5G base station application of lithium iron phosphate battery

Jan 19, 2021 5G base station application of lithium iron phosphate battery advantages rolling lead-acid batteries With the pilot and commercial use of 5G systems, the large power consumption

Front Line Data Study about 5G Power Consumption

Although the absolute value of the power consumption of 5G base stations is increasing, their energy efficiency ratio is much lower than that of 4G stations. In other words, with the same

Learn What a 5G Base Station Is and Why It''s Important

Energy Efficiency: While 5G base stations require more power compared to 4G, the use of sleep modes and dynamic resource allocation in 5G can save energy during low demands for data

Optimal configuration of 5G base station energy storage

Feb 1, 2022 · The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries. To maximize overall

Can telecom lithium batteries be used in 5G telecom base stations?

Jul 1, 2025 · It is easy to install and provides reliable backup power. Conclusion In conclusion, telecom lithium batteries can indeed be used in 5G telecom base stations. Their high energy

How Much Power Does a 5G Base Station Consume? – Smart

In conclusion, while 5G base stations consume more power than 4G, the industry is working on solutions to manage this energy demand. By using more efficient equipment, optimizing

Optimal configuration for photovoltaic storage system capacity in 5G

Oct 1, 2021 · The configuration of the 5G base station microgrid photovoltaic storage system can not only meet the energy storage requirements of the 5G base stations, but also reduce the

Modelling the 5G Energy Consumption using Real-world

Jun 26, 2024 · To improve the energy eficiency of 5G networks, it is imperative to develop sophisticated models that accurately reflect the influence of base station (BS) attributes and

Energy-efficiency schemes for base stations in 5G

In today''s 5G era, the energy efficiency (EE) of cellular base stations is crucial for sustainable communication. Recognizing this, Mobile Network Operators are actively prioritizing EE for

Modelling the 5G Energy Consumption using Real-world Data: Energy

Jun 26, 2024 · This paper proposes a novel 5G base stations energy consumption modelling method by learning from a real-world dataset used in the ITU 5G Base Station Energy

Optimal capacity planning and operation of shared energy

May 1, 2023 · A bi-level optimization framework of capacity planning and operation costs of shared energy storage system and large-scale integrated 5G base stations is proposed to

How Much Power Does 5G Base Station Consume?

Have you ever wondered how much energy our hyper-connected world is consuming? 5G base stations, the backbone of next-gen connectivity, now draw 3-4 times more power than their 4G

What is the Power Consumption of a 5G Base Station?

Nov 15, 2024 · Compared to its predecessor, 4G, the energy demand from 5G base stations has massively grown owing to new technical requirements needed to support higher data rates

Study on the Temporal and Spacial Characteristics of Electricity

The rapid development of the digital economy has led to a significant increase in the scale and electricity load of 5G base stations. 5G base stations, often equipped with batteries, can also

Modelling the 5G Energy Consumption using Real-world

Jun 26, 2024 · This paper proposes a novel 5G base stations energy con-sumption modelling method by learning from a real-world dataset used in the ITU 5G Base Station Energy

Do 5G base stations need energy storage batteries

The advent of 5G networks has brought two great news to lithium battery companies: First, whether operators choose to upgrade or build new base stations on the original base station,

Renewable energy powered sustainable 5G network

Feb 1, 2021 · This survey specifically covers a variety of energy efficiency techniques, the utilization of renewable energy sources, interaction with the smart grid (SG), and the

5G base station saves energy and reduces consumption

Dec 18, 2023 · At present, many energy-saving measures have been introduced for 5G base stations. GrenElec''s intelligent air switches will help them achieve refined on-demand energy

Energy Storage Regulation Strategy for 5G Base Stations

Dec 18, 2023 · The rapid development of 5G has greatly increased the total energy storage capacity of base stations. How to fully utilize the often dormant base station energy

How Much Power Does a 5G Base Station Consume? – Smart

On average, a 5G base station consumes between 1,000 to 3,000 watts. This is significantly higher than 4G base stations, which typically consume 500 to 1,500 watts. The power usage

