Solar: end-of-life panels revalued in the glass industry

Oct 16, 2024 · Solar: end-of-life panels revalued in the glass industry Acteurs de l''Innovation | 16/10/2024 | France - The Isère industrial start-up Rosi Solar will supply AGC Glass Europe

ETIC Partners, On Behalf Of Energy Transition Europe II, Invests

Mar 27, 2025 · ETIC Partners (ETIC), through its Energy Transition Europe II fund, has announced its second investment in a portfolio of renewable energy assets across Italy. This

Southeastern Europe''s largest solar project gets EBRD backing

Oct 16, 2020 · The European Bank for Reconstruction and Development (EBRD) is providing Greek energy company Hellenic Petroleum (HELPE) with €75 million ($87.8 million) for the

AGC Glass Europe and photovoltaic recycling pioneer ROSI

Jul 22, 2025 · Through this collaboration, AGC Glass Europe and ROSI aim to recycle and reuse high volumes of photovoltaic glass in the production of flat glass. This not only provides

French asset manager Mirova invests €480 million in

Oct 28, 2024 · From pv magazine France Paris-based asset management company Mirova has announced a total investment of €480 million ($ 519 million) in Austrian renewable energy

Xinyi Glass investment in Egypt, Algeria cancels Chinese port

Mar 21, 2025 · China''s Xinyi Glass Invests $700M in SCZone for Solar Panel Glass Manufacturing - Egypt Today. Another big Chinese investment into renewables in MENA, and another big

Eastern Europe – pv magazine International

Jul 24, 2025 · Lithuania''s Solitek has launched full-black 425 W bifacial solar modules with matte, satin-textured glass for glare-sensitive sites such as airports, road barriers, and buildings.

Europe Solar Photovoltaic Glass Market Size & Competitors

The Europe Solar Photovoltaic Glass Market is projected to witness market growth of 27.3% CAGR during the forecast period (2024-2031). The Germany market dominated the Europe

Saint-Gobain invests in renewable energy for Romanian glass

May 8, 2024 · This contract, combined with a photovoltaic park currently in the final stage of development at the Călărași glass plant, will cover 100% of Saint-Gobain''s electricity needs in

Europe Solar PV News Snippets

Oct 29, 2024 · Capital Dynamics raises finance for Italian agrivoltaic projects; UK''s Good Energy To Acquire Empower Energy; 10-year solar PPA in Poland; Aukera''s solar+storage project in

Europe Solar PV Glass Market Price, Share, Growth Insights

Europe Solar PV Glass Market installed and glass consumed volume accounted for 842.3 million Sq. mts in 2024 and projected to grow at 1,500.6 millon Sq. mts in 2031 to reach CAGR 8.6%

EMEA (Europe, Middle East and Africa) Solar Photovoltaic Glass

In this report, the EMEA Solar Photovoltaic Glass market is valued at USD XX million in 2016 and is expected to reach USD XX million by the end of 2022, growing at a CAGR of XX% between

Das Solar invests €109mn in photovoltaic plant in France

4 days ago · Chinese group Das Solar has begun work on its first industrial site in Europe, located in the town of Mandeure near Montbéliard in eastern France. The investment amounts to

Eastern European solar has ''untapped potential'',

Nov 12, 2024 · Eastern Europe is set to be pivotal in the solar industry, given its cost advantages and growth potential. Solar''s affordability and accessibility

Satinal invests in Italian solar production hub

Oct 18, 2023 · Italian glass machinery group Satinal is to invest in a production hub for its Strato Solar solution. The new division will be the only European

MENA Solar and Renewable Energy Report

Sep 5, 2024 · Introduction Renewable energy usage has been growing significantly over the past 12 months. This trend will continue to increase as solar power prices reach grid parity. In 2019,

Europe Building Integrated Photovoltaics Glass Market Size,

Apr 7, 2025 · The Europe Building Integrated Photovoltaics (BIPV) Glass market is a rapidly evolving sector within the renewable energy industry. As the world increasingly moves towards

AGC Glass Europe Invests in Future of Sustainable Building

Jan 15, 2025 · AGC Glass Europe, the European branch of world leading glass manufacturer AGC, announces a major investment in a new insulating vacuum glass production line at its

EU Market Outlook for Solar Power 2022-2026

SolarPower Europe''s annual EU Market Outlook helps policy stakeholders in delivering solar PV''s immense potential to meet the EU''s 2030 renewable energy targets. Produced with the

Almaden plans solar glass factory in UAE

May 3, 2025 · The new capacity will include mainstream products such as 1.6mm ultra-thin photovoltaic glass. Analysts said the project closely aligns with the UAE expansion of Trina

Central and Eastern Europe leads Europe in rapid solar

Aug 21, 2024 · During the first seven months of 2024, utility-scale solar output in the five largest solar-producing countries in Central/Eastern Europe—Austria, Bulgaria, Hungary, Romania,

Europe Solar PV News Snippets: Mirova Invests €480 Million

Phase I of their cooperation will focus on Eastern European markets, to be followed by the Iberian Peninsula. Enzeit operates predominantly in Eastern Europe, the Balkans, and the Iberian

6 FAQs about [Eastern Europe invests in photovoltaic glass]

Is glass for Europe a member of the European solar PV industry alliance?

website maker Glass for Europe is officially a member of the European Solar PV Industry Alliance, an initiative launched in December 2022 by the European Commission. The Alliance gathers key players in the value chain of the solar energy industry and aims at scaling up the production of solar PV panels and value chain components in Europe.

