Panama energy storage inverter manufacturer

Leading Photovoltaic Inverter Supplier We provide single and three-phase high-efficiency PV string inverters for a capacity of 1kW to 60kW, storage inverters and all-in-one storage

Solar Inverter Brands In Malaysia » Which Is

Jan 29, 2021 · The three most notable high end inverter brands in Malaysia are SMA, Solar Edge, and Fronius (of which Next Energy is a certified Fronius

JEMA will supply 40 MW of 1500 V inverters to Panama

JEMA has received awards for supplying 40 MW of inverters and medium voltage solutions for solar power projects in Panama. The scope of the order includes sixteen 1.5 MV integrated

Best Solar Inverter Manufacturer Malaysia

Sep 23, 2024 · SMA, Solar Edge, Fronius and ABB are relatively high-end inverter brand manufacturers in Malaysia. Without getting into too many technical details, these inverters are

Which are the Top Manufacturing Companies of Inverter

May 19, 2025 · Companies with a broad range of inverter products covering string inverters, central inverters, microinverters, hybrid inverters, and EV inverters are better positioned to

Top 10 Best Solar Inverter Manufacturers In The

4 days ago · In this article, we highlight the Top 10 solar inverter manufacturers in the world. These companies stand out because some of their products have

Top 10 Solar Inverter Manufacturers In The

5 days ago · With global demand for renewable energy on the rise, efficient and reliable solar inverters are more crucial than ever. This overview highlights the

List of Top Solar Inverter Manufacturers in India

Jan 28, 2025 · Looking for the best solar inverter manufacturers in India for 2025? This list features trusted and certified brands to help you make the right

Solar Inverters_Energy Storage Inverters

Solis is one of the world''s largest and most experienced manufacturers of solar inverters supplying products globally for multinational utility companies, commercial & industrial rooftop

About Ginlong Solis | Company profile

By amalgamating a global supply chain with world-class R&D and manufacturing capabilities, Ginlong tailors Solis inverters to each regional market, with dedicated teams of local experts

inverter Companies and Suppliers in Panama | Energy XPRT

Dewesoft is designing and manufacturing versatile and easy-to-use data acquisition systems. Our products are the ultimate tools for every test and measurement engineer. At Dewesoft, people

2024 Top 20 Global Photovoltaic Inverter Brands

Dec 6, 2024 · After years of competition, the inverter industry has become quite stable. The overall ranking of the list has not changed much, as most of the

6 FAQs about [Panama high-end inverter manufacturer]

Who makes solar panels in Panama?

This article delves deep into the solar energy sector in Panama, exploring its supply chain centers, top manufacturers, and main fairs, offering a comprehensive overview of the Panama solar landscape. Primroot.com is a leading-edge professional solar panels & inverter manufacturer based in the high-tech hub of Shenzhen, China.

Who is Panama solar solutions?

Founded in 2010 in Panama City, Panama Solar Solutions has quickly risen to prominence as a leading solar panel manufacturer in the country. Specializing in Monocrystalline Solar Panels and Solar PV Panels, the company offers a comprehensive range of products catering to both residential and commercial needs.

Is Panama a good place to manufacture solar panels?

Panama stands as a burgeoning hub in the realm of solar energy, leveraging its strategic geographical position to emerge as a critical supply chain center for solar panel manufacturing. With an increasing shift towards renewable energy, Panama has carved out a niche for itself, attracting a plethora of solar panel manufacturers.

Who is Symtech solar Panama?

Symtech Solar Panama’s competitive edge is its comprehensive service package, providing everything from consultation and design to installation and maintenance, making solar energy accessible to a broader audience in Panama. As part of the international Canadian Solar Inc., Canadian Solar Panama brings global expertise to the local market.

Who is Canadian Solar Panama?

Canadian Solar Panama excels in delivering high-quality, durable solar solutions, emphasizing long-term sustainability and efficiency. GreenTech Solar, based in Panama City, has emerged as a leader in sustainable solar energy solutions since its inception in 2012.

