Made in Europe: Can the EU Reclaim Solar Panel Production?

Discover the state of solar panel manufacturing in Europe, the challenges posed by imports, and what EU countries are doing to rebuild local production. Learn how European-made solar can

Technical potential of solar energy in buildings across Norway

Aug 1, 2024 · This research study delves into the solar energy potential and capacity in Norway, aiming to assess the viability of solar power integration in the country''s urban landscape.

Solar power is revolutionising commercial

Oct 17, 2023 · Today, solar technology can be integrated into any kind of surface. The possibilities are truly endless. Groundbreaking solar panel technology is

FREYR buys Trina solar panel factory in Texas for

Nov 6, 2024 · FREYR Battery, a Norwegian developer of battery cells, is getting into solar panel manufacturing after announcing it will acquire the U.S.

Top Solar Companies In Norway In 2025

Solar companies in Norway are at the forefront of renewable energy innovation, providing a range of solar products and services to the Norwegian market. These companies specialize in the

31 GW of Rooftop Solar PV can be Installed in Norway

Jul 20, 2024 · According to a recent research paper, Norway can potentially deploy 31 gigawatts (GW) of solar PV across its buildings. This study highlights both the significant opportunities

The Norwegian solar energy innovation system

Aug 12, 2021 · In this report, we explore the conditions for Norway to engage in the production and use of solar photovoltaic (PV) technology, both nationally and globally. To analyze the

Top Solar Panel Manufacturing Companies in Norway

NorSun is a Norwegian solar energy company that specializes in the manufacturing of high-performance mono-crystalline silicon ingots and wafers, essential components for solar

Solar Energy Norway: 5 Amazing Insights on Growth by 2024

Apr 12, 2025 · The growth of solar energy in Norway has been remarkable, with production skyrocketing from 5 GWh in 2015 to an anticipated 1,100 GWh by 2024. This increase is

Top Solar Panel Manufacturers Suppliers in Norway

May 17, 2025 · Yingli Solar, formerly known as Yingli Green Energy Holding Company Limited, covers the manufacturing of the photovoltaic value chain from ingot casting and wafering

Top 60 Solar Panel Companies in Norway (2025) | ensun

Solcellespesialisten is Norway''s largest supplier of solar panels, offering tailored photovoltaic systems for various needs, from quick payback to achieving plus house certification.

Largest ever US solar factory shows rapid pivot to American

May 11, 2023 · May 10 - A plan by U.S. developer Invenergy and China''s Longi to build the U.S.'' largest solar panel factory signals rapid growth ahead in U.S. manufacturing as developers

6 FAQs about [Photovoltaic solar panel production factory in Norway]

Who makes solar panels in Norway?

As we delve into the solar landscape in Norway, it’s essential to explore the supply chain centers, top manufacturers, and the pivotal fairs that are shaping the future of solar energy in Norway and beyond. Primroot.com is a leading-edge professional solar panels & inverter manufacturer based in the high-tech hub of Shenzhen, China.

Are Norwegian solar panels eco-friendly?

The ecological footprint of solar panels made with materials from Norway is therefore extremely small. REC Solar’s factory in Fiskå in southwestern Norway has even been awarded a certificate for production of the world’s cleanest silicon. Not only is Norwegian silicon production the world’s cleanest, it is also the world’s most energy efficient.

What makes otovo Norway a leading solar company?

In particular, Otovo Norway, a leading Norwegian solar company, leverages Oslo’s advanced supply chain networks to streamline its operations, ensuring timely delivery of solar panels to various markets.

Why is Norway a good choice for solar energy solutions?

This has led to Norway to become an expert in devising solar energy solutions for out of the way places. Safedesign has designed a rooftop safety system that eliminates the need for scaffolding and makes solar panels more affordable. Industry was also bitten by the solar energy bug.

Do you need a reliable solar supplier in Norway?

The Norwegian solar market enjoys a healthy presence of solar equipment manufacturers and distributors. They deal with the supply of solar panels and several other components. Do you need a trustworthy supplier for your current or next project? If the answer is yes, consider yourself lucky because you are in the right place.

Does Norway have a solar industry?

According to a recent report, there is a considerable rise in public support for the Norwegian solar industry. As of December 2019, Norway had a cumulative installed solar capacity of 120 Megawatts. This capacity came into being through the addition of 51 Megawatts, the highest added capacity in a single year.

Learn More

- Photovoltaic solar panel production factory in Libya

- Berlin Communication Base Station Solar Photovoltaic Panel Factory

- Kuala Lumpur Xuzhou Solar Photovoltaic Panel Factory

- Factory Solar Photovoltaic Panel Manufacturer

- How much electricity can a 60w solar photovoltaic panel generate

- 180x270mm solar panel 6w photovoltaic panel

- The internal structure of a solar photovoltaic panel

- A solar photovoltaic panel costs 49 yuan

- 3MW photovoltaic solar panel

Industrial & Commercial Energy Storage Market Growth

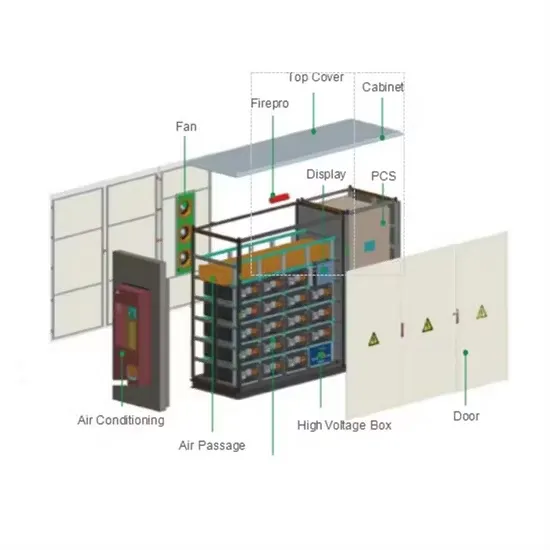

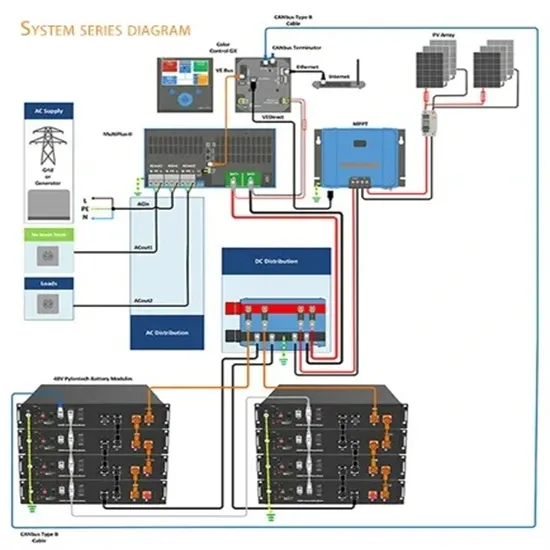

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.