How can glass for Europe help re-build a European solar industry?

Glass for Europe represents almost 90 percent of flat glass production in the EU and its members can play a key role in re-building a European solar industry in the EU. The main goal of the European Solar PV Industry Alliance is to mobilise finance for European solar PV projects to increase the manufacturing capacity.

Is Eastern Europe a good place to invest in solar?

Eastern Europe is set to be pivotal in the solar industry, given its cost advantages and growth potential. Solar’s affordability and accessibility make it ideal for achieving the region’s decarbonisation targets. Already, we see substantial project development across the Baltics, Balkans, Bulgaria, Romania and other areas.

Is Eastern Europe a promising market for solar energy deployment?

Eastern Europe indeed represents a promising market with untapped potential in solar energy deployment, given its early-stage market development. Solar energy, being highly competitive and increasingly cost-effective, is expected to play a key role in the region’s energy future.

Which European countries have the most solar energy?

The age of solar energy is dawning in Eastern Europe: According to the European industry association SolarPower Europe, Poland has been one of the top ten leading countries in Europe in terms of PV deployment since 2016. Hungary has joined the list after adding 1.6 gigawatts (GW) of PV capacity in 2023, a 45 percent increase over the previous year.

Does RWE have a solar portfolio in Poland?

RWE began construction on a new solar portfolio in Poland last month. Image: RWE Eastern Europe has seen exponential growth in its solar sector in recent years, with three of the five countries which exceeded 1GW of installed solar capacity in Europe in 2023 – Bulgaria, the Czech Republic and Romania – all in the east.

Learn More

- Eastern Europe Energy Storage Photovoltaic Water Pump

- Which company has photovoltaic glass in Comoros

- Italian Photovoltaic Glass Industrial Park

- Manama Photovoltaic Multi-span Glass Greenhouse

- Huawei photovoltaic module ultra-hard glass

- Photovoltaic glass production in East Africa

- Photovoltaic glass solar power generation

- How much does 2mm photovoltaic glass cost

- Solar photovoltaic transparent glass

Industrial & Commercial Energy Storage Market Growth

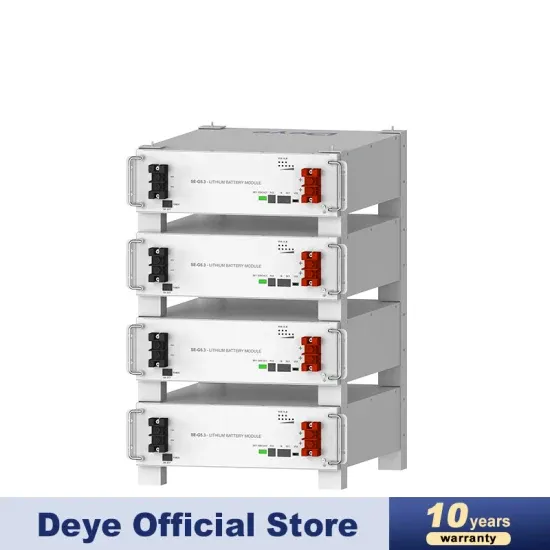

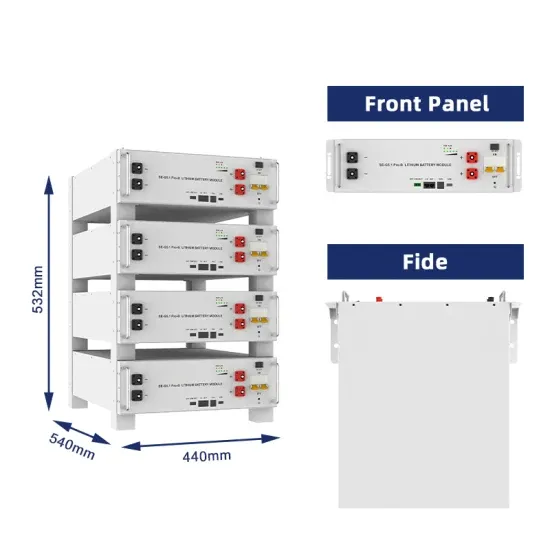

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

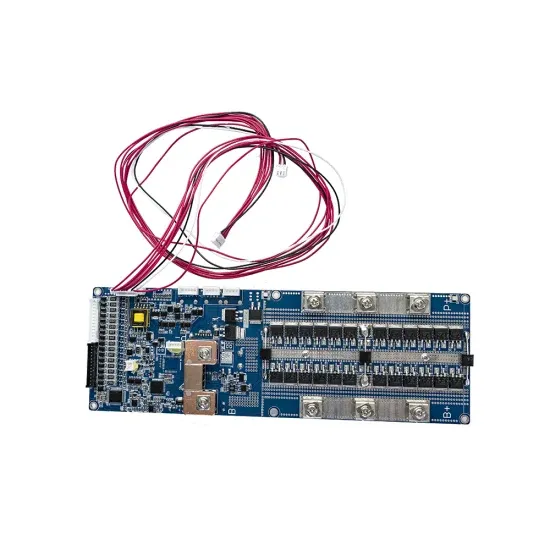

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.