Outdoor Power Supply Market Research | 2024-2032

May 15, 2024 · [ Outdoor Power Supply Market Size & Share Analysis - Growth Trends & Forecasts (2024 - 2032) ] "Outdoor Power Supply Market" Research Report 2024 Presents an

Kabul faces blackouts because the Taliban stopped paying

Oct 4, 2021 · Afghanistan is dependent on neighboring countries for much of its power supply and risks defaulting on its debts, The Wall Street Journal reported.

Badakhshan Electricity Company Enhances Power Supply

Feb 1, 2025 · The Badakhshan Electricity Company has made a significant investment in electrical equipment worth 138,411,837 Afghanis to bolster electricity supply in the Faizabad

Afghanistan Secures Power Supply Extension with

Dec 7, 2024 · KABUL (BNA): Dr. Abdul Bari Omar, Chief Executive Officer of Da Afghanistan Breshna Sherkat (DABS), finalized the extension of Afghanistan''s power purchase agreement

Afghanistan Industrial Power Supply Market (2024-2030)

Afghanistan Industrial Power Supply Industry Life Cycle Historical Data and Forecast of Afghanistan Industrial Power Supply Market Revenues & Volume By Type for the Period 2020

Worldwide Portable Outdoor Power Supply Market Research

The portable outdoor power supply market is poised for transformative growth over the next decade, driven by advancements in battery technology and an increasing demand for

Afghanistan Power Supply Market (2024-2030) | Trends,

Afghanistan Power Supply Market Overview The power supply market in Afghanistan serves electronics, telecommunications, and industrial sectors. Power supplies convert electrical

DC Power Supplies supplier Afghanistan | Kabul, Kandahar,

Trusted suppliers for DC Power Supplies across Afghanistan | Kabul, Kandahar, Mazari Sharif, Herat, Jalalabad, Nangarhar, Kunduz, Ghazni, Balkh, Baghlan, Gardez| Best Reseller Price |

DC Power Supplies supplier Afghanistan | Kabul, Kandahar,

Convenient Supply Solutions for DC Power Supplies Products for resellers and dealers based in Afghanistan serving Kabul, Kandahar, Mazari Sharif, Herat, Jalalabad, Nangarhar, Kunduz,

Outdoor Power Supply Industry Research Report 2023

Apr 3, 2025 · The Outdoor Power Supply market size, estimations, and forecasts are provided in terms of output/shipments (K Units) and revenue ($ millions), considering 2022 as the base

Global Outdoor Power Supply Market [2024-2032] | Uncover

Apr 16, 2024 · The Global Outdoor Power Supply Market Size & Future Projection [2024-2032] - The Global Outdoor Power Supply Market Size Reached USD 1157.5 Million in 2023.

Outdoor Power Supply Market Analysis

5 days ago · Outdoor power supplies refer to electrical systems and devices designed to deliver electricity to outdoor locations where traditional grid connections may be unavailable or

Afghanistan Power Supply Market (2024-2030) | Trends,

Power supplies convert electrical energy into usable voltage and current for electronic devices and systems. With Afghanistan economic development and digitalization efforts, the demand

Wahid Fahim Kabul Ltd. شرکت وحید فهیم کابل لمیتد

We are the exclusive distributer of ESCORT Brand Power gen set in Afghanistan. These generators are manufactured for long lasting performance and usage across the industrial and

Where to Buy Outdoor Power Supplies in Kabul A Complete

Need reliable outdoor power solutions in Kabul? This guide reveals the best shops, market trends, and practical tips for buyers. Discover where to find portable solar generators, battery stations,

Bosch WPTV244300UL 4-Channel Outdoor Power Supply for

The Multi-channel Power Supplies are designed to support multiple 24/28 VAC, 50/60 Hz camera installations. These models operate from a 120 VAC, 50/60 Hz or from a 230 VAC, 50 Hz

Outdoor Power Supply Market Report | Global Forecast From

Jul 26, 2023 · The distribution channel segment of the outdoor power supply market is divided into online retail and offline retail. Online retail has gained significant traction due to the widespread

