South Korea launches its largest energy storage bid to

Aug 18, 2025 · The project is expected to cost about $725 million (1 trillion won) and will be awarded based on both pricing and non-price factors, such as contributions to domestic

South Korea Perovskite Crystal Silicon Stacked Battery

Aug 9, 2024 · South Korea Perovskite Crystal Silicon Stacked Battery Market By Application Consumer Electronics Electric Vehicles Energy Storage Systems Industrial Applications

South Korea Nano-Enabled Batteries Market Overview: Key

Jun 25, 2025 · The South Korea nano-enabled batteries market offers substantial investment opportunities for businesses looking to capitalize on the growing demand for advanced energy

China and South Korea''s Battery Battle: From EVs to Grid Storage

Apr 29, 2025 · Explore the intensifying battery competition between China and South Korea, expanding from electric vehicles to grid storage, and its global impact.

Energy storage systems in South Korea

Mar 6, 2025 · Domestic infrastructural support for large-scale utilization, improved safety due diligence, and quick adoption of new technologies are some of the concerns likely to heavily

China and South Korea extend battery battle from EVs to grid storage

Apr 28, 2025 · A global surge in renewable energy and data centre demand is powering a boom in using batteries for storage on electricity grids, creating a new front in the battle between

Global Stacked Low Voltage Energy Storage System Market

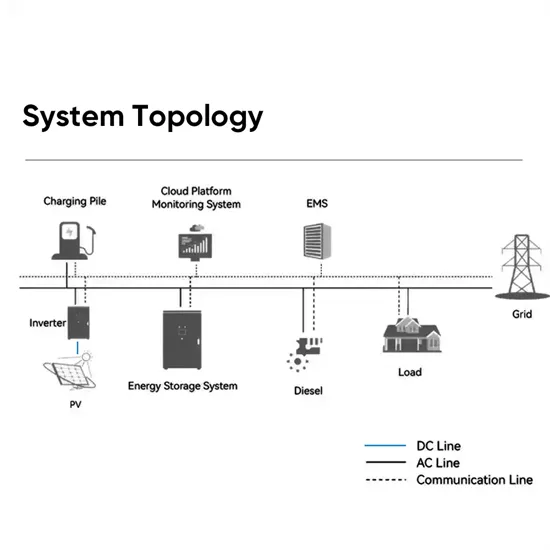

Stacked low-voltage energy storage system is an energy storage solution that stacks multiple battery modules together to form a large energy storage system. Unlike high-voltage energy

1.5GW offshore wind plant in South Korea to use

Jan 7, 2022 · A 1.5GW offshore wind power plant in South Korea will be paired with energy storage provided by so-called ''next generation'' lithium-ion batteries.

Stacked Low Voltage Energy Storage System

Stacked low-voltage energy storage system is an energy storage solution that stacks multiple battery modules together to form a large energy storage system. Unlike high-voltage energy

Stacked Energy Storage XX CAGR Growth Analysis 2025-2033

Jul 19, 2025 · The global stacked energy storage market is experiencing robust growth, driven by the increasing demand for renewable energy integration and backup power solutions. The

Stacked Energy Storage Market Trends and Strategic Roadmap

Dec 21, 2024 · Stacked energy storage systems are gaining traction due to their ability to integrate multiple energy storage technologies, such as batteries and flywheels, into a single

Energy storage battery market in southeast asia

The Sembcorp Energy Storage System is Southeast Asia''''s largest utility-scale ESS of 289MWh. Built across two sites on Jurong Island, our ESS enhances Singapore''''s grid resilience by

Battery Innovation System of South Korea

Apr 9, 2025 · South Korea is the centre of global secondary battery R&D and a leading manufacturing base, but it is still necessary to ensure a stable supply chain and core

Energy Storage Stacked Battery Strategic Roadmap: Analysis

Jul 18, 2025 · The energy storage stacked battery market is experiencing robust growth, driven by the burgeoning demand for electric vehicles (EVs) and the increasing adoption of renewable

