华为智能光伏官网-太阳能光伏发电站解决方案-光伏

华为智能光伏推出领先的户用光伏发电、户用光伏储能、工商业光伏发电、工商业储能电站、大型地面智能光伏电站建设的解决方案,华为光伏逆变器,储能、

Top Solar inverter Manufacturers Suppliers in Mexico

5 days ago · Solarfeeds is a gateway to leading solar equipment suppliers in Mexico. It is the number one source of quality and affordable solar equipment. What you need to do is request

GROWATT COMPANY PROFILE

Sep 20, 2022 · Growatt is a new energy enterprise dedicated to the R&D and manufacturing of PV inverters, Energy Storage and EV Charger as well as Smart Energy Management solutions.

Energía solar en México crecerá 13% en 2025 impulsada por Solis Inverters

Jul 30, 2025 · Solis Inverters impulsa la energía solar en México con una participación dominante y nuevas soluciones basadas en inteligencia artificial, proyectando un crecimiento del 13%

FusionSolar Smart PV Solutions

Jan 6, 2020 · Products and solutions are deployed in over 170 countries and regions worldwide. Huawei USA Inc. was founded in 2001 and has 10 branch offices, 7 R&D Centers and TAC

A Smart Energy Approach Will Drive Solar Growth

Jun 1, 2025 · A: Growatt is a Chinese company dedicated to the manufacturing of photovoltaic (PV) solar inverters. Beyond that, we are also recognized as one of the global leaders in the

Top 5 Chinese Solar Inverter Companies Account for 36% of

Aug 22, 2019 · The first half of 2019 saw China''s PV inverter export volume growth for the third year in a row. Import and export customs data from the first half of 2019 shows that Chinese

Smart PV Warranty Services | HUAWEI Smart PV Global

The table above provides warranty descriptions for Huawei Smart PV''s products, devices, and solutions. These descriptions reflect the general warranty services. However, in specific

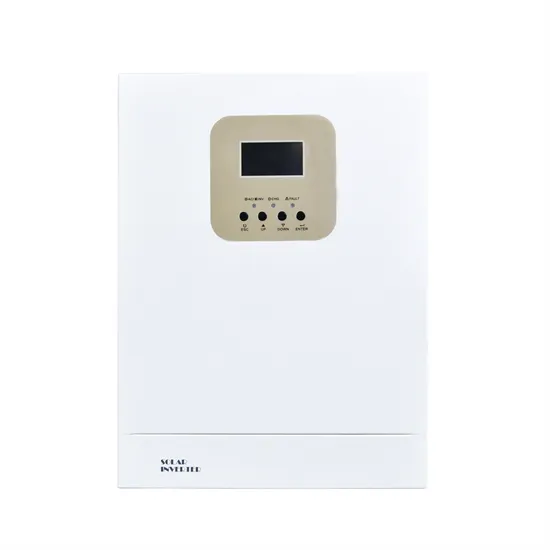

Off Grid Solar Inverter Manufacturers in China

Jul 31, 2025 · Looking for reliable off grid solar inverter manufacturer? Our China-based solar power inverter factory offers top-quality OEM inverters. Partner

What Is the Best Solar Inverter in the Mexico Market?

Jul 7, 2025 · With the high electricity prices, aging power grid, frequent power outages and other issues in Mexico, solar power generation is the best solution to solve the power problem. This

Hybrid Solar Inverter China Manufacturer

Xindun is a hybrid solar power inverter manufacturer in China. We only supply good quality solar inverter power inverter hybrid inverter and hybrid solar inverter. We accept inverter OEM/ODM

A Guide To Finding Top10 China solar inverter Manufacturers

Feb 18, 2025 · Discover the best china solar inverter manufacturers with our guide. Learn how to choose quality, reliable inverters for your solar projects today!

The Ultimate Guide to Solar Inverters in China

Dec 24, 2024 · A Comprehensive Guide to Solar Inverters in China China has become a major player in the solar industry, with many companies specializing in solar inverters. As renewable

Top 10 Inverter Manufacturers In Mexico

6 days ago · Therefore, due to the high demand for renewable energy from Mexicans, many renewable energy entrepreneurs are investing in this country. This article will discuss the top

Solis Launches Residential Storage Hybrid Inverter into Mexico Solar

Ginlong Technologies (Stock Code: 300763.SZ), a global leader in photovoltaic string inverter manufacturing, is releasing its energy storage inverter to Mexico homeowners. The Smart

6 FAQs about [Smart solar inverter in China in Mexico]

Who is the best solar inverter manufacturer in China?

LIVOTEK is poised to become the foremost solar inverter manufacturer in China in the future due to its global industrial layout, complete range of products, and responsive after-sales technical service.

Do inverter manufacturers in Mexico need Norma Oficial Mexicana certification?

Inverter Manufacturers in Mexico, along with solar panel producers, need to secure the Norma Oficial Mexicana (NOM) certification for all their electrical products. This certification ensures that these products comply with Mexico’s safety and quality standards.

Who regulates solar panels and inverters in Mexico?

In Mexico, the Federal Commission for the Protection Against Sanitary Risk (COFEPRIS) is responsible for the regulation and certification of solar panels and inverters. This includes the evaluation of products to ensure they comply with established safety standards and guidelines..

Does Mexico have a solar energy sector?

Mexico’s solar energy sector is growing at an unprecedented rate, establishing the country as a leading player in the renewable energy market. The commitment to clean energy has seen an increase in domestic manufacturing of solar panels, thus boosting the country’s economic potential and self-sustainability.

Who makes Kyocera solar panels?

Kyocera, a Japanese multinational with manufacturing facilities in Tijuana, Mexico, has a rich history in the solar industry. The company is dedicated to creating solar panels that are efficient and environmentally friendly.

Where are SunPower solar panels made?

SunPower, an American company with manufacturing operations in Mexico, is well-known for its high-efficiency solar panels. Based in San Luis Potosi, SunPower’s Mexican facility demonstrates the company’s commitment to global sustainability and renewable energy.

Learn More

- Smart solar inverter in China in Yemen

- Smart solar inverter in China in Jamaica

- Cheap smart solar inverter in China Seller

- Omega solar inverter in China in Mexico

- Smart solar inverter in China in Suriname

- 4000w solar inverter in China in Kazakhstan

- 4000w solar inverter in China in Moscow

- China omega solar inverter in China Buyer

- Omega solar inverter in China in Austria

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.