Status of power generation and power supply position in the

In the past nine years, power generation capacity of 1,93,794 MW has been added ensuring adequate availability of power. The demand has increased rapidly; and we have met the

What is the Standard Voltage in India?

Discover the standard voltage in India for residential and industrial use. Learn about IS12360, IEEE519-2014, single-phase and 3-phase voltage ranges, and how to ensure power quality

India Power Market Analysis | Industry Growth,

Apr 17, 2025 · India Power Market Analysis The India Power Market size in terms of installed base is expected to grow from 536.23 gigawatt in 2025 to 817.52

and India Outdoor Power Supply Market, Report Size, Worth,

Outdoor Power Supply market is segmented in regional and country, by players, by capacity and by sales channel. Companies, stakeholders, and other participants in the global Outdoor

Status of power generation and power supply position in the

Dec 19, 2023 · The details of All India State-wise Power Supply position for the past two years and current year up to November 2023 are given in Annexure. Details of source- wise Power

DISTRIBUTION PERSPECTIVE PLAN 2017

Apr 7, 2020 · Distribution of Electricity is the most crucial area of the power sector and as per Indian Electricity Act 2003, the responsibility of providing quality, reliable and affordable

Voltage, Current, and Power Specifications for Single Three

Jul 17, 2023 · Here are the general voltage, current, and power specifications for single-phase and three-phase electric vehicle chargers in India, China, the United States, and the European

Power Sector in India: Trends in Electricity

Jan 1, 2024 · Explore the power sector, uncover trends in electricity generation in India, & learn how the India energy sector is evolving. Discover more about

Comprehensive Indian Power Generation & Distribution

Nov 5, 2024 · India''s 2024 Power Sector Report: Latest trends, top players, regulatory updates, and investment opportunities. Navigate India''s booming digital payments, lending, and

Power Sector at a Glance ALL INDIA

1.1 The electricity generation target (Including RE) for the year 2023-24 has been fixed as 1750 Billion Unit (BU). i.e. growth of around 7.2% over actual generation of 1624.158 BU for the

[Solved] The common domestic power supplied in India is

Sep 17, 2022 · The correct answer is 220 V, 50 Hz. Key Points: The government of India chooses the home power supply based on the environment in which we live and the supply cables that

India Power Monitor

Aug 11, 2025 · > 5.2 GW of capacity added in July 2025 > Tamil Nadu leads daily renewable energy generation in India on August 19, 2025. > FY26 (till July) aggregate MVA addition at

Voltage and frequency of domestic power supply used in India is

Jul 1, 2025 · CONCEPT: As per Indian standard for domestic power supply we use A.C current, which is also known as alternating current since they change its polarity at a certain interval of

How Much Electricity Does India Use? Unveiling the Power of

Dec 29, 2024 · Discover how much electricity India uses and the implications of its growing energy demand on the nation''s economy and environment.

6 FAQs about [How much is the outdoor power supply in India]

How much power does India produce?

Power Production in India India has a diverse energy mix, including thermal, hydro, nuclear, and renewable energy sources. As of 2025, the total installed power generation capacity stands at approximately 430 GW. The major contributors to India's power production are:

How can distribution companies make electricity cheaper in India?

Distribution Companies can buy power at cheapest available rates from any generator in any corner of the country thereby enabling cheaper electricity tariffs for consumers. India has committed to augment non fossil fuel based installed electricity generation capacity to over 500000 MW by 2030.

How big is India's power market?

The India Power Market size in terms of installed base is expected to grow from 536.23 gigawatt in 2025 to 817.52 gigawatt by 2030, at a CAGR of 8.8% during the forecast period (2025-2030). India's power sector is undergoing a significant transformation driven by rapid industrialization and urbanization.

What are the main sources of power in India?

A. Thermal Power (Coal, Gas, and Oil) Coal remains the dominant source, accounting for nearly 55% of India’s power generation capacity. Gas and oil-based plants contribute around 7-8% to the total power generation. Despite the push for renewables, coal continues to be the primary fuel due to its affordability and availability. B. Renewable Energy

What is India's energy mix?

India has a diverse energy mix, including thermal, hydro, nuclear, and renewable energy sources. As of 2025, the total installed power generation capacity stands at approximately 430 GW. The major contributors to India's power production are: A. Thermal Power (Coal, Gas, and Oil)

How much power is available in urban areas?

The availability of power in urban areas is 23.6 hours. According to the National Electricity Plan notified in May 2023, installed Capacity in the country for the year 2031-32 is expected to be 900,422 MW, out of which carbon-free capacity is expected to be 6,15,955 MW.

Learn More

- How much is the fast charging current of outdoor power supply

- How much is the price of outdoor power supply in South Korea

- How many watts is a good outdoor power supply in Bahrain

- How much is a high-power outdoor power supply

- How much does BESS outdoor power supply cost in Bolivia

- How much does a large outdoor communication power supply BESS cost

- How much does it cost to assemble a 3 kWh outdoor power supply

- How many mAh does an outdoor power supply require

- How much is the Spanish outdoor power supply factory

Industrial & Commercial Energy Storage Market Growth

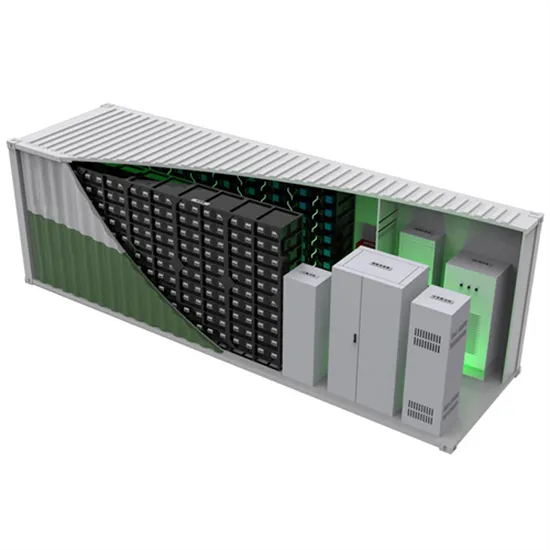

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.