SOUTH KOREA''S SOLAR POWER INDUSTRY: STATUS

Jan 2, 2024 · Introduction China''s growing global market dominance in solar photovoltaic (PV) supply chains has created considerable challenges for South Korea''s PV industry in various

South Korean Solar Panels Suppliers and Manufacturers

Find Solar Panels Suppliers. Get latest factory price for Solar Panels. Request quotations and connect with South Korean manufacturers and B2B suppliers of Solar Panels. Page - 1

Optimal renewable power generation systems for Busan metropolitan city

Apr 1, 2016 · Many governments plan to enhance their energy infrastructure and the electricity supply–demand reliability of their energy sources. Among them, South Korea''s government

South Korea Solar Photovoltaic (PV) Module Panel Handling

May 31, 2025 · The South Korea Solar Photovoltaic (PV) Module Panel Handling System market is experiencing rapid growth, driven by the nation''s commitment to renewable energy and the

South Korean Solar Components Suppliers and Manufacturers

Find Solar Components Suppliers. Get latest factory price for Solar Components. Request quotations and connect with South Korean manufacturers and B2B suppliers of Solar

South Korea Photovoltaic Backsheet Market Size, Investment

Jun 5, 2025 · The South Korea photovoltaic (PV) backsheet market plays a crucial role in the rapidly growing solar energy industry, driven by the nation''s commitment to increasing its

Solar Panel Solar Panel Suppliers from South Korea

Apr 17, 2025 · Find Economical Suppliers of Solar Panel Solar Panel: 606 Manufacturers in South Korea based on Export data till Apr-25: Pricing, Qty, Buyers & Contacts.

Sellers in Korea | PV Companies List | ENF Company Directory

Korean wholesalers and distributors of solar panels, components and complete PV kits. 11 sellers based in Korea are listed below. List of Korean solar sellers. Directory of companies in Korea

Harnessing Solar Power in Busan A Guide to Photovoltaic Panel

Why Busan is Ideal for Solar Power Generation Busan, South Korea''s second-largest city, combines coastal advantages with progressive energy policies. With over 2,200 hours of

South Korea Solar Photovoltaic (PV) Cell Handling System

Jun 22, 2025 · The South Korea solar photovoltaic (PV) cell handling system market is experiencing robust growth fueled by the country''s strong commitment to renewable energy

Solar Company in South Korea | Solar EPC Companies in South Korea

As a trusted solar panel company in South Korea, we manufacture and supply premium-grade solar panels that harness the power of the sun to generate clean and sustainable energy. Our

Top Photovoltaic Panel Manufacturers in Busan South Korea

Busan, South Korea''s bustling port city, is emerging as a hub for renewable energy innovation. This article explores leading photovoltaic panel manufacturers in Busan, their specialties, and

South Korea solar panel diagram

How should solar panels be positioned in South Korea? In Autumn,tilt panels to 42° facing Southfor maximum generation. During Winter,adjust your solar panels to a 52° angle

6 FAQs about [South Korea Busan photovoltaic panel component manufacturers supply]

Who are the best solar panel manufacturers in South Korea?

Trina Solar’s commitment to innovation and quality has made it a trusted name among solar panel manufacturers in South Korea. KT Solar, part of the KT Corporation, is a rising star in the solar industry, focusing on Transparent Solar Panel Manufacturers and Solar PV Panel Manufacturers.

Where are solar panels made in South Korea?

South Korea’s solar panel supply chain is anchored in key cities, each contributing uniquely to the industry’s ecosystem. One prominent city is Ulsan, known for its industrial prowess. Ulsan has become a hub for solar battery manufacturers and solar inverter manufacturers, thanks to its advanced manufacturing facilities and a skilled workforce.

How many solar panel suppliers are there in South Korea?

According to Volza's Solar Panel Solar Panel export data of South Korea, there are a total of 500 Solar Panel Solar Panel Suppliers in South Korea, exporting to 566 buyers globally.

Why should you choose Daegu solar panel manufacturers in Korea?

Daegu, with its rich history in manufacturing, has adapted its industries to support solar panel manufacturers in Korea. Its emphasis on Monocrystalline Solar Panel Manufacturers has attracted investments and talent, making it a critical node in the solar supply chain.