Is Panama a leader in solar power in Latin America?

With an increasing shift towards renewable energy, Panama has carved out a niche for itself, attracting a plethora of solar panel manufacturers. This transformation is not only indicative of Panama’s commitment to sustainable energy but also highlights its potential as a leader in the solar power industry in Latin America.

Learn More

- Panama 5kw inverter manufacturer

- Tirana high-end inverter manufacturer

- Panama Industrial Energy Storage Cabinet Manufacturer

- Budapest photovoltaic dedicated inverter manufacturer

- Bamako Solar Inverter Manufacturer

- Algerian industrial inverter manufacturer

- Antananarivo three-wheel inverter manufacturer

- New Zealand Auckland wall mounted inverter manufacturer

- Honiara Industrial Inverter Manufacturer

Industrial & Commercial Energy Storage Market Growth

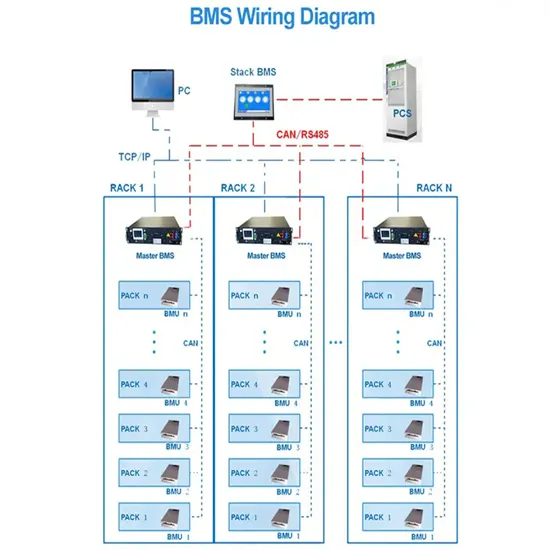

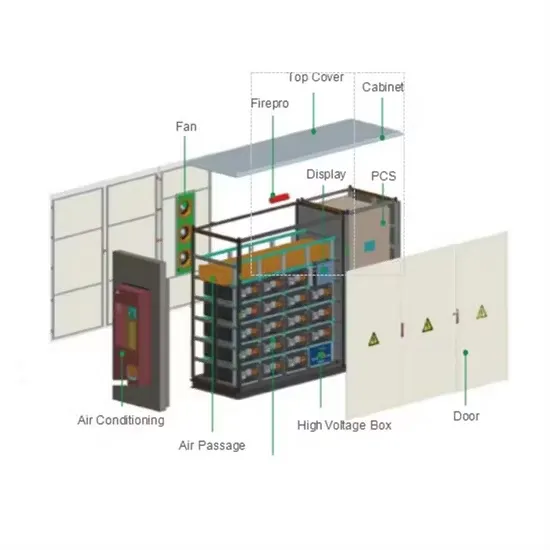

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

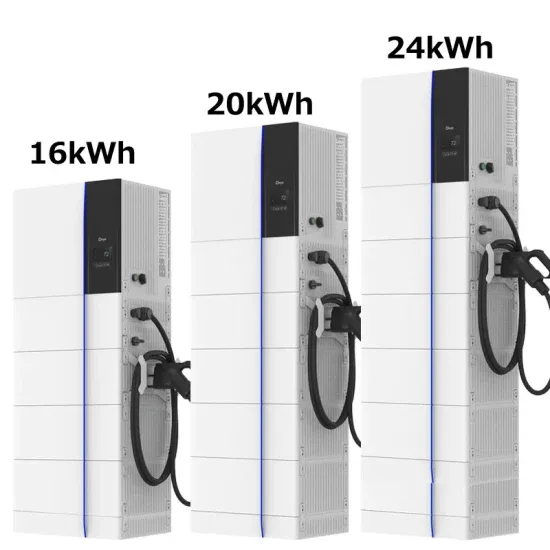

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.