Lead-acid Battery for Telecom Base Station Market''s Tech

Mar 28, 2025 · The global market for lead-acid batteries in telecom base stations is experiencing robust growth, driven by the expanding 4G and 5G networks worldwide. The increasing

Battery for Communication Base Stations Growth

May 13, 2025 · The market is segmented by battery type (lead-acid, lithium-ion, and others), with lithium-ion batteries dominating due to their superior performance characteristics. Application

Battery For Communication Base Stations Market: Strategic

Jun 16, 2025 · The Battery For Communication Base Stations Market is highly competitive and features a mix of established global players, emerging startups, and region-specific

Battery Backup Solutions for Communication Sites: Ensuring

Sep 3, 2024 · Lead-acid batteries are one of the most common types of battery backup solutions used in communication sites due to their reliability and cost-effectiveness. Pros: High tolerance

Lithium-ion Battery For Communication Energy Storage System

Aug 11, 2023 · And for base stations with large temperature change ranges, long-time use of the valve regulated lead acid battery is prone to cracking, leakage, and other problems to greatly

Battery For Communication Base Stations Market Overview:

Jul 17, 2025 · The Battery For Communication Base Stations market is poised for considerable growth, driven by technological advancements, shifting consumer preferences, and a growing

Solar Powered Cellular Base Stations: Current Scenario,

Dec 17, 2015 · There is a second factor driving the interest in solar powered base stations. In the recent past, the bulk of the growth in the deployment of cellular base stations has been in

Maintenance and care of lead-acid battery packs for solar communication

The battery pack is an important component of the base station to achieve uninterrupted DC power supply. Its investment is basically the same as that of the rack power supply equipment.

Battery for Communication Base Stations 9.3 CAGR Growth

Mar 30, 2025 · The global market for batteries in communication base stations is experiencing robust growth, projected to reach $1692 million in 2025 and maintain a Compound Annual

Comprehensive Insights into Communication Base Station Battery

Dec 21, 2024 · The global communication base station battery market is projected to reach USD 1.26 billion by 2033, exhibiting a CAGR of 11.3% during the 2025-2033 forecast period. The

【MANLY Battery】Lithium batteries for communication base stations

Mar 6, 2021 · In general, as the demand for 5G communication base stations continues to increase, there will be considerable market space for lithium battery energy storage in the

Application of energy storage lead-acid batteries in 5G base stations

As of the end of 2018, there was approximately 120,000 base stations in 31 provinces and cities across the country, and the ladder lithium battery was used to directly replace the lead-acid

How Energy Storage Lead Acid Batteries Are Revolutionizing Telecom Base

Dec 18, 2024 · In recent years, the telecommunications industry has witnessed a significant transformation, with energy storage lead acid batteries emerging as a game-changer for

Environmental feasibility of secondary use of electric vehicle

May 1, 2020 · The choice of allocation methods has significant influence on the results. Repurposing spent batteries in communication base stations (CBSs) is a promising option to

Communication Base Station Li-ion Battery Market

By contrast, lead-acid battery capacity degrades 50% faster when operated above 25°C, necessitating oversized installations or active cooling in tropical climates. Indonesia''s telecom

Global Battery for Communication Base Stations Market

Global key players of Battery For Communication Base Stations include Narada, Samsung SDI, LG Chem, Shuangdeng and Panasonic, etc. Global top five manufacturers hold a share nearly

Energy Storage in Telecom Base Stations: Innovations

With the relentless global expansion of 5G networks and the increasing demand for data, communication base stations face unprecedented challenges in ensuring uninterrupted power

Battery for Telecom Base Station Market

NorthStar Battery specializes in advanced lead-acid solutions with thin plate pure lead (TPPL) technology, widely adopted by European telecom operators like Vodafone for off-grid sites in

Telecom Battery Backup System | Sunwoda Energy

A telecom battery backup system is a comprehensive portfolio of energy storage batteries used as backup power for base stations to ensure a reliable and stable power supply. As we are

Communication Base Station Energy Storage Battery Market

Apr 3, 2025 · The Communication Base Station Energy Storage Battery market is experiencing robust growth, driven by the increasing deployment of 5G and other advanced wireless

Lead-Acid Batteries in Telecommunications: Powering...

Critical Infrastructure: Telecommunications infrastructure, including cell towers, base stations, and communication hubs, requires a constant and reliable power supply. Lead-acid batteries serve

Battery for Communication Base Stations Market''s

Apr 23, 2025 · The global market for batteries in communication base stations is experiencing robust growth, projected to reach $1692 million in 2025 and maintain a Compound Annual

Battery for Communication Base Stations Market | Size

One of the key trends shaping the communication base station battery market is the shift towards lithium-ion batteries from traditional lead-acid batteries. Lithium-ion batteries offer higher

Learn More

- Lead-acid battery power supply for communication base stations

- Detailed explanation of lead-acid battery equipment for communication base stations

- Lead-acid battery tower base protection for communication base stations

- Lithium battery energy storage for communication base stations

- Work on designing battery energy storage system for communication base stations

- Lithium battery solar power price for communication base stations

- Why is the battery energy storage system for communication base stations equipped

- Battery energy storage system for communication base stations in South Africa

- Communication base station lead-acid battery UPS host

Industrial & Commercial Energy Storage Market Growth

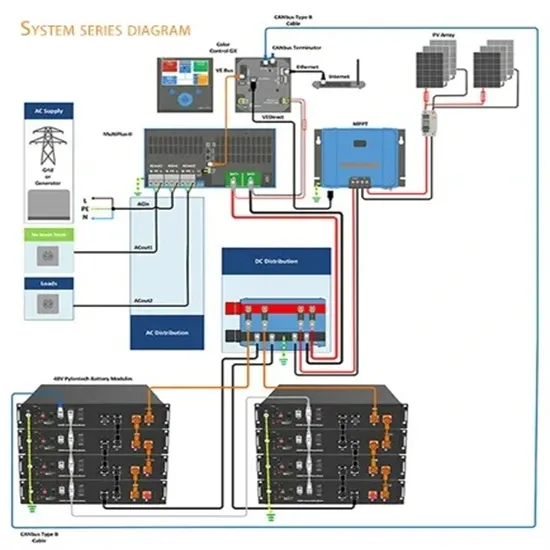

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.