How does South Korea's solar panel manufacturing industry work?

The solar panel manufacturing industry in South Korea is characterized by a robust regulatory framework and significant government support aimed at promoting renewable energy. Key considerations include understanding the various subsidies and incentives available for manufacturers, which can significantly impact profitability.

Why are solar panels popular in South Korea?

The country’s commitment to sustainability and innovation has led to the emergence of South Korea solar panels, including specialized products like floating solar panels South Korea and advancements by leading solar panel manufacturers in South Korea.

Learn More

- South Sudan monocrystalline photovoltaic panel manufacturers supply

- UPS outdoor power supply service in Busan South Korea

- Photovoltaic panel manufacturers in South Tarawa

- South Korea Busan grid-connected inverter factory direct supply

- Photovoltaic panel component manufacturers

- How much is the price of outdoor power supply in South Korea

- Smart photovoltaic panel equipment manufacturers

- Cuban rural photovoltaic panel manufacturers

- Photovoltaic panel manufacturers installed in Tripoli

Industrial & Commercial Energy Storage Market Growth

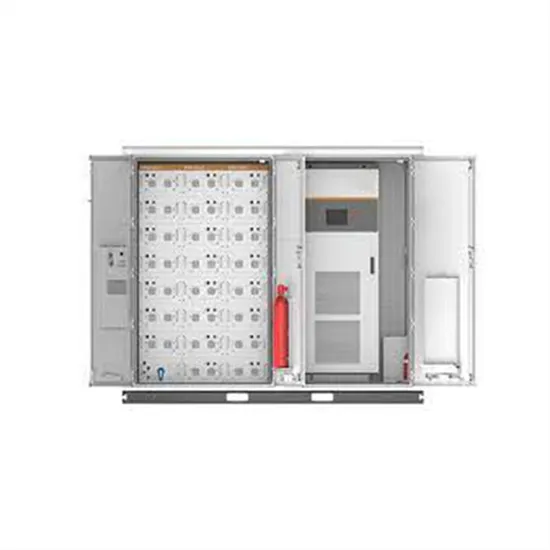

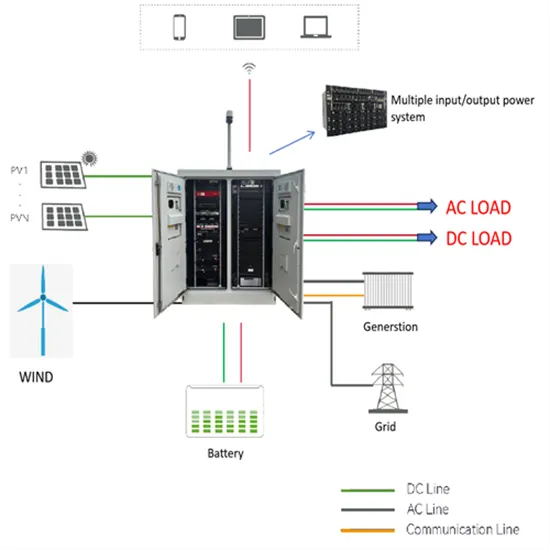

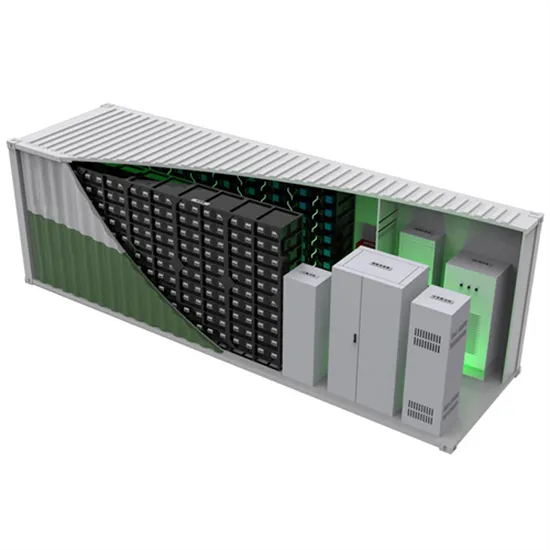

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.