US Outdoor Power Supply and Generator Market: Unveiling

Jun 12, 2025 · US Outdoor Power Supply and Generator Market Size And Forecast US Outdoor Power Supply and Generator Market size is estimated to be USD 5.3 Billion in 2024 and is

China Outdoor Power Supply, Outdoor Power Supply

The Outdoor Power Supply is a top choice in our Switching Power Supply collection.Buying switching power supplies wholesale presents benefits such as cost savings, availability of bulk

Afghanistan Resource Corridor Development: Power

Aug 18, 2025 · The RCD Project may offer Afghanistan an opportunity to generate and transmit power from its domestic coal and gas resources while also undertaking the development of

Outdoor Power Supply Market Consumption Trends: Growth

Aug 15, 2025 · The global outdoor power supply market, valued at $1,594 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of

6 FAQs about [Kabul outdoor power supply purchase channel]

Which country supplies electricity to Kabul?

Uzbekistan supplies Parwan, Samangan and partly Kabul. Tajikistan supplies Baghlan, Balkh, Kunduz and Takhar provinces and, in summer, it transmits power to Kabul (in winter, Tajikistan faces electricity shortages itself), while Uzbekistan additionally feeds Balkh province in summer. Iran supplies electricity to partly Herat and Nimruz provinces.

Can a 300 MW power plant be used in Kabul?

Kabul’s peak load is in winter, thus the 300 MW could not be utilised by the consumers in the northern and central regions. The 300 MW can be dispatched to southern and eastern regions – both get their peak in summer – which again, is subject to transmission links with sufficient current carrying capacity.

Why does Afghanistan need asynchronous power supply?

While this has helped Afghanistan grow its electricity sales over the last five years, asynchronous supplies limit the opportunities to interconnect and expand the power network in a rational way. Of the five main geographically separate power networks in Afghanistan, the North Eastern Power System (NEPS) is the largest.

How much power does Kabul need?

The National Load Control Center of DABS, the 100 per cent state owned but corporatised national power utility and the sole power producer, transmitter and distributor in the country, states that Kabul’s current demand is 530 MW.

What is the source of power for Afghanistan?

source of power for Afghanistan, since the large generation projects necessary to serve the extraction and processing of ores can readily be sized to meet more than just the mining project demand. Significant deposits of coal and reservoirs of gas make such generation possible.

Will dabs increase electricity distribution in Kabul?

For instance, in 2003, electricity consumers in Kabul numbered 84,831 – at the end of 2014, numbers had increased more than five-fold, to 450,000. DABS is of course expected to increase distribution, as its mandate is to bring electrical power to the Afghan people.

Learn More

- Outdoor power supply channel

- Kabul outdoor power supply manufacturer

- Malawi outdoor power supply purchase

- Purchase mobile outdoor power supply

- Outdoor power supply 70 degrees

- Kazakhstan mobile outdoor power supply price

- Six hundred yuan outdoor power supply

- Outdoor power supply transformation for home use

- San Diego high power outdoor power supply customization

Industrial & Commercial Energy Storage Market Growth

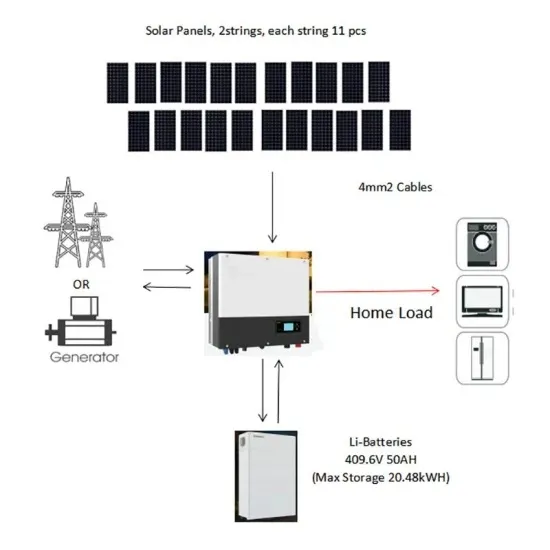

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.