Energy consumption optimization of 5G base stations

Aug 1, 2023 · 5G base station (BS), as an important electrical load, has been growing rapidly in the number and density to cope with the exponential growth of mobile data traffic [1]. It is

Mitsubishi Electric to Ship Samples of 100Gbps EML CAN

Nov 27, 2024 · TOKYO, September 3, 2020 – Mitsubishi Electric Corporation (TOKYO: 6503) announced today that it will begin shipping samples of its 100Gbps EML (electro-absorption

Modeling and aggregated control of large-scale 5G base stations

Mar 1, 2024 · A significant number of 5G base stations (gNBs) and their backup energy storage systems (BESSs) are redundantly configured, possessing surplus capacity during non-peak

Aggregated regulation and coordinated scheduling of PV

Nov 1, 2024 · Photovoltaic (PV)-storage integrated 5G base station (BS) can participate in demand response on a large scale, conduct electricity transaction and provide auxiliary

5g base stations require energy storage batteries

As the number of 5G base stations, and their power consumption increase significantly compared with that of 4G base stations, the demand for backup batteries increases simultaneously.

6 FAQs about [Can 5g base stations use electricity ]

How much power does a 5G station use?

The power consumption of a single 5G station is 2.5 to 3.5 times higher than that of a single 4G station. The main factor behind this increase in 5G power consumption is the high power usage of the active antenna unit (AAU). Under a full workload, a single station uses nearly 3700W.

Is 5G more energy efficient than 4G?

Although the absolute value of the power consumption of 5G base stations is increasing, their energy efficiency ratio is much lower than that of 4G stations. In other words, with the same power consumption, the network capacity of 5G will be as dozens of times larger than 4G, so the power consumption per bit is sharply reduced.

What is 5G base station?

1. Introduction 5G base station (BS), as an important electrical load, has been growing rapidly in the number and density to cope with the exponential growth of mobile data traffic . It is predicted that by 2025, there will be about 13.1 million BSs in the world, and the BS energy consumption will reach 200 billion kWh .

How does mobile data traffic affect the energy consumption of 5G base stations?

The explosive growth of mobile data traffic has resulted in a significant increase in the energy consumption of 5G base stations (BSs).

Will MIMO increase the energy consumption of 5G base stations?

As a result, there are many more hardware components per base station. Björnson believes this will probably increase the total energy consumption of 5G base stations compared to 4G. But as massive MIMO technology develops, its energy efficiency may also improve over time.

How will 4G & 5G networks work?

In both 4G and future 5G networks, operators will probably run their base stations so they transmit at the maximum power allowed by their licenses, in order to maximize the coverage, according to Björnson.

Learn More

- Can Nicaragua s communication base stations use 5G

- How to deal with the electricity bill of 5g base stations

- How to expand the electricity consumption of 5g base stations

- Do 5G micro base stations require electricity

- Research on electricity charges for foreign 5G base stations

- Burundi communications and 5g base stations

- Are all the base stations on the roofs of China Communications Buildings 5G

- Communication base stations use photovoltaic

- Is it okay to use ordinary energy storage system for 5g base station

Industrial & Commercial Energy Storage Market Growth

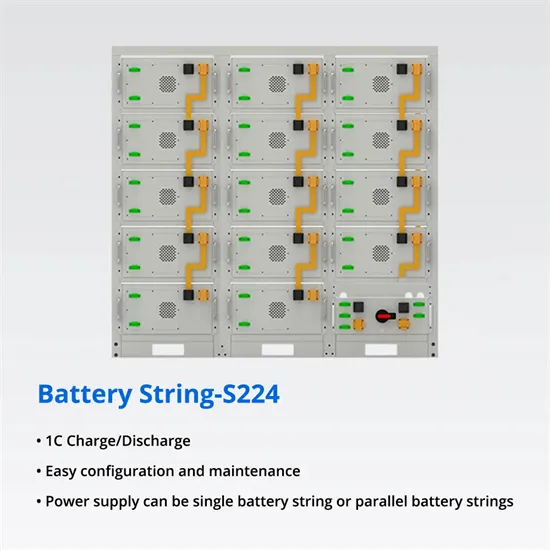

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.