Georgia Power requests certification of approximately 9,900 MW of new

ATLANTA, July 31, 2025 /PRNewswire/ -- Georgia Power announced today that it has requested certification [link to filing] from the Georgia Public Service Commission (PSC) of new resources...

PSC Greenlights Georgia Power Plan to Expand

Jul 17, 2025 · As POWER has reported, the utility filed its 2025 IRP with the Georgia regulator on Jan. 31, 2025, seeking to strategically shift its approach

Georgia Power seeking certification of new energy projects

Jul 31, 2025 · Construction is currently underway on new BESS projects in Bibb, Lowndes, Floyd, and Cherokee counties, while the company is seeking certification of 10 new BESS facilities at

Georgia Power seeks to certify new energy projects

Aug 1, 2025 · Georgia Power has requested certification from state energy regulators for 9,900 megawatts of new energy resources, including power-purchase agreements, natural gas

Customer Story: Improving Outdoor Lighting Operations with Georgia

Jan 2, 2025 · Georgia Power''s outdoor lighting operations are responsible for the full life cycle of outdoor lighting infrastructure maintenance, including surveys, new construction, inspections,

Fossil fuels to remain in Georgia Power energy-supply mix

Jul 23, 2025 · Fossil fuels to remain in Georgia Power energy-supply mix Georgia energy regulators Tuesday unanimously approved Georgia Power''s plan to keep burning coal and gas

6 FAQs about [Georgia s new outdoor power supply]

How many megawatts of new energy resources does Georgia Power have?

Georgia Power has requested certification from state energy regulators for 9,900 megawatts of new energy resources, including power-purchase agreements, natural gas generation, battery energy storage systems, and solar projects.

How many megawatts will Georgia Power Add?

Georgia Power seeks to add 9,900 megawatts of new energy resources through a variety of projects. The projects include natural gas generation, battery energy storage systems (BESS), solar power, and power-purchase agreements. The proposal incorporates projects from the 2022 and 2025 Integrated Resource Plans.

Will Georgia Power certify 9900 megawatts of new energy resources?

Georgia Power asked state energy regulators Thursday to certify 9,900 megawatts of new energy resources that would come from a variety of power-generating projects.

Does Georgia Power have an Integrated Resource Plan?

In a filing with the Georgia Public Service Commission, the Atlanta-based utility proposed projects the PSC already has approved in Georgia Power’s last two Integrated Resource plans (IRPs), which the company submits every three years outlining the mix of energy sources it intends to rely on for power generation during the coming years.

Where are Georgia Power's new gas turbines being built?

The list of projects includes previously approved new gas turbines to be built at Georgia Power's Plant Yates near Newnan and Plant McIntosh near Savannah as well as a request for five additional turbines - two at Plant Bowen near Cartersville, two at Plant Wansley in Heard County, and one at Plant McIntosh.

Will Georgia Power approve a new state-of-the-art solar system?

Georgia Power also is requesting approval of two new state-of-the-art solar systems paired with BESS. Those would be located in Laurens County and at the site of the former Plant Mitchell in Dougherty County. The PSC will hold hearings on the two certification requests in October and early December, with a vote set for Dec. 19.

Learn More

- New energy-saving and environmentally friendly outdoor power supply

- A new generation of safe and fast charging outdoor power supply

- Outdoor power supply manufacturers in Papua New Guinea

- Brand new outdoor power supply field in Ljubljana

- New Delhi Xinxin Outdoor Power Supply

- Colombia s new mobile outdoor power supply

- Can I have a new outdoor power supply in stock

- New outdoor power supply 3000w container

- New Delhi outdoor power supply brand new field

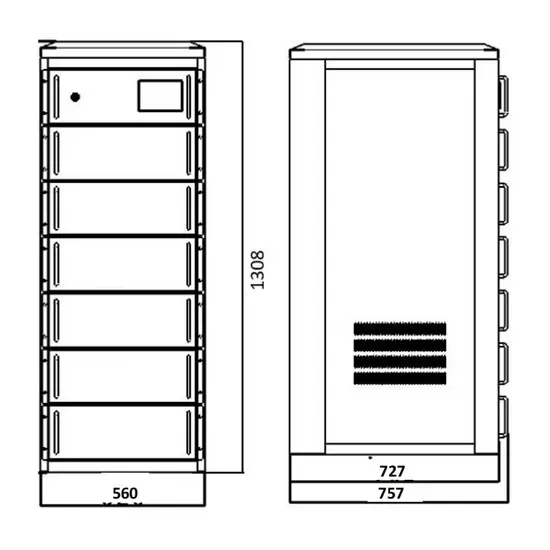

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

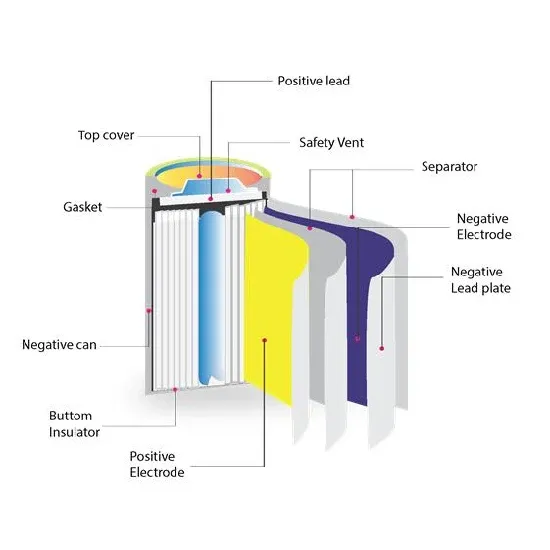

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.