Energy storage products in Arab countries

Why are energy storage systems being integrated in MENA? The pace of integration of energy storage systems in MENA is driven by three main factors: 1) the technical need associated

Elecod 3 Alice container energy storage system service

Elecod 3 Alice container energy storage system service plastic factory in Middle East. The country''s power grid is unstable, but it is rich in wind and solar resources. The customer

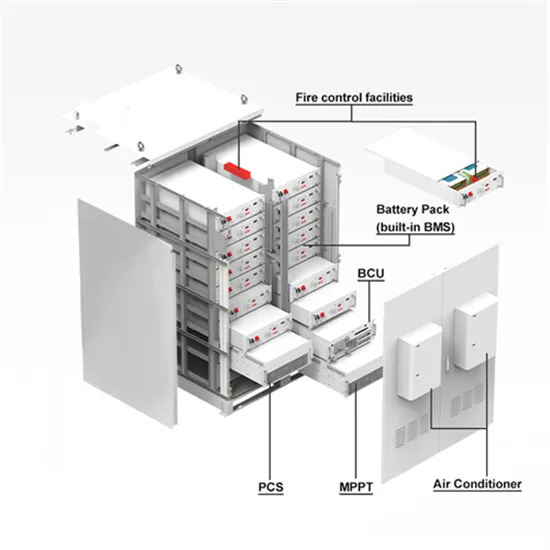

Container Battery Energy Storage System Manufacturer | AEME

AEME''s Container BESS features integrated battery safety design and advanced thermal management, and can be used in different scenarios and environments. It supports high

saudi arabia energy storage container manufacturers

We have 40 feet containers, 20 feet containers, reefer containers, Open Top Containers, and Flat-track containers for sale nationwide. We offer a spectrum of new, used, and refurbished

Sales of industrial aluminum energy storage boxes in Arab countries

Energy storage: Status and future perspective in Arab countries AbstractIn this paper, the present status of energy storage implementation and research in Arab countries (ACs) is investigated.

What are energy storage container manufacturers

certification. Energy storage systems are becoming increasingly popular throughout the United States and, indeed, the entire world. Pairing energy storage with a. Siemens is the biggest

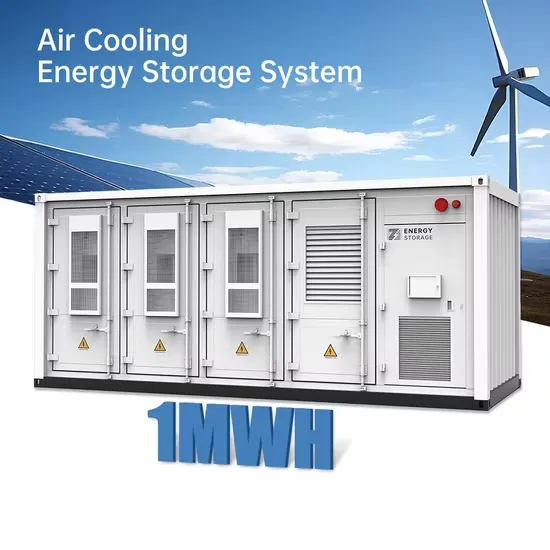

Container Energy Storage Systems

6 days ago · Atlas Copco container energy storage system range with nominal power of 250-1000kW integrates our reliable battery ESS solutions into demanding applications, reduces

Solutions for energy storage systems (ESS)

CATL battery-powered energy storage systems provide energy storage and flexibility in power generation. Instant utilization and energy output due to battery electrochemical technology and

ABB containerized energy storage offers plug-in

Sep 8, 2021 · • The Containerized Energy Storage System (ESS) integrates sustainable battery power for existing ships in a standard 20ft container • All

2024 Global energy storage system (ESS) shipment ranking

Feb 21, 2025 · InfoLink Consulting has released its 2024 global energy storage system (ESS) shipment ranking, based on its Energy Storage Supply Chain Database. In 2024, global ESS

container energy storage system Manufacturer & Supplier in

Container energy storage systems are a perfect answer for energy conservation. It is the sustainable version of hoarding but on a much larger scale, powered by renewable energy and

Containerized Battery Energy Storage Systems (BESS)

Huijue''s containers are designed for durability and efficiency, integrating advanced battery technology with smart management systems. These turnkey solutions are ideal for industrial

Energy storage machinery and equipment manufacturers in Arab countries

Company profile: Sungrow in Top 10 solar energy storage battery manufacturers was established on July 11, 2007. It is a national key high-tech enterprise focusing on the research

Container Energy Storage System (1000kWh / 2000kWh) –

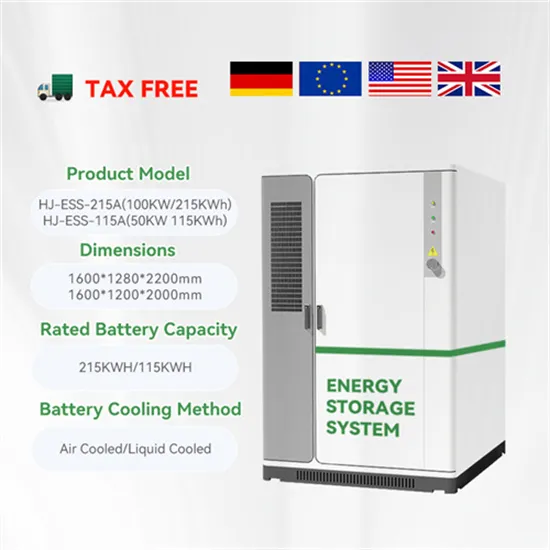

About Manufacturer Shenzhen Elecod Electric Co., Ltd. is a leading Chinese manufacturer specializing in high-performance energy storage systems and power conversion solutions.

6 FAQs about [Container energy storage system manufacturers in Arab countries]

Which energy storage technology has the most installed capacity in MENA?

Pumped hydro storage (PHS) has the largest share of installed capacity in MENA at 55%, as compared to a global share of 90%. Pumped hydro storage is one of the oldest energy storage technologies, which explains its dominance in the global ESS market.

Which country has the most battery storage capacity in MENA?

Currently, NaS battery technology dominates the battery storage capacity in operation in MENA, particularly in the UAE, with a total of 108 MW/648 MWh projects developed by the Abu Dhabi Water and Electricity Authority (ADWEA).

What is energy storage system deployment in MENA?

Energy Storage System deployment in MENA Energy Storage Systems (ESS) play a critical role in the integration of VRE into the power grid, as these systems manage the intermittencies of renewable energy resources and mitigate potential power supply disruptions.

Which energy storage solutions will be the leading energy storage solution in MENA?

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries.

What are CATL battery-powered energy storage systems?

CATL battery-powered energy storage systems provide energy storage and flexibility in power generation. Instant utilization and energy output due to battery electrochemical technology and the technology of electricity production using gas-piston units can be combined into a single most efficient system.

Can energy storage be integrated in MENA?

Although the energy storage market in MENA is bound to grow, several barriers exist that hinder the integration of ESS and the ramping up of investments. Financial, regulatory, and market barriers need to be addressed via policy tools that lay the foundations for an evolved power market to integrate the deployed ESS.

Learn More

- Recommendations from Central Asian container energy storage cabinet manufacturers

- United Arab Emirates electrical energy storage container factory is in operation

- Prefabricated energy storage container manufacturers

- Ranking of energy storage station container manufacturers in Tunisia

- EU energy storage container manufacturers

- Southern European container energy storage system manufacturers

- Marine energy storage container manufacturers ranking

- Oman Energy Storage Container Manufacturers Ranking

- Photovoltaic energy storage container manufacturers

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.