South Korea Energy Storage Stacked Battery Market By

Aug 11, 2024 · The South Korean energy storage stacked battery market by application is segmented into several key areas. Residential applications focus on providing energy storage

KOREA''S ENERGY STORAGE THE SYNERGY OF

1 day ago · Korea''s battery storage industry has experienced remarkable growth for the accounting for more than 80% of the total lithium-ion battery (hereinafter, Korea''s LiB ESS

South Korea unveils $35 billion battery investment plan

South Korea''s trade, industry and energy ministry (Motie) has unveiled plans to boost the country''s relevance in the global EV battery market, Kallanish reports. The so-called K-battery

South Korea injects $14 bil to revitalize ''green'' vehicle, battery

Jan 15, 2025 · Dubbed as "measures to strengthen competitiveness of eco-friendly vehicles and secondary batteries," the investment is directed at achieving four goals, namely addressing a

Top five energy storage projects in South Korea

Sep 10, 2024 · Listed below are the five largest energy storage projects by capacity in South Korea, according to GlobalData''s power database. GlobalData uses proprietary data and

South Korea Domestic Storage Battery Solar Energy Battery 5kwh Stacked

Feb 22, 2024 · South Korea Domestic Storage Battery Solar Energy Battery 5kwh Stacked to 30kwh, Find Details and Price about Home Solar Energy Storage System Lithium Battery from

China and South Korea''s Battery Battle: From EVs to Grid Storage

Apr 29, 2025 · South Korea''s battery makers are fighting back with innovation and global expansion. LG Energy Solution secured a 39 GWh LFP battery deal with Renault in 2024,

South Korea''s long-term sodium-sulfur BESS demonstration

Jun 13, 2023 · A megawatt-scale sodium-sulfur (NAS) battery demonstration project involving South Korea''s largest electric utility has gone online.Operational start of the

6 FAQs about [South Korea s stacked energy storage battery investment]

Why is South Korea launching a 540mw battery energy storage tender?

South Korea is ramping up its battery energy storage deployment with a new 540MW tender to stabilize the grid and support renewable energy growth. Learn how this move strengthens both domestic resilience and global market leadership.

Are South Korean companies investing in energy storage systems?

Less than a decade ago, South Korean companies held over half of the global energy storage system (ESS) market with the rushed promise of helping secure a more sustainable energy future. However, a string of ESS-related fires and a lack of infrastructure had dampened investments in this market.

Will South Korea install 540 megawatts of battery energy storage systems?

The Ministry of Trade, Industry and Energy unveiled plans for a nationwide tender to install 540 megawatts of battery energy storage systems (BESS), marking the country's first major government-led deployment of its kind. The project is part of a broader effort to modernize South Korea’s power grid and support the transition to renewable energy.

Does South Korea have a battery industry?

But South Korea’s battery industry faces mounting pressure from China, whose manufacturers, led by CATL, currently account for nearly 90 percent of global energy storage battery capacity. CATL expanded its footprint in January by establishing a South Korean subsidiary, signaling an aggressive push into the local market.

Why are South Korea's EV battery makers moving to North America?

South Korea’s battery makers, including LG Energy Solution and SK On, have been squeezed by waning EV subsidies and shifting demand, prompting a strategic pivot toward North America, where demand for grid storage is accelerating.

What is energy storage capacity in Korea?

k (IRENA,2018).06Grid Energy StorageIn KoreaSince 2018,the total capacity of all energy storage systems (ESS) connected to the Korean power sy tem has reached 1.6 GWand 4.8 GWh (NARS,2021). In terms of power capacity,40% of ESS are used for peak load reduction,36% in hybrid systems (i.e.,a combination of

Learn More

- Stacked energy storage battery investment

- Huawei s energy storage battery sales in South Korea

- 30kw energy storage for Busan power grid in South Korea

- South Korea Busan PV energy storage ratio requirements

- Huawei South Ossetia Battery Energy Storage

- Korea s container energy storage lithium battery solution

- Battery energy storage in Johannesburg South Africa

- Lithium battery energy storage station investment

- South Tarawa All-vanadium Liquid Flow Battery Energy Storage

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.