, associated with small scale solar plants, having an average capacity of less than 20 kWh.

Is Italy a leader in industrial energy storage and commercial energy storage?

Accordingly, there is a growing market for industrial energy storage and commercial energy storage projects, positioning Italy as a leader in advanced Italy storage solutions and renewable energy Italy initiatives.

Is there a real energy transition in Italy?

There can be no real energy transition in Italy without electricity storage systems. And here Enel Green Power is also playing a leading role, particularly in battery energy storage systems (BESS), which are increasingly efficient and competitive, thanks to technological innovation.

Learn More

- Factory price bess electrical in Italy

- BESS Solar Power System Factory

- Bess system for solar factory in Bahamas

- Bess system for solar factory in Moscow

- Bess system for solar factory in Brisbane

- Bess system for solar factory in El-Salvador

- Hybrid solar inverter factory in South-Africa

- Cheap 3 6 kw solar inverter factory Buyer

- Norway Bergen rooftop solar power generation system factory direct sales

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.