THE RENEWABLE ENERGY TRANSITION AND SOLVING

Aug 14, 2025 · Summary ty constraints as critical challenges facing the elec Current Japanese laws and regulations do not adequately deal with energy storage, in particular the key question

Cost Analysis of Energy Storage Systems for Osaka Power Station in Japan

As Osaka Power Station explores modern energy storage solutions, industry leaders are focusing on lithium-ion battery systems and flow battery technologies. The average price range for

Japan''s Home Energy Storage Subsidy: What You Need to

Oct 2, 2024 · Because Japan just dropped a 90 billion yen bombshell to boost home and commercial energy storage systems—and you don''t want to miss the details [1]. Let''s unpack

Japan''s Largest Grid-Connected Battery Storage to Be Built in Osaka

May 12, 2025 · Osaka, Japan — Kansai Electric Power Co., Kinden Corporation, and Japan Excellent Infrastructure (JEXI) have announced plans to build one of Japan''s largest grid

Osaka Gas USA Enters Battery Storage & Distributed

Jun 30, 2023 · Osaka Gas USA Corporation ("OGUSA"), a subsidiary of Osaka Gas Co., Ltd., has entered into a joint venture with Summit Ridge Energy, LLC ("SRE"), the leading commercial

Osaka Gas forecasts domestic thermal power capacity to hit

Mar 13, 2025 · Osaka Gas, Japan''s second-largest city gas provider, said its domestic thermal power generation capacity will reach 3.2 gigawatts by 2026 with the planned launch of two 600

Home Energy Storage Systems and Inverters: Technological

Mar 4, 2025 · As global energy transition accelerates and household electricity demands diversify, home energy storage systems (HESS), combined with photovoltaic (PV) self-consumption

Japanese Energy Storage Box Market Price: Trends, Analysis,

In 2024 alone, the market size for portable energy storage in Japan crossed ¥200 billion, with projections showing a 25% annual growth rate through 2030 [2]. But what''s driving this surge?

Tesla''s Osaka station Powerpack is its largest

Mar 27, 2019 · Tesla has built another Powerpack system in record time, this time at Osaka train station in Japan, where it will be used as emergency backup

日本蓄電株式会社 Eku Energy-明日のエネルギ確保

6 days ago · Eku Energyは、エネルギー転換の促進を使命とし、安心・安全なクリーンエネルギーの安定供給を目指して世界中で蓄電所プロジェクトの開発

Understanding Japanese Energy Storage Inverter Quotation:

Sep 21, 2023 · Navigating Japanese energy storage inverter quotation isn''t just about yen signs—it''s about value. Whether you''re powering a skyscraper or a ramen shop, the right

Japan Energy Storage Policies and Market Overview

Jun 29, 2025 · Home lithium-ion battery systems generated USD 278.5 million in 2023 and could surge to USD 2.15 billion by 2030—a compound annual growth rate of 33.9%. Systems rated

Japan''s ITOCHU, partners start up 11-MW energy storage plant in Osaka

6 days ago · Japanese trader ITOCHU Corp (TYO:8001) announced today that, together with its partners, it has commenced the operation of an 11-MW/23-MWh energy storage facility in

Japan Residential Energy Storage System Market (2025-2031

In the Japan residential energy storage system market, one of the key challenges is the high upfront cost of installing energy storage systems in homes. This cost includes not only the

Mastering the Future of Energy: How Japanese Innovation

Aug 21, 2024 · Introduction The future of energy, characterized by clean and renewable sources, hinges largely on the development and perfection of energy storage systems. Over the years,

Japan''s Energy Storage Industry: Innovations, Challenges,

Nov 7, 2023 · Let''s face it: Japan isn''t exactly blessed with abundant fossil fuels. But what it lacks in oil, it makes up for in cutting-edge energy storage solutions. From earthquake-resistant

Itochu, Osaka Gas partner for 11 MW grid-scale battery energy storage

Jun 13, 2023 · Itochu has launched Senri Power Storage, a grid-scale battery energy storage system (BESS) project with 11 MW output and 23 MWh energy capacity in Suita City, Osaka

Why Japan''s Home Energy Storage Systems Are Becoming a

Did you know that 88% of Japan''s energy storage capacity sits in homes and businesses rather than utility-scale facilities? As the country phases out its Feed-in Tariff (FiT) program by 2025,

6 FAQs about [Price quotation of home energy storage system in Osaka Japan]

How is Japan's energy storage landscape changing?

Japan’s energy storage landscape is shifting, pushed by household demand, corporate ESG mandates, and domestic battery manufacturing. The residential lithium-ion market, projected to grow at a CAGR of 33.9% through 2030, remains one of the fastest-expanding segments.

What is Japan's energy storage policy?

As policy, technology, and decarbonization goals converge, Japan is positioning energy storage as a critical link between its climate targets and energy reliability. Japan’s energy storage policy is anchored by the Ministry of Economy, Trade and Industry (METI), which outlined its ambitions in the 6th Strategic Energy Plan, adopted in 2021.

How big is Japan's battery storage market?

In the commercial space, Japan’s battery storage market was valued at USD 593.2 million in 2023 and is projected to reach USD 4.15 billion by 2030. While commercial installations currently dominate revenues, industrial adoption is expected to scale faster. Utility-scale storage is also gaining ground.

How can the Japanese power market bridge the income gap?

In order to bridge the income gap and achieve investment return targets, the Japanese power market is committed to developing ancillary services and developing capacity markets. A range of revenue streams from energy storage systems can enable frequency fluctuations in the grid to be more effectively managed.

Should you buy a battery storage system in Japan?

In addition, Japan’s capacity market is currently limited to battery storage systems lasting 3 hours, and the uncertainty of its overall revenue stack may make investors cautious about purchasing large-scale battery storage systems.

Does Japan's energy storage rollout face structural headwinds?

Despite strong policy signals, Japan’s energy storage rollout faces deep structural headwinds. The nation’s split-grid architecture—50 Hz in the east and 60 Hz in the west—limits electricity transfer and complicates nationwide deployment.

Learn More

- Africa home energy storage battery price

- Huawei Japan Osaka Energy Storage Container Power Station

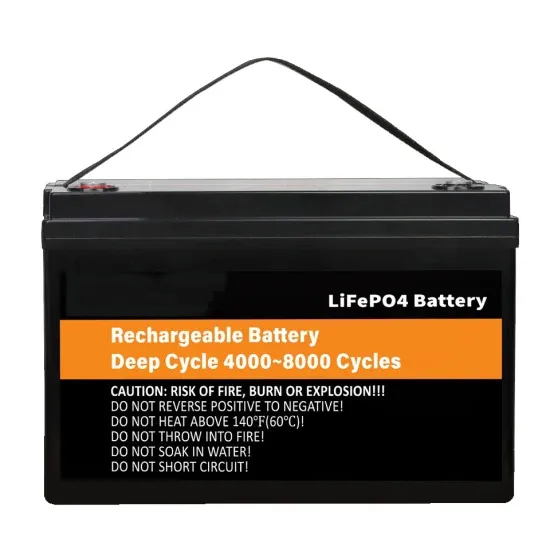

- Japan Osaka Energy Storage Lithium Battery Wholesale

- Construction of a large-scale energy storage project in Osaka Japan

- Huawei Portable Energy Storage in Osaka Japan

- Price quotation for medical UPS uninterruptible power supply in Osaka Japan

- Oslo home energy storage power supply price

- New mobile energy storage power supply in Osaka Japan

- Average EPC price of energy storage projects

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.